Trillion-dollar giants expect RWA to grow exponentially in the coming years. The market, which has already grown 4 times in one year, is getting stronger unrelated to the general cryptocurrencies. Moreover, for now, leading public networks such as Ethereum, on which the RWA revolution was built, have not been able to fully benefit from this. So how is China positioned?

China, Hong Kong and Crypto

China, which has constantly adopted a negative approach towards cryptocurrencies, implemented comprehensive bans in 2021. Behind Hong Kong In 2023, cryptocurrency began to bend its rules and position itself differently from the mainland. This step in the region, which promised a maximum capital flow of at least 500 billion dollars, made a splash in those days.

Then, Hong Kong-based cryptocurrency products did not receive enough attention. Moreover, the story that investors under surveillance on the mainland would multiply their investments from here did not hold up. Now we see that the theses that “China, which designated Hong Kong as a pilot region, is preparing to embrace cryptocurrencies” have fallen through.

Trump and senior members of his team have said many times in the last year, “We need to make the USA the cryptocurrency capital, otherwise China will have this position and this is against our national interests.” But China does not care about these.

China and RWA Regulation

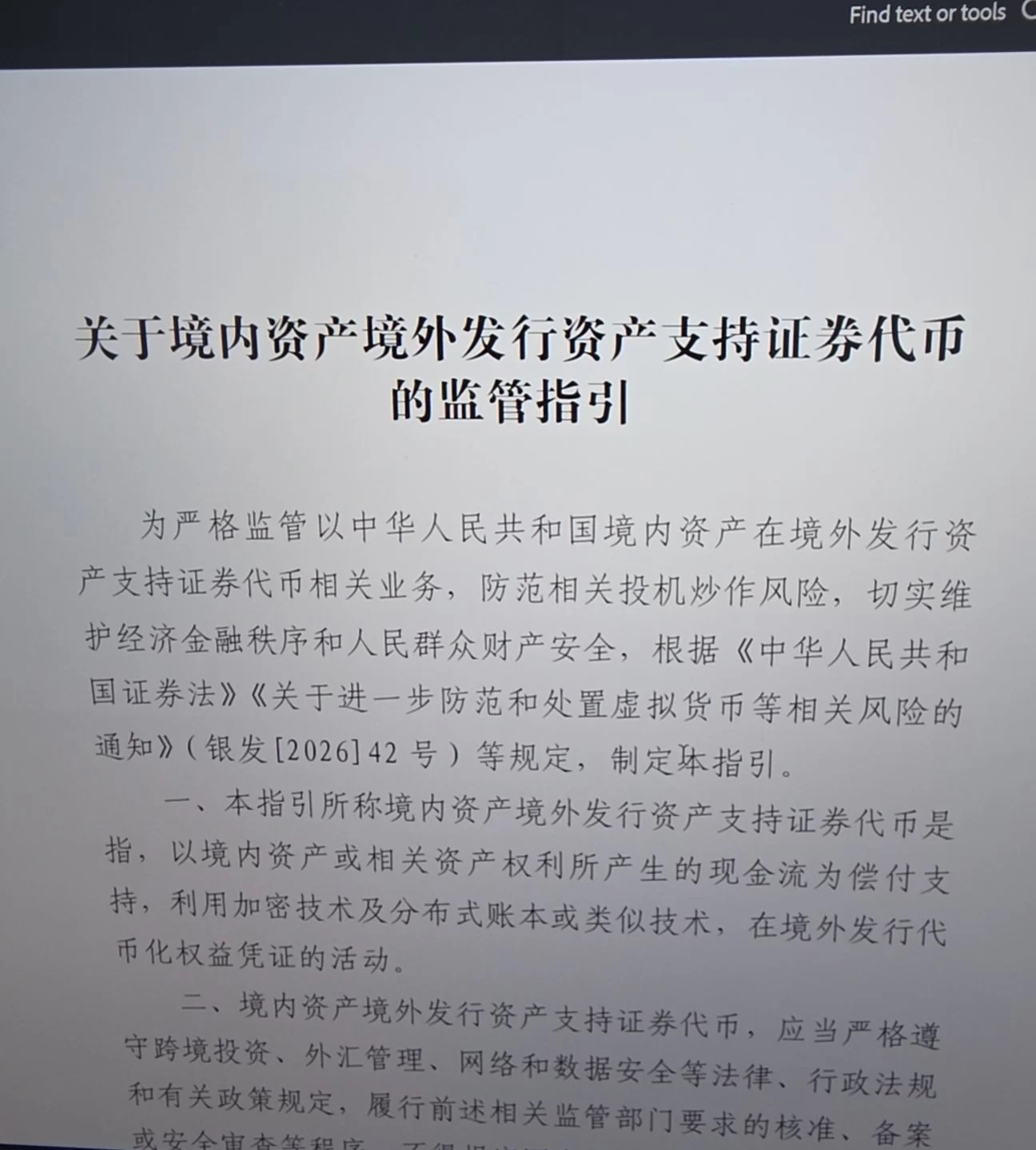

PBOC and seven institutions Yin Fa on virtual currency risks [2026] No. He released 42 this month. CSRC, on the other hand, published the rules for the international issuance of asset-backed tokenized securities backed by domestic assets.

The “Notice No. 42” jointly issued by 8 central institutions (PBOC, CSRC, SAFE, etc.) and the “Guideline No. 1” of the CSRC repealed the prohibitive “924 Notice” in 2021. By editing RWA It was officially described for the first time.

“Conversion of asset rights or revenues into tokens using cryptographic and distributed ledger technologies (DLT).”

Domestic RWA activities remain illegal in principle, but a “compliance exception” is granted if approval is obtained from competent authorities and carried out within designated financial infrastructures. CSRC registration, transparent disclosure and strict compliance requirements have been introduced for overseas token issuances based on assets in mainland China.

In addition, with the last step, experience powers were distributed to institutions according to asset types.

- NDRC: RWAs that are external loans.

- CSRC: Equity and securitization-based RWAs.

- SAFE: Bringing foreign funds back to the country.

Overseas branches of Chinese banks, RWA must integrate its services into local risk management and AML (Anti-Money Laundering) rules.

This move does not mean that China is opening its doors to the crypto world, but it is relatively good that it has stopped closing the doors completely. Of course, this regulation, which shows that they do not want to be the crypto capital of the world, also shows that Trump and his team are wrong.