It was expected that BTC would soon break the narrow range in which it had been stalled for 3 months, and it did so with a massive liquidation wave. The four-year cycle narrative already said that the breakout would be downward. Now the chart neither signals a full reversal nor continues the decline. What’s the next move for Bitcoin?

Will Bitcoin (BTC) Return?

Those who remember the 2021 crash know what Bitcoin constantly makes deeper bottoms as if it will never come back, and what the anxiety this creates looks like. When BTC starts to fall, you feel like it will never see $60,000 or $50,000 again, and it won’t for a long time. Now of Bitcoin Investors who are worried that they saw the prices of 80, 90 and 100 thousand dollars for the last time and fell of BTC He hopes it will not reach 60 thousand levels.

So is there still hope? He says there is an analyst with the pseudonym Jelle.

“BTC It closed below the weekly support level, but has not broken or lost the 2025 low so far.

If we can break above the weekly support level and stay there, the bulls could revive. Until then, the gray box is the resistance level.”

Key support has turned into resistance and volatility in cryptocurrencies will increase further in the coming days.

Bear Markets Begin

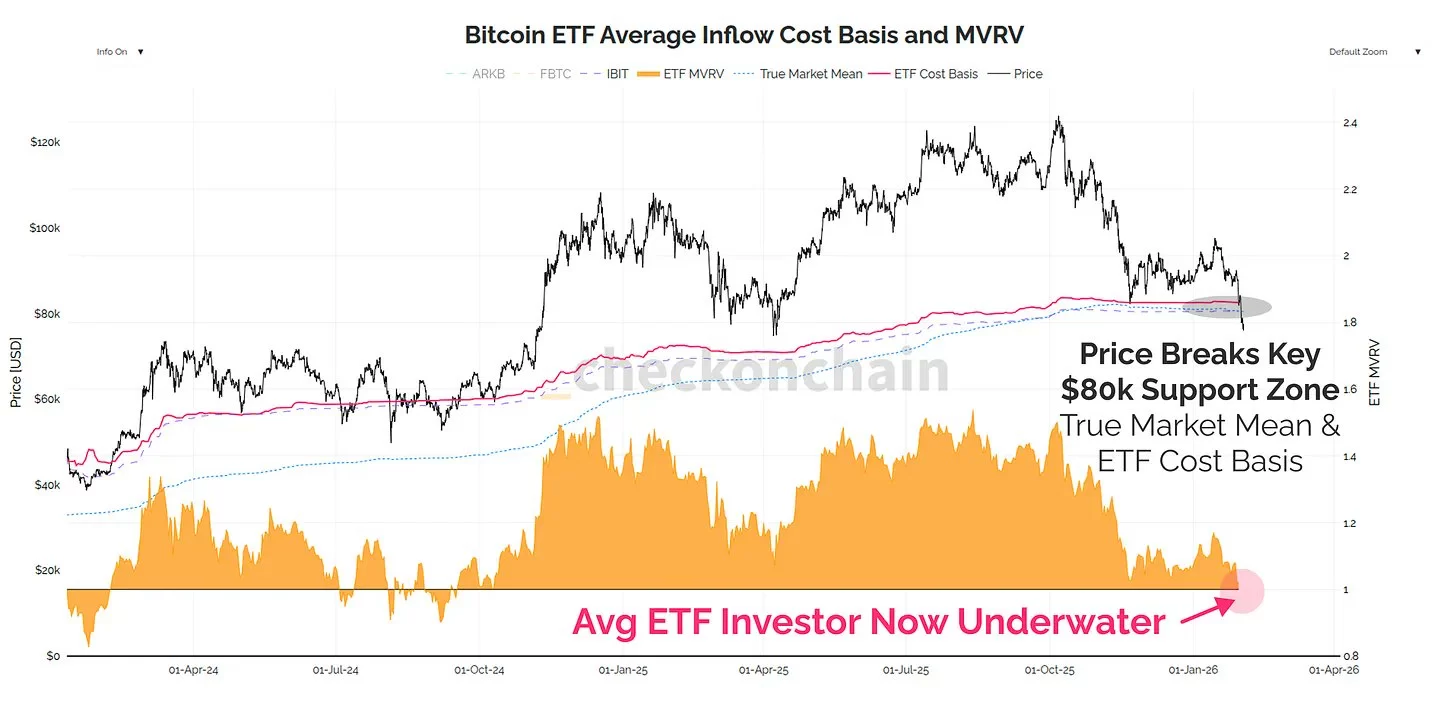

Bitcoin The fact that the price has fallen below the ETF cost average indicates that larger losses are approaching. _Checkonchain says some data is still promising for cryptocurrencies compared to previous bear markets and the expected average.

“Bitcoin’s drop below $80k pushed the price below the Real Market Average and the average ETF cost base, but fundamental data suggests this was not a final capitulation event but rather a deeper progression into the bear market.

– ETF outflows were significant, but still lacked the “mass flight” profile typical of end-of-cycle panics.

– Onchain losses are increasing, but not yet at the intensity typically seen during actual capitulations.

– Futures markets continue to show traders trying to take long positions on the bottom; “This is a regime in which permanent lows rarely occur.”

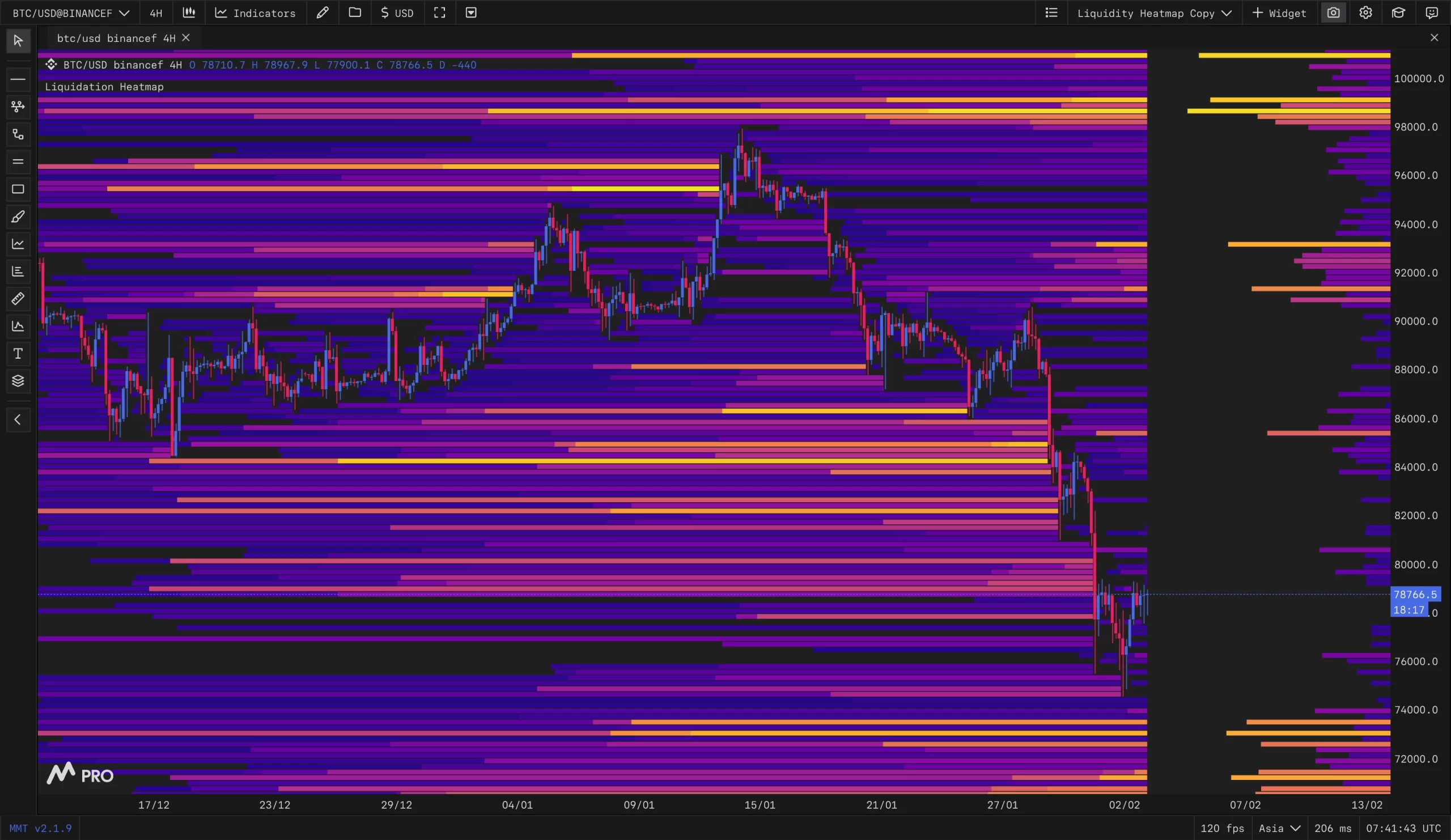

Columbus says small bounces are being accommodated by sellers and the decline is not yet complete.

“There is still accumulated liquidity below the price and the more predictable path is first another decline, followed by an appropriate response.”