The Ethereum price keeps falling, despite supply on Binance keeps shrinking. Normally, declining exchange reserves are bullish and many immediately speculate for a rally. Coins leave exchanges, sell pressure drops, price rises. That’s the textbook theory.

But markets don’t care about textbooks, it works in a more twisted way and ordinary textbook theories don’t always work and ETH not going up is clear evidence of this.

Right now, the Ethereum price sits near $1908 with fading momentum, moving averages weakening after a bearish crossover on both long-term and shortterm spans, and downside pressure refusing to let up. So what’s overpowering the shrinking exchange supply narrative?

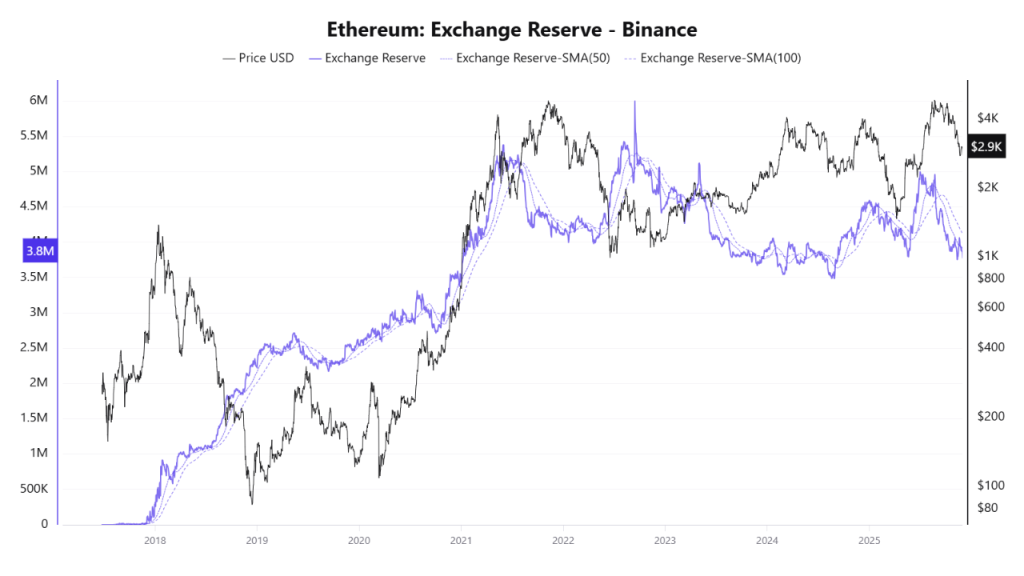

Shrinking Binance Reserves Explained

Binance’s ETH exchange reserve is trending downward again. That means ETH is being withdrawn. Under normal spot-driven conditions, that’s constructive theoretically.

As, less ETH on exchange typically means fewer coins readily available for sale.

Well, here’s the catch: spot dynamics don’t dominate short-term price action anymore. Infact, Derivatives do as they have strong leverage support from exchanges that covers up spot activity in short term.

And that is what changes everything. Since, exchange reserve data reflects spot supply. But the Ethereum price chart is currently reacting more to futures positioning than to on-chain withdrawals.

If open interest is elevated, funding rates has turned negative, and traders are leaning heavily short, aggressive derivatives selling can drag Ethereum/USD lower. That’s why even if spot supply is shrinking. In that scenario, futures pressure simply overwhelms spot optimism. And that appears to be what’s happening.

Withdrawals Don’t Always Mean Holding

But, still knowing what futures activities are capable of, then let’s be real. This clearly implies that withdrawals aren’t automatically bullish accumulation anymore and theories like these are not certain indicators anymore.

Also, withdrawals also implies that ETH can leave Binance for DeFi collateral use, staking, Layer-2 activity, OTC transactions, or even transfers to other exchanges. A decline in Binance reserves doesn’t guarantee coins are locked away long term. That’s a very practical and logical thing to assume at this point about exchange reserve metrics. As Global sell pressure can still persist elsewhere.

So, shrinking supply on one exchange doesn’t necessarily mean shrinking supply everywhere.

Weak Demand and Macro Drag

Here’s another inconvenient truth, as a reduced exchange supply isn’t enough without demand presence.

In the crypto sector this demand comes from stablecoins inflows. If these are weak, then risk appetite is low, or broader market sentiment is negative, as a result ETH price won’t respond positively. In this mix, if we add macro correlation into the mix then it complicates the outlook even more bleak.

Like, if broader crypto is soft or risk markets are under pressure, then reserve signals can be completely overridden.

There’s also the possibility that large players are playing both sides: withdrawing spot ETH while opening short positions in derivatives. Strategic hedging Or positioning for lower levels.

So What’s Next For Ethereum price?

If derivatives pressure continues and liquidity gets cleared to the downside, Ethereum price prediction models increasingly point toward a deeper support retest, potentially in the $1,700 region. That doesn’t invalidate long-term structure but it does suggest pain could come first.

For now, the Ethereum price remains under pressure despite falling Binance reserves, proving once again that in this market, supply signals alone don’t move charts but positioning does.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.