According to the statements made, activity is increasing in Washington; The Digital Asset Market Clarity Act is moving closer to possible signature in 2026. The White House is reportedly encouraging major banks to accept limited stablecoin yields to speed up progress. At the same time, state-level adoption initiatives and renewed technical outlooks on some tokens are gaining attention in the market, with investors taking early positions ahead of regulatory clarity.

Clarity Act Pressure Grows as Stablecoin Debate Heates

The White House is in talks with major US banks about limited returns on stablecoin balances. This compromise aims to break the legislative impasse around the Digital Asset Market Clarity Act. Lawmakers are debating whether banks should allow incentive mechanisms for dollar-backed digital assets.

Although bank executives remain cautious, federal pressure has increased. The bill aims to define market structure rules and determine supervisory roles among institutions. If signed, it will provide clearer guidelines for exchanges, issuers and custody service providers. Investors are watching developments closely as regulatory clarity has historically supported capital inflows.

Market participants expect volatility as negotiations continue. However, greater visibility of the legislative process generally reduces uncertainty. This shift may impact institutional positioning, especially in tokens that are directly tied to the regulatory narrative.

XRP Gains Attention as Arizona Advances Digital Asset Reserve

XRP has moved closer to around $1.43 following the recent consolidation. While the token remains within a certain band, technical indicators give mixed momentum signals. The Relative Strength Index (RSI) is at 44.73, reflecting neutral conditions. While MACD shows weak momentum, CMF is in the negative territory at -0.08.

The Arizona Senate Finance Committee passed bill SB1649 by a 4-2 vote. The bill proposes creating a Digital Assets Strategic Reserve Fund that includes Bitcoin, XRP and other digital assets. If enacted, the state treasurer would manage seized or voluntary crypto deposits and be able to lend them out to generate bonuses.

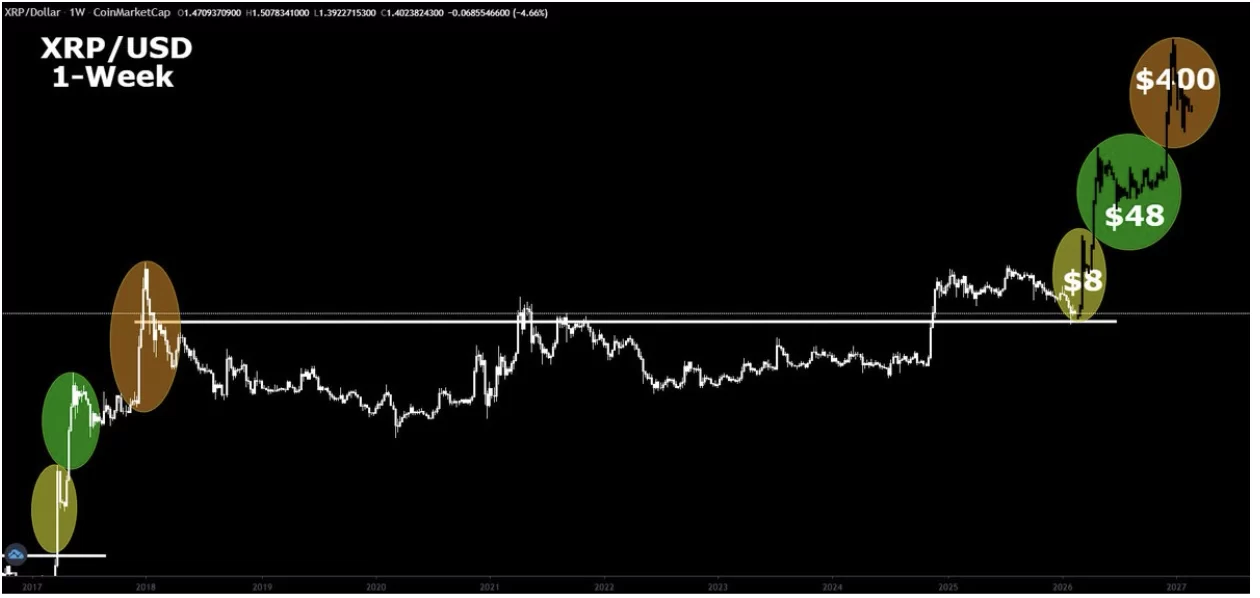

A break above $1.50 could bring up $1.60 and $1.80 as next resistance levels. However, failure to maintain $1.30 could trigger selling pressure again. Investors are monitoring both legislative progress and technical levels. According to crypto analyst Crypto Bull, if XRP repeats the 2017 fractal, its next price targets could be $8, $49, and $400.

Hyperliquid Tests Critical Resistance as Derivatives Activity Weakens

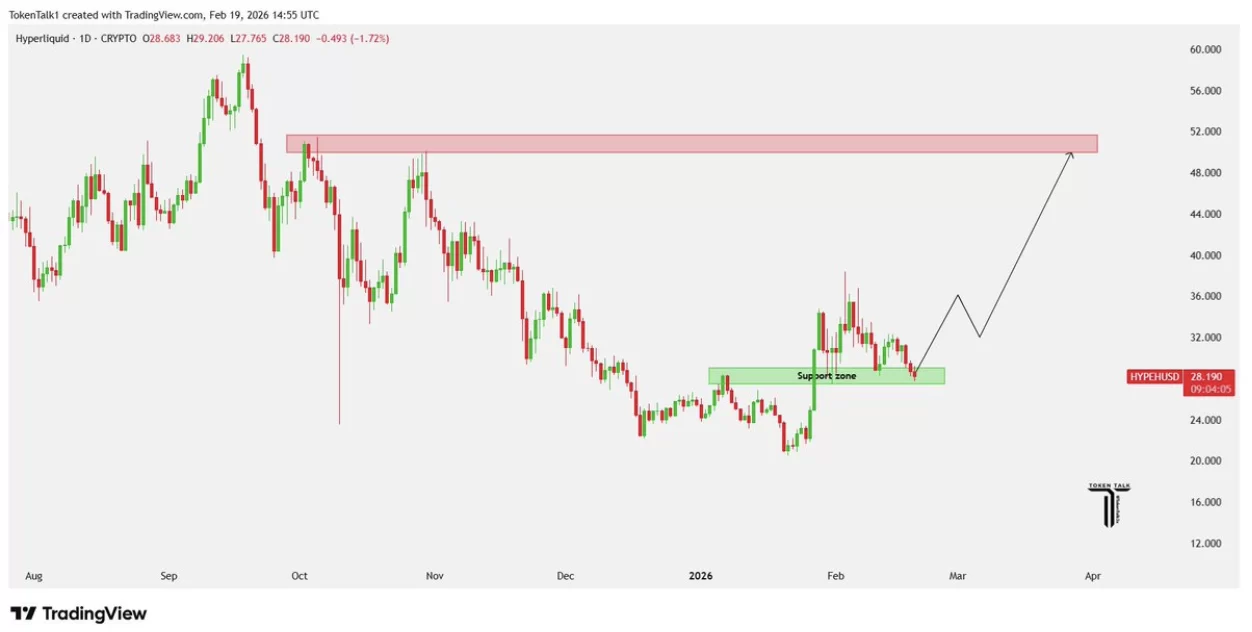

Hyperliquid’s HYPE token headed towards the $30 trend line after a 1% recovery. Although the price action points to a short-term bullish structure, derivative data suggests caution. According to CoinGlass data, Open Interest decreased to approximately 1.30 billion dollars. This decline indicates that buyers are reducing leverage or closing positions.

The platform recently introduced HIP-3, which enables futures trading of tokenized commodities. Market participants are now waiting for HIP-4, which is expected to bring prediction markets. A sustained move above $30 could confirm a continuation of the breakout.

If the momentum weakens, consolidation under resistance may continue. Open Interest falling while the price is rising is often interpreted as a sign of cautious participation rather than aggressive accumulation.

Minotaurus Attracts Attention in Pre-Sale

According to its team’s claims, Minotaurus (MTAUR) collected more than 3.115 million USDT in the pre-sale phase. The token is currently selling for approximately 0.00012671 USDT. At this price, 100 USDT brings approximately 790,000 MTAUR tokens. An allocation of 1,000 USDT provides approximately 8 million tokens.

According to the team’s statements, the project works on Binance Smart Chain and integrates in-game purchases, NFT bonuses and character upgrades. Passed SolidProof and Coinsult audits. on presale Bonus pool of 100,000 USDT is available. The largest investor receives 50,000 USDT, while the remaining bonus is shared among 99 participants.

According to claims on pre-sale panels, wallet activity has increased steadily in recent weeks. Today, according to the team, investors who allocate 100 USDT can clearly calculate their positions with the fixed token rate before the next stage becomes 0.00014 USDT and the launch price becomes 0.00020 USDT. This transparency is touted as important because it allows more precise measurement of potential return. Allegedly, if the market value increases from 5.6 million USDT to 56 million USDT, early investments could reflect a tenfold growth.

Why Does Regulatory Clarity Shape Positioning?

Increased federal interest in stablecoin bonuses has strengthened the expectation that the Clarity Act could be signed in 2026. Clearer rules often influence liquidity allocation decisions. While XRP benefits from state-level reserve recommendations, HYPE stands out with its technical positioning near resistance.

Allegedly, Minotaurus offers a pre-sale option for investors looking for early stage transactions. As discussions in Washington progress, investors are trying to identify cryptocurrencies that can be purchased before policy changes. Market participants may continue to evaluate XRP, HYPE, and MTAUR during legislative transition periods.