US stock markets have been active for 2 weeks with the earnings reports of major US companies. When Iran tensions and the new Fed Chairman were added to the list, we saw that the Bitcoin price dropped to 69 thousand dollars. Moreover, the Supreme Court tariff decision is expected to be announced on February 20. What about today? calendar What?

US Markets and Cryptocurrencies

Bitcoin Bitcoin, which dropped to $69,163, is experiencing a steep decline and at some point it is necessary to take a break from these sales. At the time of writing, the European Central Bank announced its interest rate decision and kept it constant at 2%. The Fed is still behind the world’s central banks and the US may not touch interest rates until June.

Nasdaq 100 futures, After previously rising up to 0.7%, it fell by 0.8% and 2026 earnings were reset. Tomorrow’s Iran meeting is hanging by a thread, many countries tried to persuade Trump for the talks, which were later moved to Oman. Trump does not believe that the negotiations will yield results and wants missiles to be discussed along with nuclear power. Iran also opposes this. Considering the details such as the downed UAV this week and the fact that the ongoing protests in Iran encourage the USA to make regime change, the outlook for risk markets is negative.

Stress has spread across all asset classes. While silver dropped up to 17% following a historic decline, gold hovered around $4,900/ounce. BTC is below 70 thousand dollars for the first time since 2024.

Cryptocurrency Calendar

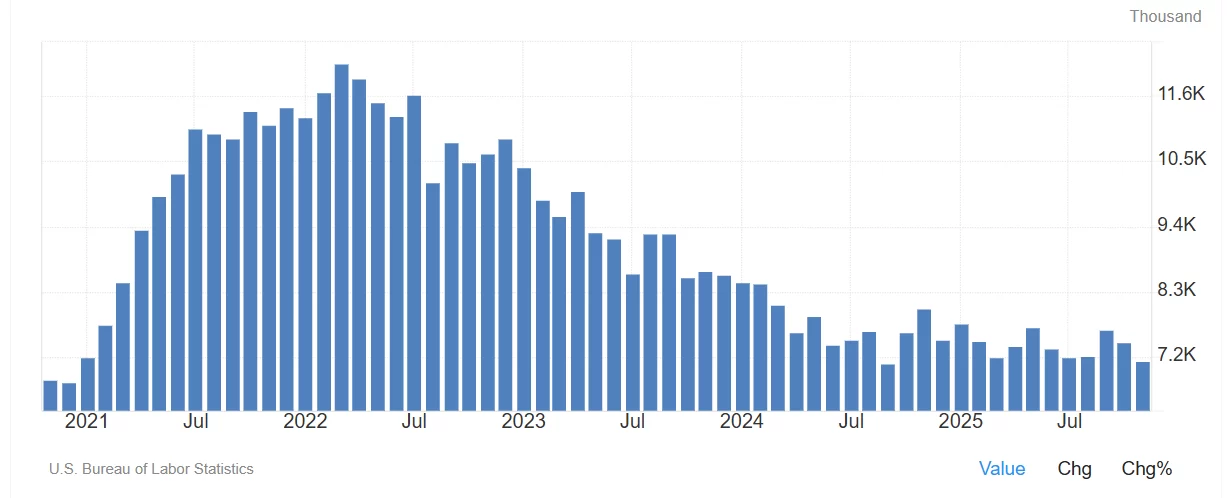

In the coming days US inflation figures Future and employment data this week have been postponed. The data flow will be more intense next week. However, today at 18:00, US JOLTS job vacancy figures will be available. Dreams of interest rate cuts have been dashed as employment data is constantly coming in better than expected. At 16:30, Trump will attend the breakfast event.

at 18:50 from the fed Bostic will participate in a moderated conversation and question-and-answer session with Clark Atlanta University School of Business Dean Silvanus J. Udoka. At 21:00 we will see a press conference with White House Press Secretary Leavitt and possibly statements about Iran.

Yesterday’s bomb was Alphabet, today it will be Amazon. Issues such as AI-related spending and earnings, details of the general earnings report will move US futures and cryptocurrencies after the close.