While cryptocurrency markets continue their volatile course, the Ripple ecosystem continues to be at the top of the agenda with both corporate steps and price movements. The company’s strategic expansion in the Middle East, growing interest in XRP-based ETFs, and upcoming global events have made Ripple one of the most talked about projects of 2025. XRP’s recovery effort after the sharp market decline in early February turned investors’ focus back to this asset.

Middle East Moves and Ripple’s Global Strategy

Ripple has turned its route to global markets in recent years, following the regulatory process in the USA. In particular, the Middle East stands out as a key region in the company’s growth plans. The recent expansion of the cooperation with United Arab Emirates-based Zand Bank, which started in 2025, to include new initiatives is an important indicator of this strategy. According to the statements made, the parties are evaluating various projects, including the use of Ripple’s stable cryptocurrency called RLUSD in Zand’s regulated digital asset custody infrastructure.

Ripple’s steps in the region are not limited to this. It is stated that significant progress has been made in Bahrain and Saudi Arabia in recent months. On the other hand, the fact that the company is among the top 10 most valuable private companies in the world with a valuation of $ 40 billion reveals that Ripple has increased its weight not only in the crypto world but also in the global finance scene. It is noteworthy that it is in the same league with giants such as SpaceX, OpenAI and Revolut in this list.

Another important development on the Ripple front is the XRP Community Day event. This global organization, which will start on February 11, will include representatives from leading institutions in the industry such as Bitwise, Grayscale and Gemini. The conversation that CEO Brad Garlinghouse will have with Tony Edward, one of the well-known names in the crypto world, at the opening of the event may contain important messages in terms of corporate adoption and XRP usage areas.

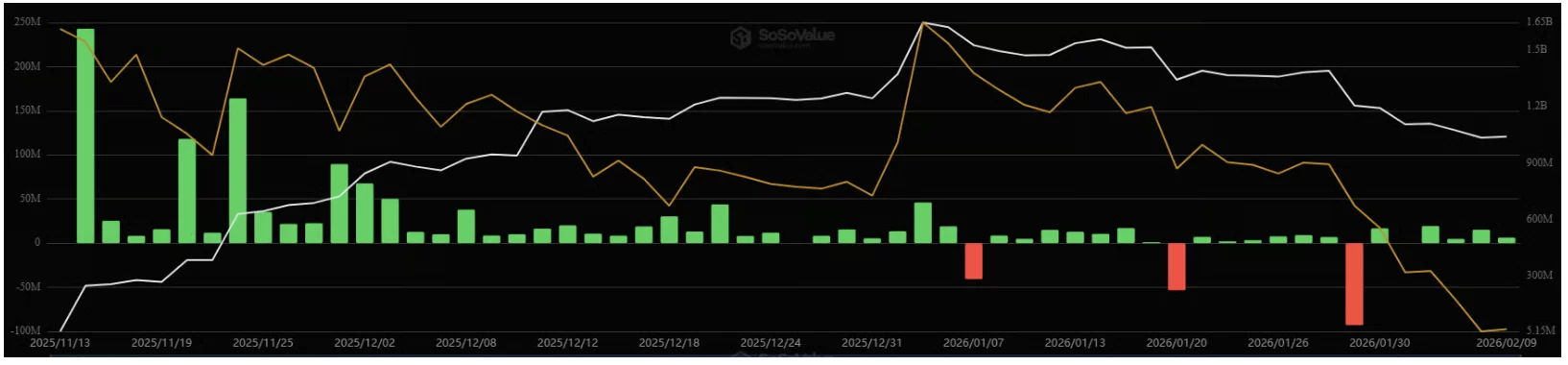

The year 2025 was also a turning point for Ripple on the ETF side. With the launch of the first spot XRP ETF, the involvement of major funds such as Bitwise and Franklin Templeton enabled total net inflows to exceed $1.23 billion. Maintaining interest in ETFs despite sharp market fluctuations indicates continued long-term investor confidence. In parallel with these developments, although XRP dropped to $1.11 last week, it quickly recovered to $1.42.

As a different development at this point, the news that regulations regarding crypto ETFs will be relaxed in Europe also resonated in the market. Analysts argue that this step could indirectly support not only Bitcoin and Ethereum, but also alternative major projects such as XRP.

Looking at the overall picture, the relationship between the corporate steps taken by Ripple and the XRP price is becoming increasingly complex. Although correction expectations are expressed in the short term, ETFs and global partnerships appear to provide a strategic advantage to Ripple in the long term. However, for XRP to reach very high market values, not only optimistic expectations, but also sustainable usage areas and clear regulatory frameworks are critical.