Ali Martinez in the middle of the latest surge PEPE Coin Sharing the decline chart, he said that this is what is coming for HYPE Coin. Cryptocurrencies are once again in a time of alert because inflation data will be released just before the US market opens on Friday. So what awaits us tomorrow? What is Martinez’s goal for HYPE Coin?

February 13 Cryptocurrencies

Employment figures in January and February confirmed that interest rate cuts were no longer necessary. Inflation reports in January were also added to this in a supportive way. Investors are now holding their breath for the January inflation report, expecting figures of 2.5% and below. The predictions for Headline and Core Inflation are the same. An annual decrease of 0.1% and 0.2% points is predicted for both of them compared to the previous month.

As employment data has been extremely strong for two months Fed’s Expectations that interest rates will not be reduced in the next 2 meetings are extremely strong. What changes this? If inflation is very close to 2% and below expectations, the Fed may consider interest rate cuts.

However, the reasonable scenario is that the Fed will not reduce interest rates, with the strength it gets from the confirmation of employment reports, with the arrival of a report at or close to the expectation. This is largely priced in, so no surprises expected for Friday’s data. In summary, investors need to be more cautious in the coming hours.

If inflation has decreased compared to last month, then we will see figures above expectations. This will clearly be against cryptocurrencies.

HYPE Coin and Cryptocurrencies

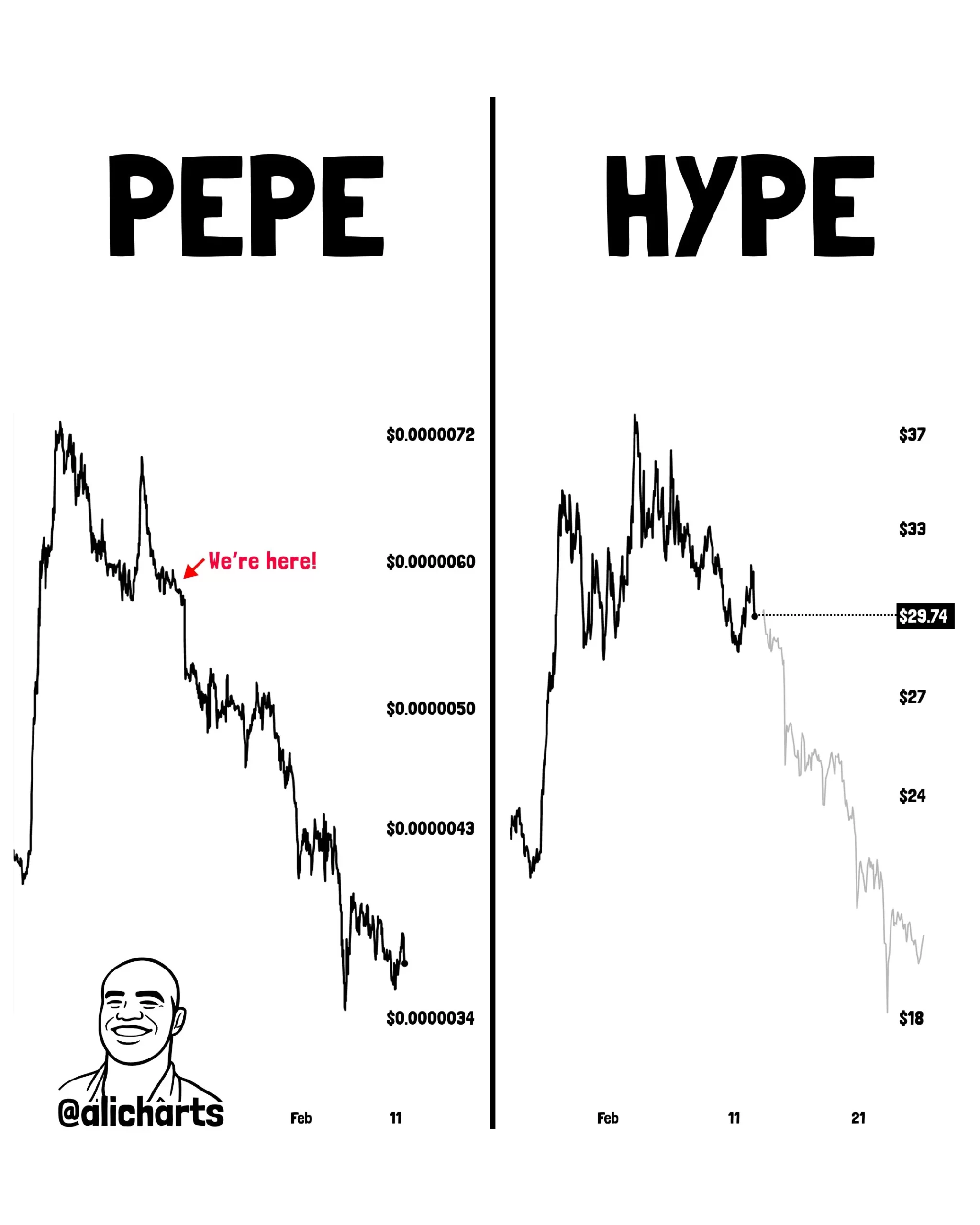

Sharing the PEPE and HYPE Coin chart comparison below, Martinez expects the price to drop rapidly. The analyst, who predicts that the decline will continue up to $ 18, pointed to the level of $ 27 and $ 24. The key support is $28, and we have already written that due to many factors, HYPE Coin could remain isolated from the overall market decline.

If commodity volumes remain strong HYPE Coin can move away from deeper bottoms. However, as Binance FUD on social media has started to cool down, it may be time for a short break from HYPE Coin’s periodic rise.

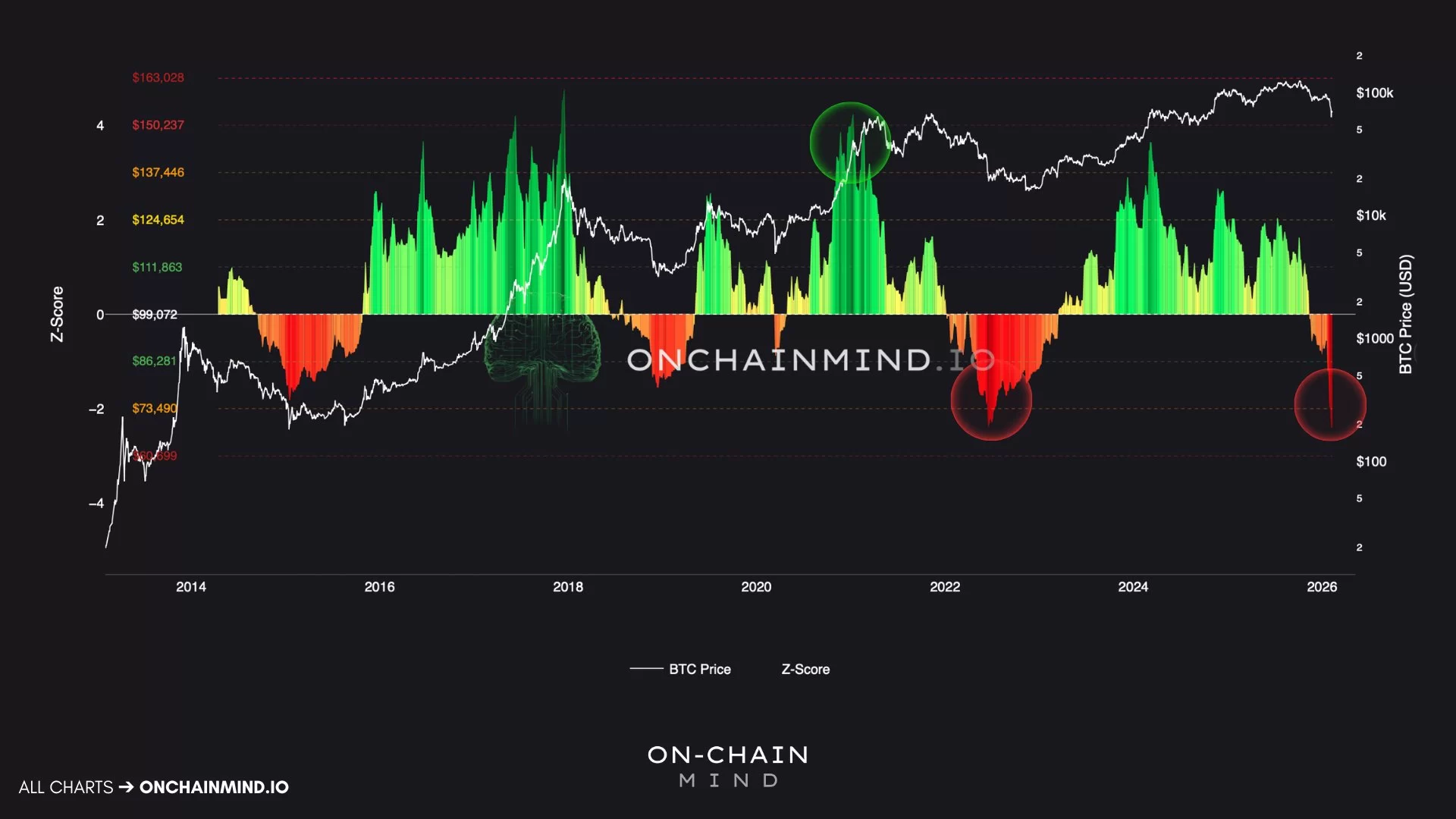

On-Chain Mind BTC It predicts that general market sentiment will remain bad for a while due to the price experiencing the most extreme statistical decline in its history.

“In the last crash, BTC experienced the most extreme statistical decline in its history, with a -3σ downward bias (around $60,000). An even sharper decline below this level would be historically unprecedented.

I expect nothing but negative fluctuations for a while. “Eventual bottoms are formed not by vertical collapses, but by boring, choppy squeezes.”