Bitcoin experienced a sharp 10 percent correction between Wednesday and Thursday, retesting the $81,000 level. While this level was seen for the first time in the last two months, it was observed that the risk perception in the crypto market increased significantly. Especially the strong outflows from spot Bitcoin ETFs and the sudden decline in gold prices caused investors to take a cautious position. These developments brought to the agenda once again the question of how strong the 80 thousand dollar level is as psychological support.

ETF Outflows and Macro Effects Pressure Bitcoin

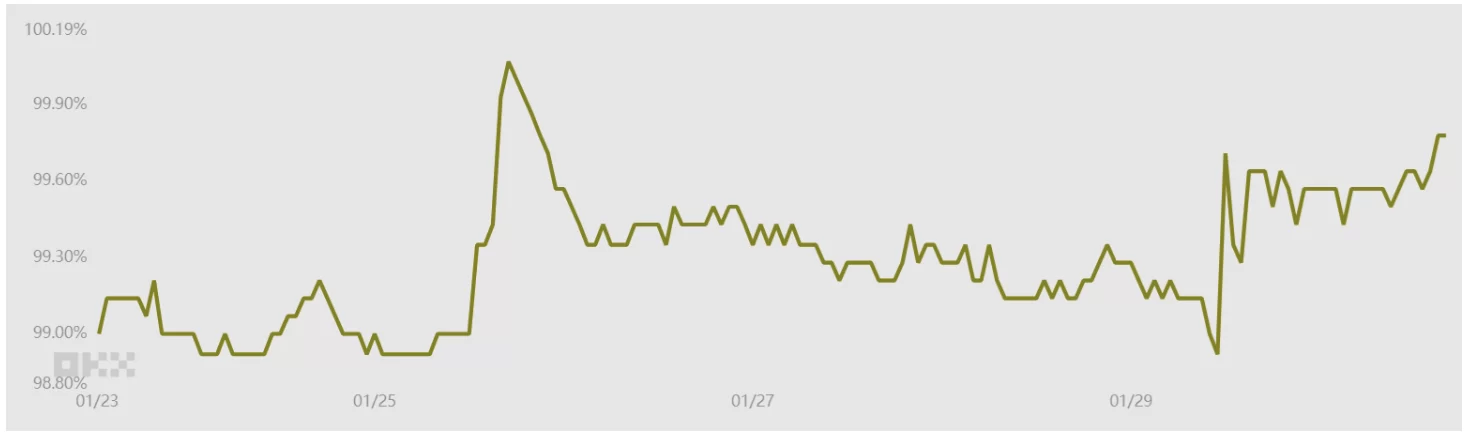

Spot Bitcoin ETFs traded in the US have experienced a total net outflow of $2.7 billion since January 16. This figure corresponds to approximately 2.3 percent of the ETFs’ total managed assets. While some market players argue that institutional demand has stalled, others think that gold, which has gained 18 percent in value in the last three months, has temporarily overshadowed Bitcoin’s “store of value” narrative. As a matter of fact, the 13 percent retreat of gold prices in just a few days shows that the risk aversion trend is not specific to crypto.

At this point, it is difficult to attribute Bitcoin’s decline to a single reason. However, increasing uncertainty on a global scale causes investors to turn to cash and short-term US bonds. A similar trend was seen in the US stock markets last week. The sharp fluctuations in the Nasdaq index once again revealed that crypto assets are considered in the same risk basket as technology stocks.

Quantum Computers and Derivatives Markets Raise Concern

Another factor that increases the anxiety of Bitcoin investors is the potential threat of quantum computers to blockchain security. The fact that Coinbase has established an independent advisory board to evaluate these risks and plans to publish public research by 2027 shows that the issue is being taken seriously. Jefferies’ removal of Bitcoin from its flagship portfolio also fueled this debate. However, Blockstream co-founder Adam Back argues that the panic may be exaggerated, stating that he does not see a concrete quantum threat in the next decade.

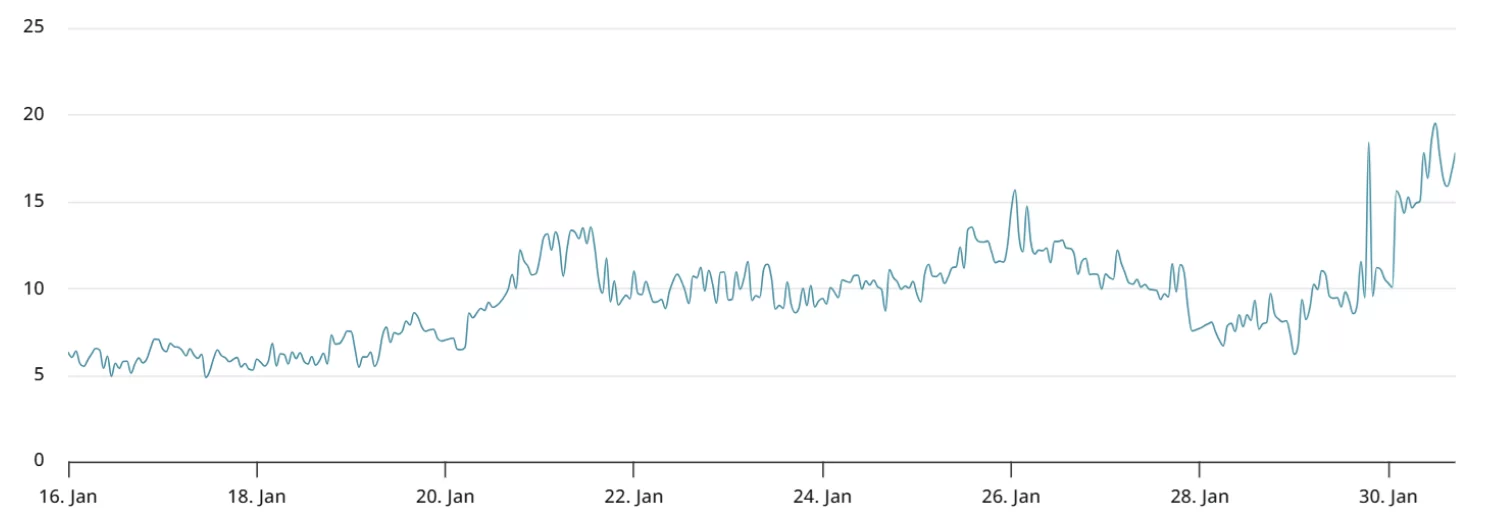

In derivative markets, the situation is quite cautious. The delta skew rate in Bitcoin options increased to 17 percent, reaching the highest level in the last year. This shows that investors are intensively seeking protection against downside risks.

The liquidation of approximately $860 million in leveraged long positions between Thursday and Friday revealed that many investors were caught off guard by the decline.

On the other hand, the decrease in total futures open positions in the last three months indicates that the risk of excessive leverage in the market has decreased.