Bitcoin is trading around $69,781 after dropping over 44% from its October 2025 all-time high of $126,296.

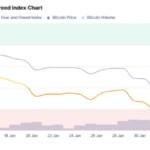

Four months into this drawdown, new data from Ecoinometrics shows that institutional demand through spot ETFs is still heading in the wrong direction, and history says recoveries from corrections this deep don’t happen fast.

Bitcoin ETF Flows Remain Negative Despite Green Days

Daily ETF numbers have been all over the place. Some days show large inflows, others show heavy selling. But zooming out tells the real story.

Cumulative net flows over the last 10 trading days sit at roughly -18,000 BTC. Spot Bitcoin ETFs have now posted four straight weeks of outflows, with $360 million in net losses this week alone. A small $15.2 million inflow on Friday barely made a dent.

According to Ecoinometrics, isolated positive days don’t signal a shift during bear markets. What actually changes the trend is sustained capital coming in over weeks, not random green days here and there.

Also Read: Who’s Really Selling Bitcoin? Bitwise CIO Reveals What ETF Flows Show

Long Drawdowns Don’t End Quickly, History Shows

Ecoinometrics mapped past drawdowns for both Bitcoin and the Nasdaq 100 by how long they lasted and how deep they went. The pattern is hard to ignore: the longer a drawdown drags on, the deeper it usually gets before bottoming out.

Bitcoin is now 128 days into this correction, with a drop of over 50% at its worst point. Once a drawdown crosses the 100-day mark, history shows recovery takes months, sometimes years, but rarely weeks.

The Nasdaq 100 is also deep into drawdown territory. That matters because when U.S. growth stocks are under pressure, Bitcoin tends to move with them, not away from them.

The Economy Isn’t Weak, and That’s the Problem

Retail sales in the U.S. are still tracking their long-term growth trend. Consumer spending hasn’t rolled over. This is not what a recession looks like.

But that’s exactly why the Fed has no urgency to cut rates. The central bank held steady at 3.5%-3.75% in January, and markets don’t expect the first cut until June at the earliest.

No rate cuts means tighter conditions stick around longer. That keeps pressure on risk assets across the board, and Bitcoin is no exception.

What Should Bitcoin Holders Watch For?

The signal to look for isn’t a single day of ETF inflows or a weekend bounce. It’s persistent buying pressure that lasts for weeks.

Ecoinometrics’ bottom line is straightforward: there’s no sign yet that capital is flowing back into risk. Trying to call the bottom in a slow drawdown like this usually costs more than it’s worth. The smart move right now is patience.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.