Strategy founder Michael Saylor has responded to ongoing discussions suggesting the company could face a forced sell-off as Bitcoin’s price continues to decline. He said Strategy can still manage its debt even if Bitcoin crashes 88% to $8,000

He explained how the Strategy Convertible Debt Bitcoin Plan is designed to reduce long-term risk.

Here’s How Strategy can survive Bitcoin at $8,000?

Michael Saylor’s Bitcoin Strategy Shows No Forced Liquidation Risk

In a recent tweet post, Salyor said that the strategy’s balance sheet can handle extreme market pressure. As of now, the firm currently holds about 714,644 BTC, worth nearly $48.86 billion at recent prices.

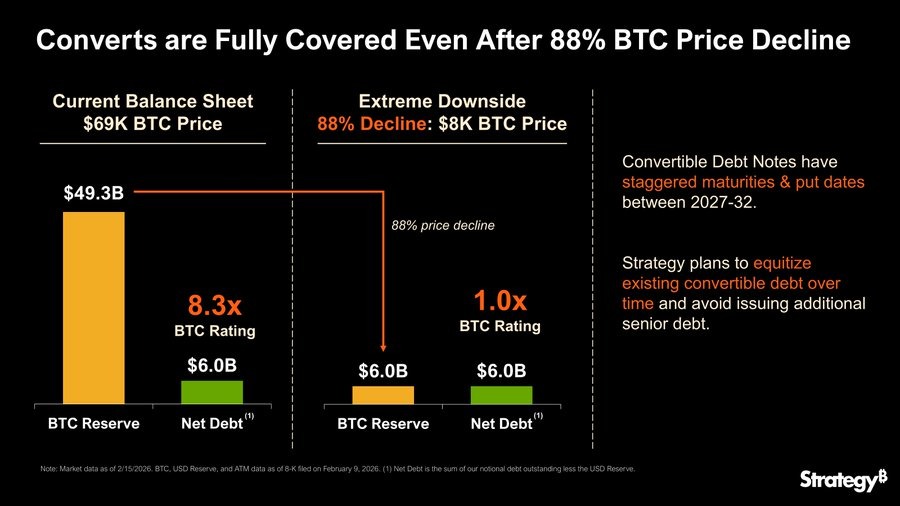

While Bitcoin is trading near $68,000, below Strategy’s average purchase price of roughly $76,000, Saylor argues that short-term price drops do not threaten the company’s survival.

Unlike margin loans, Strategy structured its debt as low-interest convertible notes with maturities extending to 2032. This means there are no margin calls and no automatic forced sales tied to Bitcoin’s price.

However, this massive reserve remains the backbone of the firm’s financial position and supports its ability to manage obligations safely.

How Strategy can Survive Bitcoin at $8,000? Strategy Convertible Debt Bitcoin Plan

Michael Saylor shared plans to convert the company’s debt into equity. He explained that Strategy’s convertible debt Bitcoin obligations are low-interest notes with maturity dates between 2027 and 2032. This structure gives the company enough time and flexibility to manage its payments.

Instead of relying on asset sales, Strategy will slowly convert this debt into equity. This helps the company protect its Strategy Bitcoin holdings and avoid selling assets during a market crash.

As a result, even if Bitcoin crashes 88% to $8,000, the value of Strategy’s Bitcoin holdings would drop to roughly $6 billion, almost equal to its net debt. This creates a 1.0x coverage ratio, meaning the company would still have enough assets to cover what it owes.

Will Strategy Continue to Raise Funds, If BTC drop To $8K

Despite all, Bitmern Mining founder Giannis Andreou has raised concerns about the strategy’s ability to continue raising capital in the future.

He said the $8,000 Bitcoin scenario was presented as a stress test to show strength. However, the real question is not just survival after a sharp crash. But the question is whether Strategy can keep raising capital at reasonable costs.

This becomes harder if a long bear market continues and Bitcoin stays weak.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.