Trump won the elections and became the first cryptocurrency-friendly US President. But then he got too involved in the cryptocurrency business. He and his family and even the people around him earned billions of dollars from this business. However, US Senators think that this situation is not legal.

Cryptocurrency Complaint Letter

It is not legal for heads of state to accept bribes or sell the powers granted to them in exchange for benefits. This is the same in the USA, and since Trump’s crypto business took office, bribery has turned into something akin to corruption. On behalf of himself and his wife cryptocurrency exports family DeFi project, WLFI receives half a billion dollars of investment from the UAE, and after countless moves, Trump’s fortune grows.

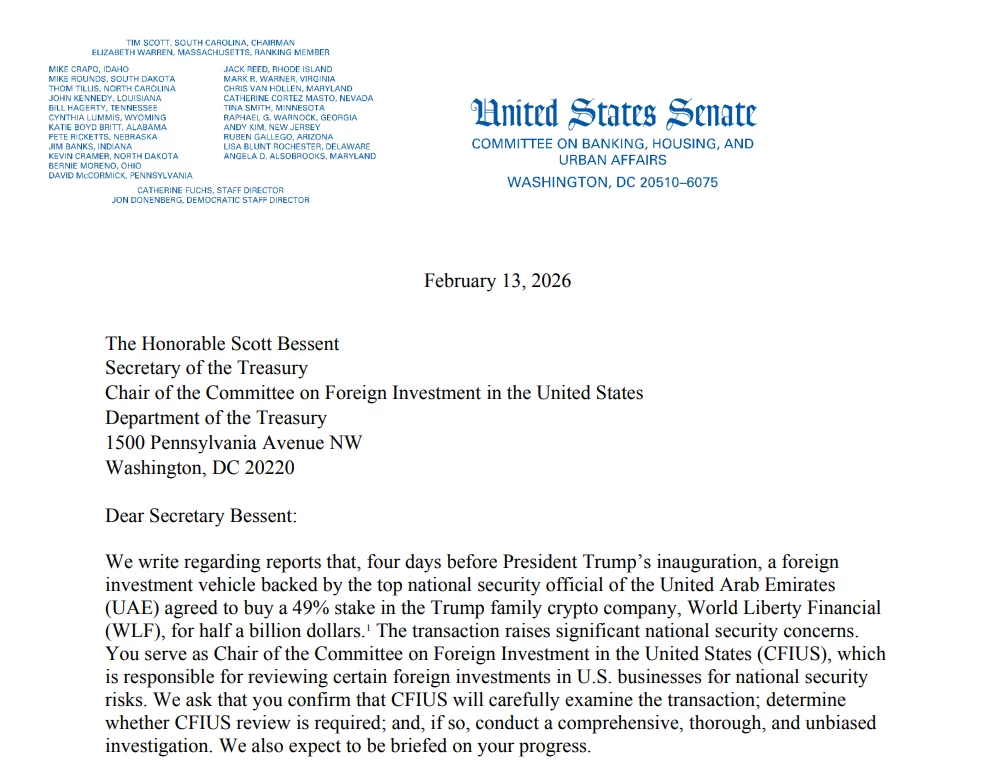

Elizabeth Warren and Andy Kim are calling for action due to national security concerns. They wrote a letter to Scott Bessent to review the acquisition of shares of the Trump-linked WLFI company by the BAE-backed company. This is not a big problem for now, because last year we saw action taken on different issues, but again in connection with the crypto business. The real problem is that this is about to turn into electioneering for the Democrats and the possibility that Trump will be put on trial as the Republicans taste defeat in the midterm elections.

Massachusetts Senator Elizabeth Warren and New Jersey Senator Andy Kim asked the Committee on Foreign Investment in the United States (CFIUS) to review the UAE-backed company’s share purchase of World Liberty Financial (WLFI). They sent the letter to Bessent, as he chairs CFIUS.

Details of the Letter

The letter sent to the UAE’s National Security Advisor Sheikh Tahnoon bin Zayed Al Nahyan regarding his purchase of WLFI shares is as follows;

“Four days before President Trump’s inauguration, a foreign investment firm backed by the United Arab Emirates’ (UAE) top national security official reportedly claimed that the Trump family crypto company We are writing about news that World Liberty Financial (WLF) has agreed to purchase 49% of its shares for half a billion dollars.

This transaction raises significant concerns for national security. You chair the Committee on Foreign Investment in the United States (CFIUS), which is responsible for reviewing foreign investments in the United States for national security risks. We ask for your confirmation that CFIUS will carefully review this transaction, determine whether a CFIUS review is necessary, and, if necessary, conduct a thorough, detailed and impartial investigation. We also expect to be informed about your progress. According to recent news, the UAE-backed fund’s agreement to acquire majority shares of WLF makes it the company’s largest shareholder and only known outside investor.

This is the case, as the Wall Street Journal puts it, “the deal marks an unprecedented event in American politics: a foreign government official taking a significant stake in the company of the new U.S. president.”

The deal reportedly gave two of WLF’s five board members to senior executives who also served at Sheikh Tahnoon’s company, G42. US intelligence has long warned that G42 was providing technology to aid the Chinese military. G42’s current CEO is reportedly developing a messaging app with Chinese engineers. CFIUS plays a critical role in protecting our national security, and the public deserves assurance that any review will be conducted impartially, regardless of political favoritism by President Trump or other administration officials.

These concerns were further increased by the news that the “fast-track pilot program for foreign investors” announced by the Treasury Department in May 2025 was directly lobbied by the UAE. We request that you answer the following questions by March 5, 2026:

The questions are as follows:

- of WLF Was the BAE-backed investment to acquire 49% (“WLF transaction”) a transaction that required CFIUS review?

- Have the parties to the WLF transaction filed an affidavit or notice with CFIUS? If so, when?

- Did CFIUS follow the “fast track” of the WLF process? So, on what grounds did CFIUS determine that the WLF transaction qualified for an expedited or “fast track” transaction?

- Has CFIUS conducted an initial review or formal investigation of the WLF transaction?

- Has CFIUS provided President Trump with any recommendations or materials regarding the transaction?

- Have you discussed anything with White House officials or President Trump regarding CFIUS’ review of any WLF transactions? What was the nature of these talks? Who participated in these talks? When did these talks take place? What was the outcome of these talks?