In the past 24 hours, no major change has been seen in the crypto markets, except for the Bitcoin price, which experienced a minor pullback. The token maintained a tight consolidation until the start of the US trading session and plunged by over $1500 in minutes. With this, the price closed the day’s trade at around $67,500, dropping from the highs around $69,200. The trading volume around BTC has been consistent, around $35 billion, hinting towards an average participation of the traders.

Interestingly, the other top cryptos within the top 10 remain stuck within a tight range. Ethereum consolidates below the local resistance at $2000 while XRP sustains at $1.45, Solana is close to $85, BNB is above $615, and Dogecoin is above $0.1. The crypto market capitalisation surged briefly above $2.3 trillion, but the volume dropped marginally from $98 billion to $84 billion. In the times when the crypto market sentiments have improved a bit, the Santiment data tells a different story.

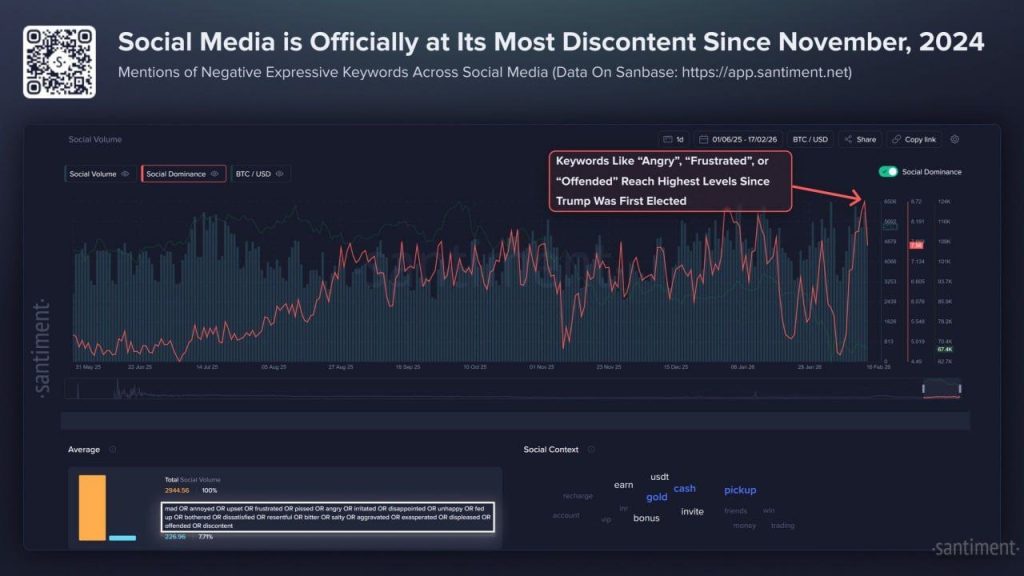

The chart above shows that traders’ sentiment has become extremely negative. The market participants seem to have been extremely disappointed, angry, and fearful, as keywords such as ‘Angry’, ‘Frustrated’, or ‘offended’ have reached their highest levels since Trump was first elected. These extreme negative sentiments often signal an opportunity for those positioned as contrarians.

Bitcoin-Led Selling, Liquidations and Weak Institutional Demand

Bitcoin price fell 0.78%, contributing over 80% of the total market’s decline. The drop triggered $67.01 million in forced liquidations over 24 hours, with long positions making up 74% of the total. This suggests the market is following Bitcoin’s lead, and hence a sustained break below the $65,000 spot bid zone may trigger another wave of liquidations.

On the other hand, the spot Bitcoin ETFs have seen four consecutive weeks of outflows, with over $133 million leaving last week alone. The on-chain data suggests the current accumulation is notably weaker than during the November 2025 bounce. This suggests the institutional buying has cooled a bit, and hence, a reversal in weekly ETF net flows from negative to positive may signal renewed institutional confidence.

Near-Term Outlook: Here’s What to Watch Out for This Week

The immediate outlook hinges on Bitcoin’s ability to defend the $65,000 to $67,000 range. Key resistance sits at the 7-day simple moving average near $70,000. The next major macro catalyst is the release of U.S. PCE inflation data on February 28. Holding the support is pretty crucial to prevent a deeper correction, and a rise above $70,000 would help neutralize the short-term bearish structure.

Overall, the current dip is driven by Bitcoin’s weakness, amplified by liquidations and tempered by institutional inflows. The crypto market is looking for a base as the sentiment is stuck in extreme fear. Therefore, now the question arises for the week whether spot demand can absorb selling pressure at the $65,000 support or if fatigue sets in for a retest of lower levels.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.