Litecoin isn’t the market favorite it once was. Since the beginning of the year, the price has dropped more than 36%, sliding to around $45 before showing signs of life during the recent market bounce. Even with that recovery, LTC price remains stuck below $55, a level that now acts as a ceiling rather than support. The broader signals still lean cautious, and momentum hasn’t fully shifted in favor of the bulls.

That said, the chart structure suggests this compression could resolve higher. If buyers manage to push past $55 with strength, a move toward $70–$75 could quickly come into play.

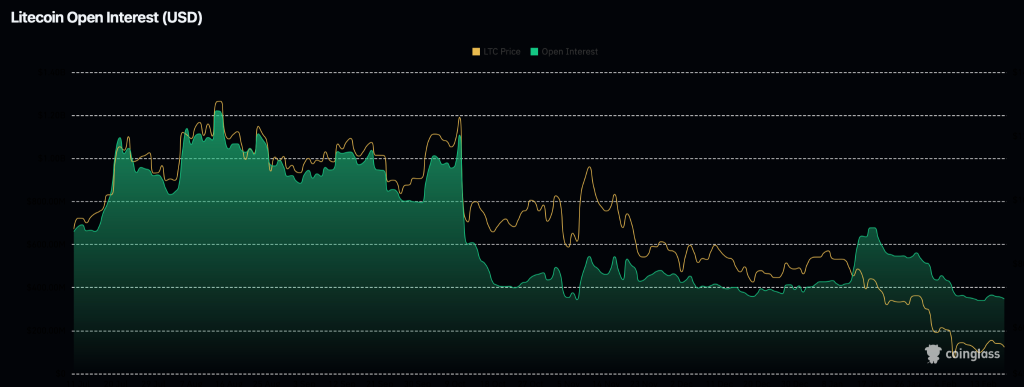

Drop in Open Interest Hints Long Liquidations

Litecoin’s open interest tells a clear story of fading conviction. Over the past few months, both price and open interest have trended lower, signaling long liquidation rather than aggressive new short positioning. In simple terms, traders are stepping away instead of building fresh bets. The steady decline in OI suggests deleveraging and reduced speculative participation, which often accompanies weak momentum phases.

Interestingly, previous spikes in open interest were followed by sharp price swings, but the current environment shows contraction instead of expansion. This drop in participation reflects caution across derivatives markets. It explains why LTC struggles to sustain recoveries; without rising open interest, breakout attempts lack the fuel needed for a sustained move higher.

What’s Next for the LTC Price Rally?

On the 4-hour chart, Litecoin is forming a tightening structure just beneath the $55–$56 resistance zone. Price continues to print higher lows along the rising trendline near $49–$50, suggesting buyers are gradually stepping in. However, the horizontal resistance around $55 remains firm, creating a developing ascending triangle setup.

Momentum indicators reflect indecision. The MACD is flattening near the zero line, showing weakening bearish pressure but no strong bullish expansion yet. Meanwhile, RSI hovers around the mid-40s to 50 region, signaling neutral momentum without clear dominance. If bulls manage a clean breakout above $56 with volume, LTC could target $61–$62 next. On the downside, a breakdown below $49 would invalidate the structure and expose $45 support.

The Bottom Line

The Litecoin price is sitting at a make-or-break level. The structure still favors a potential upside breakout, but momentum hasn’t fully confirmed it yet. As long as the price continues to defend the rising trendline near $49–$50, bulls retain a short-term edge. A decisive move above $56 could quickly shift sentiment and open the path toward $61 and possibly $65 if follow-through builds.

However, failure to hold the trendline would weaken the setup significantly. A breakdown below $49 would likely trigger renewed selling pressure, dragging LTC back toward $45. For now, patience is key—the next breakout or breakdown should define Litecoin’s direction for the coming sessions.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.