Netherlands-based banking giant ING is expanding its cryptocurrency-related business. Financial giants around the world are offering crypto products to their customers, and they are doing so because they are excited by earnings projections despite the crash. The latest move came from ING’s German branch.

ING Cryptocurrency

ING Germany, US asset managers Bitwise And VanEck expanded access to cryptocurrency investment products by joining forces with. ETPs and ETNs of these two companies were added to the 21Shares, WisdomTree and BlackRock crypto ETFs listed on ING. cryptocurrency Despite the great decline in the market, the increasing volatility rightfully excites financial companies.

Starting from February, ING Germany customers will be able to execute orders of at least 1,000 Euros without paying Bitwise ETP transaction fees. For transactions below this, they will pay a commission of $4.6. The entire Bitwise product range is included in this promotion, including Bitwise Core Bitcoin ETP (BTC1), Bitwise MSCI Digital Assets Select 20 ETP (DA20) and Bitwise Physical Ethereum ETP (ZETH).

Cryptocurrency Investment Products

BlackRock The largest ETF earned its revenues from its BTC product. Even those who are against it, like Vanguard, are getting into the cryptocurrency business because the goal of financial companies is to make money. Being able to offer your customers the alternative investment products they demand is also part of making money.

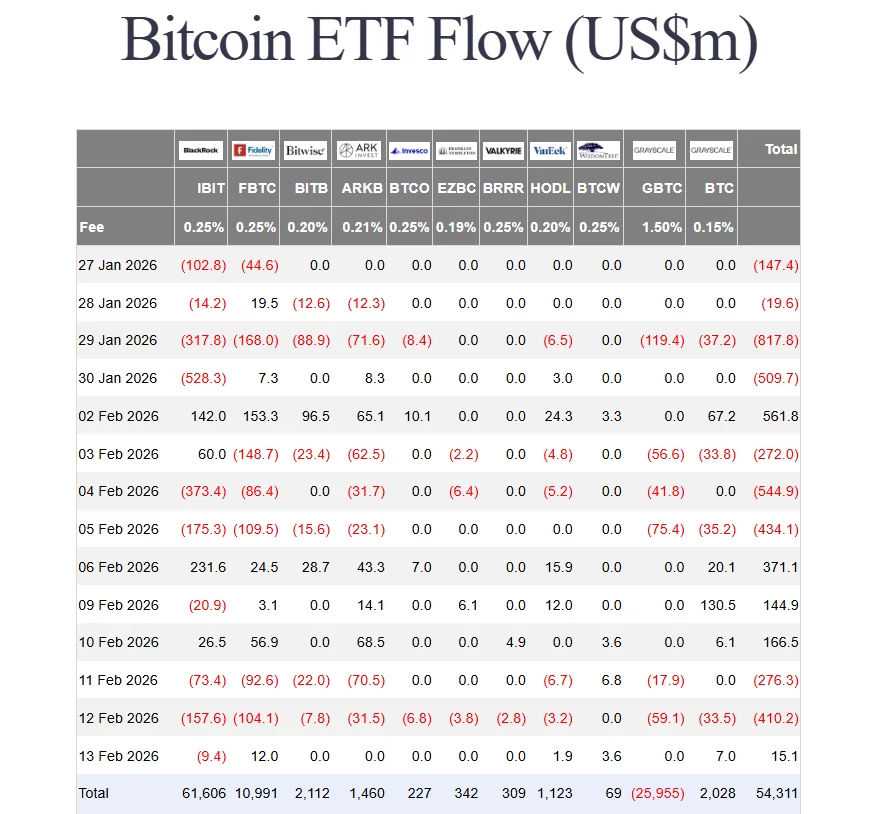

in january cryptocurrency Although investment products have performed relatively well, 2026 has turned into a net sales year with recent big sales. We have seen an outflow of nearly 3.5 billion dollars in the last 2 weeks. Although BTC saw a net inflow for a few days in the week we came to the end, there was a net outflow of approximately 300 million dollars due to larger sales.

However, the strong entry series that started with the launch in 2024 took longer than expected. So, stable net outflows for a while will not damage confidence in cryptocurrency ETFs that much.

At the same time, if Warsh takes a less hawkish position than expected, the attractiveness of cryptocurrencies will rapidly increase due to decreasing macro risks. In this environment, large asset managers and banks want to enable their customers to make transactions that will make them money.