As you can see from the Bitcoin chart, Trump’s announcement of Warsh as the new Fed Chairman did not produce good results in the short term. Although the decline occurred due to a combination of many factors, Warsh has pros and cons for cryptocurrencies. Now let’s examine the name Trump nominated for the Fed Chairmanship.

Fed Chairman Kevin Warsh

First of all, it is good that the uncertainty is gone, and even if names such as Hassett and Bessentt were announced, there would be a decline in cryptocurrencies. Compared to the other candidates, Warsh seems a little more neutral, meaning the risks that we could see a longer-term permanent negative impact on the Fed’s independence have diminished. However, with Trump’s statement Warsh’s Its name caused the dollar to strengthen and risk markets to weaken.

Well this name cryptocurrencies Is it too bad for you? Kevin, who worked at the Fed from 2006 to 2011, experienced the 2008 global financial crisis closely. He served as a bridge between the Fed and the financial markets in those turbulent days.

to the fed Prior to joining Morgan Stanley, Kevin served as Special Adviser to the President on Economic Policy and Executive Secretary of the National Economic Council during the George W. Bush administration.

His work at Stanford University gives us some insight into him. His most important work there was on the long-term risks of central banks’ balance sheet expansion. He is also sensitive about the reliability of the central bank. The appointment of such a person in an environment where Trump insulted Powell may reduce concerns about the Fed’s independence. However, the fact that it does not favor monetary expansion is a detail against cryptocurrencies, just as QT has ended.

How Will the Process Work?

Powell’s term as Chairman will end on May 15, but he has the right to remain on the Fed board until the end of January 2028. In his statements on Wednesday, he said that he had not yet decided whether he would leave the Fed completely when his term as chairman ended.

Warsh must be confirmed by the Senate to take office. Some Democratic Senators are already saying that Warsh should not be voted for before the case against Powell is dropped. However, they will most likely approve it, albeit with a delay.

Miran’s term expired yesterday, and Warsh could join the organization sooner if he receives approval.

What is the Impact for Cryptocurrencies?

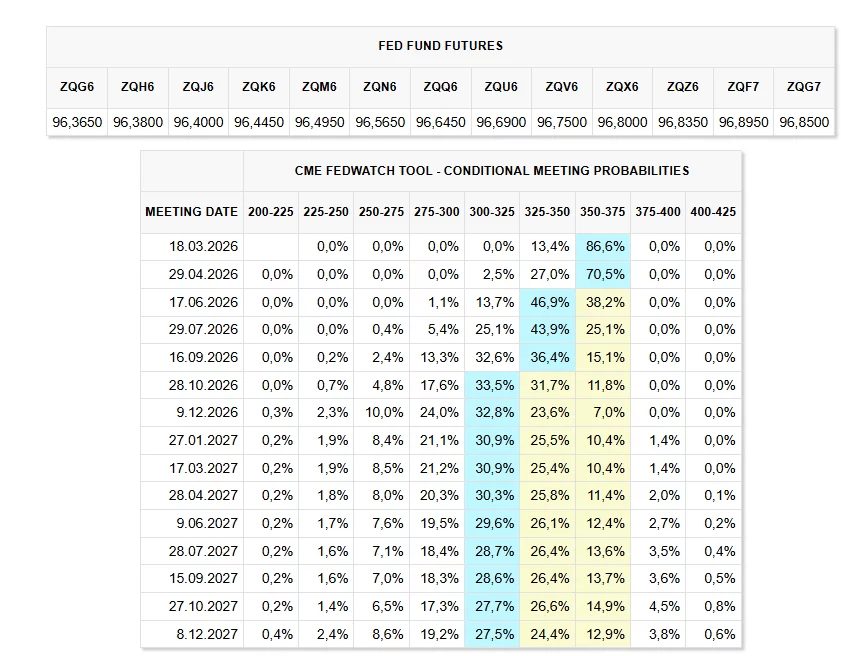

Opposition to QE is negative because cryptocurrencies need quantitative easing to rise. Trump too interest cares about its subject. Warsh may make interest rate cuts in a slightly front-loaded manner as data allows, but it is possible that he will suppress cryptocurrencies on the macro front by saying that there is no need for monetary expansion. Moreover, there are many members of the Fed who think like him.

We’ve talked about what he said about Bitcoin before. of Bitcoin He says it’s good software but can’t be considered money, and he’s relatively moderate compared to the usual Bitcoin opponents. Moreover, considering Trump’s crypto policy, he can adapt to it.

Compliance with Trump policies could make it more crypto-friendly. As a matter of fact, Trump said during his election campaign that he would definitely ban CBDCs. But in the past, Warsh has argued that central bank-issued digital dollars, like the digital yuan, should be issued to compete with China. If Trump nominates him today, he does so because they find common ground in such strict policy frameworks.

on Bitwise Considering his role and tenure at the algo stablecoin Basis, Warsh is hardly a crypto hater. However, due to its monetary discipline, we can say that it is a detriment to cryptocurrencies on the macro front.

Jason Fernandes said the following about Warsh:

“Warsh to cryptocurrency He is not hostile, and the perception that the new Fed Chairman is more likely to cut interest rates could trigger a short-term relief rally in risky assets.

However, without a real macroeconomic rationale for easing, such a move would be viewed with skepticism and lead to a sell-off.”