Tokenization It is an area that has gained momentum in the past year and received the support of trillion-dollar financial giants. More growth is predicted here and this transformation Chainlink It is carried out by giants such as. Banks, asset managers and even governments. Today we will take a look at how this transformation is progressing and the role of Chainlink in the UK.

Chainlink (LINK) and Tokenization

United Kingdom It has one of the deepest capital markets in the world, and its steps towards tokenization are more important than many other countries. The UK, through the Financial Conduct Authority (FCA), HM Treasury and the Bank of England, is taking regulatory steps that support innovation while maintaining high standards of market conduct and operational resilience. And now the new phase has begun. Index providers, asset managers, fintech companies and infrastructure providers are also moving from conceptual pilot projects to real applications that meet operational needs.

Chainlink plays an important role in this transformation. FTSE Russell (a subsidiary of the London Stock Exchange Group)’s move to publish its global indices on-chain via Chainlink’s DataLink is just one of them.

“By making available trusted benchmark data used to track and manage trillions of pounds of assets directly on blockchain networks, this initiative ensures tokenized products are based on the same inputs as traditional funds and securities.

FTSE Russell and Chainlink bring global financial indices to onchain with Chainlink DataLink.” – Chainlink

Chainlink Services

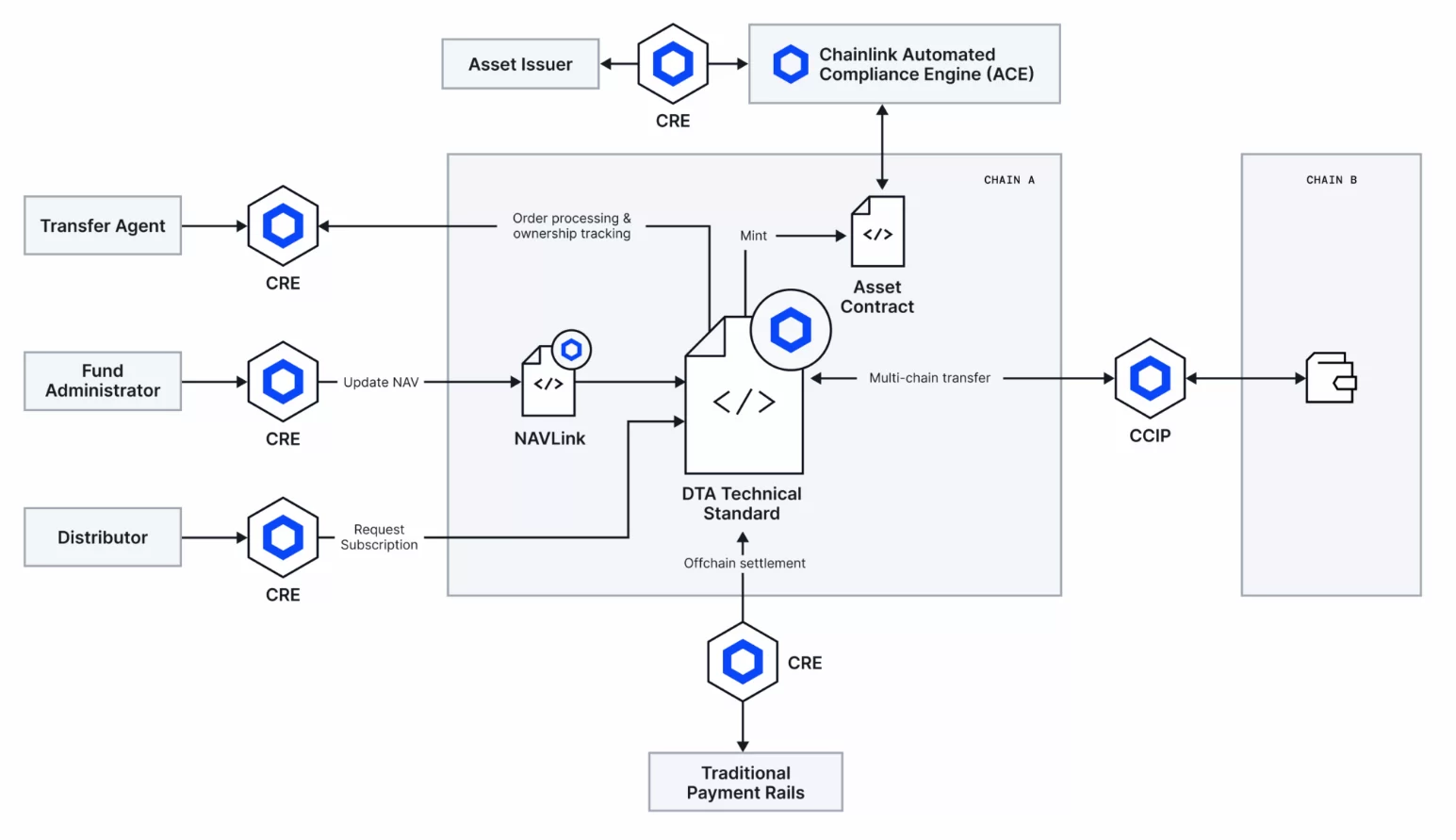

Chainlink, which provides data services for exchanges, launched the Automatic Compliance Engine (ACE) to comply with regulations. ACE makes things even easier in tokenization by enabling compliance rules, eligibility checks, and policy controls to be built directly into on-chain workflows and applied consistently across networks.

Standardized interoperability infrastructures such as Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and synchronization tools such as Chainlink Runtime Environment (CRE) also enable assets, data and workflows to move securely between these environments. In other words, Chainlink has tools that it has been working on for a long time for all processes, from regulation to transferring assets to the blockchain and monitoring them.

For banks, asset managers, infrastructure providers and policymakers, tokenization in the UK is now moving beyond experimentation and into the realization phase. In this transformation environment, Chainlink takes its slice of the cake while making things easier with its own tools. in the long run Chainlink This expansion in tokenization is noteworthy in terms of its potential.