Today Bitcoin (BTC) The decision moment for and the rise in meme coins is promising. Bitcoin price also regained $70 thousand. Although it is too early to rejoice, BTC, which avoids deeper bottoms, gives hope on the decision day. Let’s examine the current evaluations of different analysts and try to understand the next stage.

Bitcoin Decision Day

Today is the weekly closing and of Bitcoin Continuing closes above $68,000 reduce the possibility of the decline intensifying. The level to be permanently exceeded for the rise is 72 thousand dollars and BTC is finding buyers above 70 thousand dollars at the time of writing. Nic discussed the current situation and pointed to the weekly closing candle.

“It is a critical day for Bitcoin. We are on the verge of the 4th weekly negative closing, at approximately 70 thousand levels.

It is also very close to the ATH level of the previous cycle. “If we manage to close in green, maintaining the 69 thousand support will be a welcome relief.”

Another promising detail is that although the cryptocurrency has been hit hard, it shows some signs of stability. Despite the great fluctuation, crypto loan demands continue steadily.

“Bitcointook a big hit in the last market downturn. Since the all-time high on October 6, 2025, the total market cap has fallen by approximately 50%.

This decline reflects increasing economic pressure and continued weakness in technology stocks and other risky investments. But while prices fluctuate, something important is happening behind the scenes: crypto is increasingly establishing itself as a true wealth service.

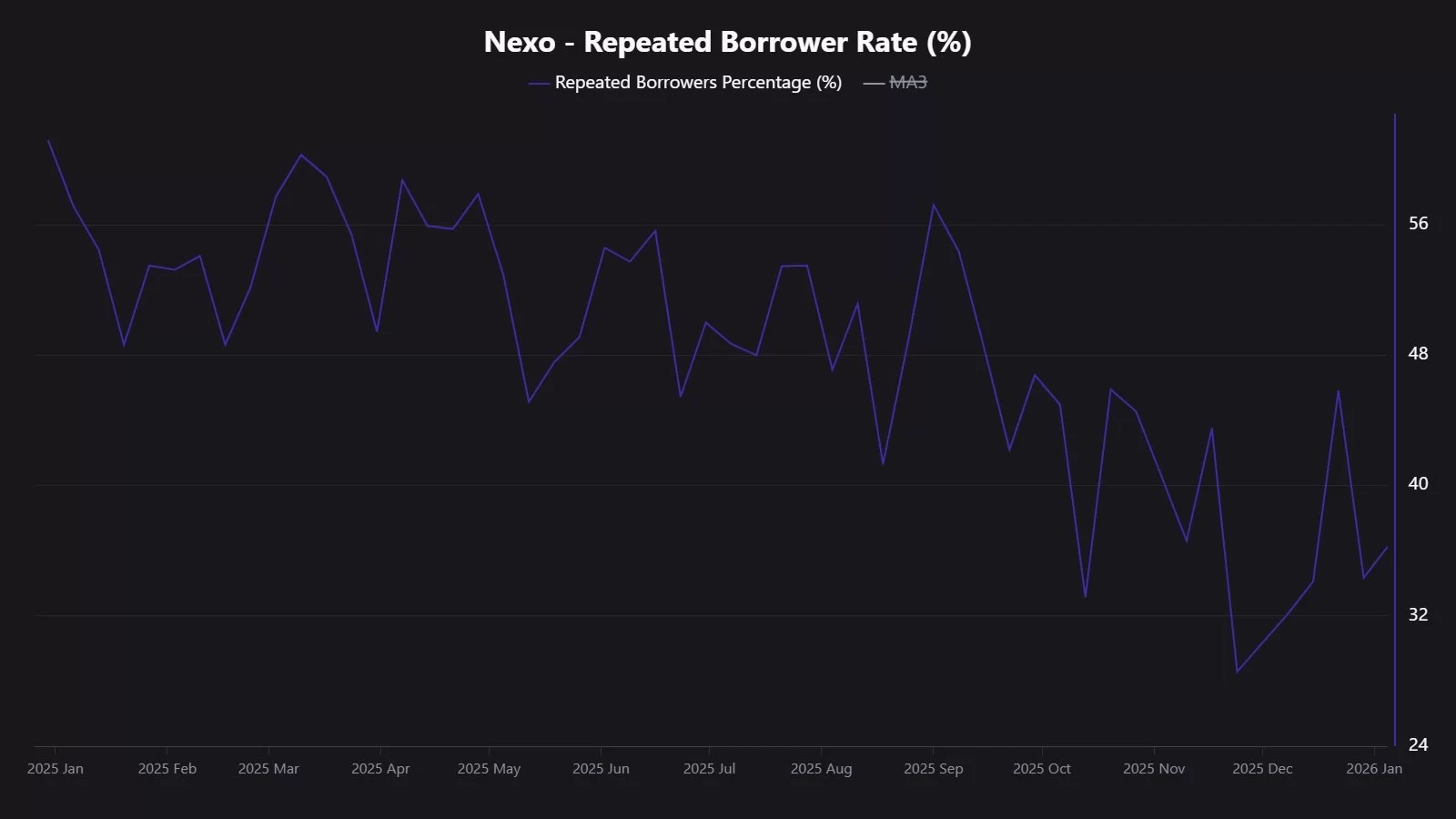

Nexo data shows that a total of $863 million was loaned from January 2025 to January 2026, while users were borrowed nearly $1 billion.

More than 30% of users return: More than 30% of borrowers return, indicating that they are regular users of the service and not one-time customers.

“Despite large price fluctuations, these data show that cryptocurrency is increasingly becoming a stable and reliable financial product.”

Bear Markets Were Severe

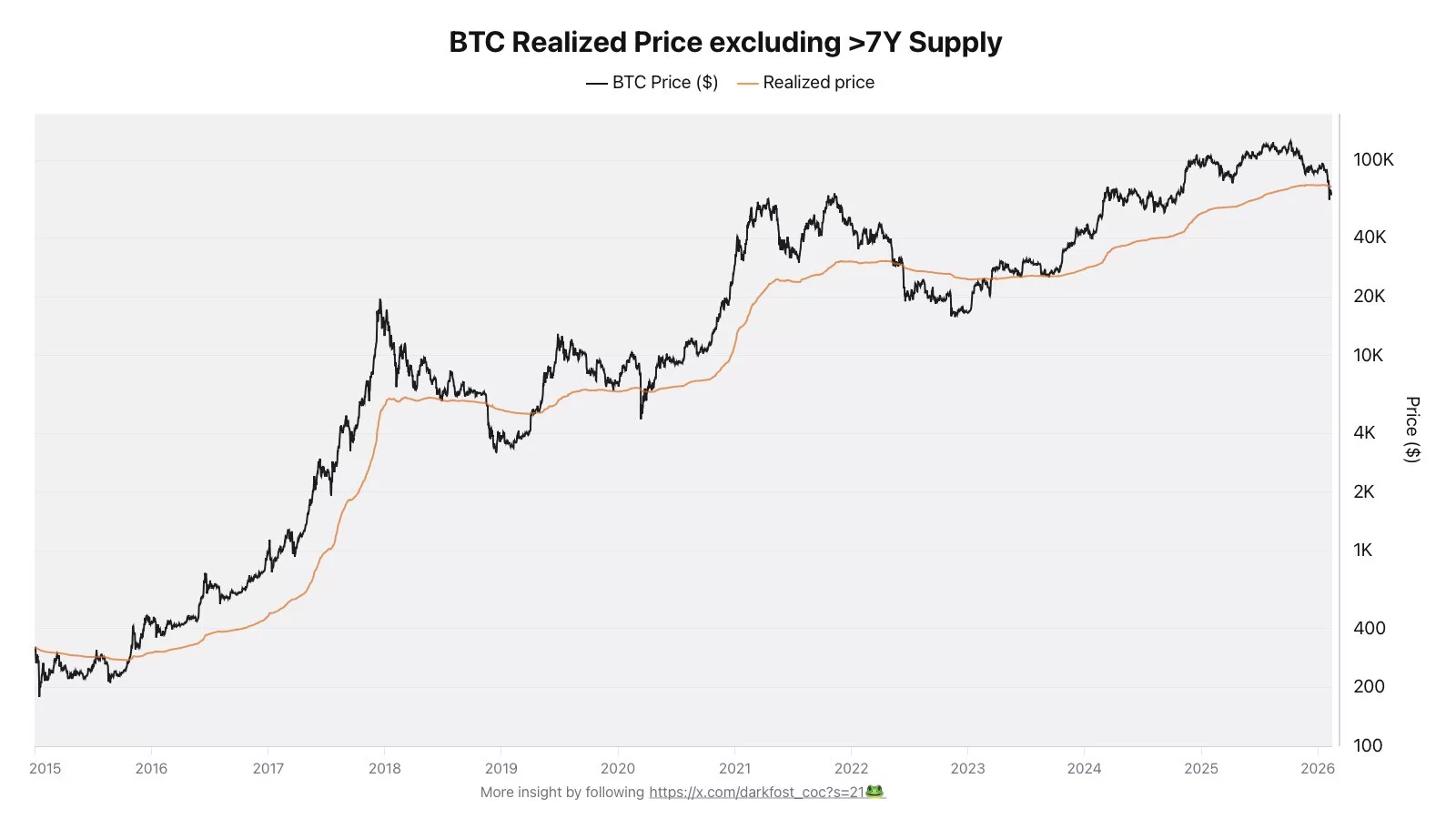

If Bitcoin can start and sustain its recovery from here, accelerated bear markets We can say that it was severe but left behind. $70,000 could already offer a big early signal for a best-case scenario. Darkfost, one of the CryptoQuant analysts, emphasizes the importance of this by drawing attention to the investor cost.

“The realized price of active Bitcoin investors is estimated at approximately $73,000. For more than seven years BTC Investors who own it are not included in this calculation because they are no longer actively involved in the market. Part of this supply can be considered lost, so it makes sense to exclude this part. Since Bitcoin is currently trading around $70,000, the market remains below the cost base of these active investors.

The only times this has happened in the past were during well-advanced bear market phases. “Reclaiming this price range would be the first positive signal before hoping the worst is behind us.”

In other words, 70 thousand dollars should be protected and 72-73 thousand dollars level should be gained.