Bitcoin It’s back to where it started and it’s like we’ve been teleported to December 2025. Markets are nervous, crypto is skittish, and altcoins are painted red. Trump is making new statements as the article is being prepared. Today’s statements by Fed members say that interest rates will not move for a while. So what do analysts say about Bitcoin?

Fed, Interest and Iran

trump Every week, he shouts loudly on social media, saying “stupid Powell, lower interest rates now.” He did the same today. But the Fed Chairman will change in May. In his previous statements, Trump said that someone who does not favor interest rate cuts and who does not study the economy like him will never become president and will not allow it.

These statements caused discussions about the independence of the Fed. Of course, Cook’s dismissal and to Powell When we consider events such as lawsuits as a whole, we have experienced processes that led to Trump’s “changed attitudes” leading to the sale of US bonds due to “concerns about nonsense”.

While Trump promised to guarantee the “independence of the Fed” in his previous statements, he also hinted that he would meddle in everything. We will see where these contradictions will take us in 2026. Making a statement about the Iran deadline, Trump said, “They know this best.”

“Warsh hasn’t committed to lowering interest rates; it wouldn’t be appropriate to ask him to lower interest rates. I’ll probably talk to him about lowering interest rates, Warsh wants to lower interest rates.”

Warsh will cut interest rates without pressure from the White House.

(Trump’s statement about Iran’s latest date) Only they know for sure.” -Trump

Bitcoin and Cryptocurrencies

Looking from now until the weekend, good things are not waiting for cryptocurrencies. We mentioned yesterday that the sales in crypto could deepen with the Asian market opening around this time. At this point today, everything continues as expected in favor of the bears. If the bears can turn the weekend’s lack of volume into an advantage and start a large sales wave, BTC may break down $ 81 thousand.

Roman Trading addressed those who are still not convinced that bear markets have begun.

“So when will we all finally accept that $BTC is in the bear phase of the cycle? And it’s heading towards 50k…”

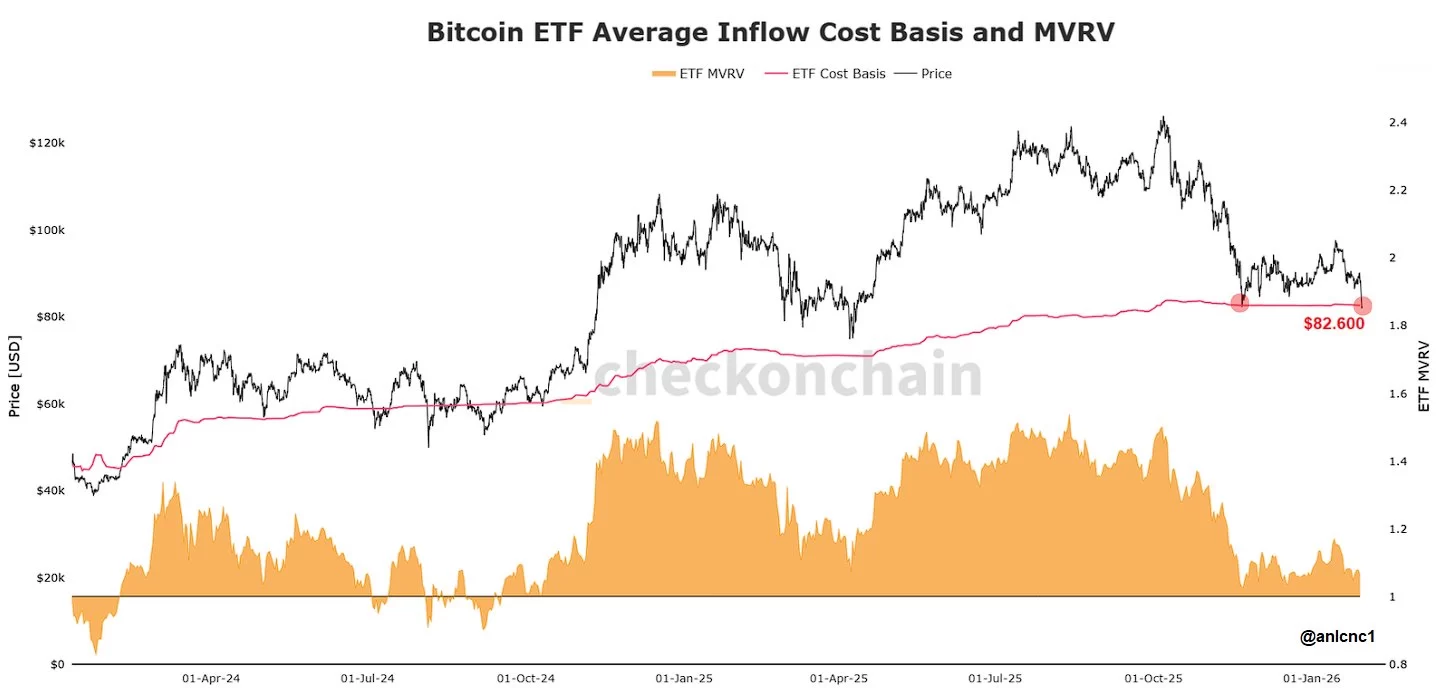

The analyst nicknamed Columbus shared the chart above and mentioned that there are no signs of reversal yet.

if anlcnc1 ETF He says that we should move away from the average cost area.

“Last trading day of the week — Need support from Wall Street After the open, Bitcoin should move away from the ETF average cost area.

$82,600”

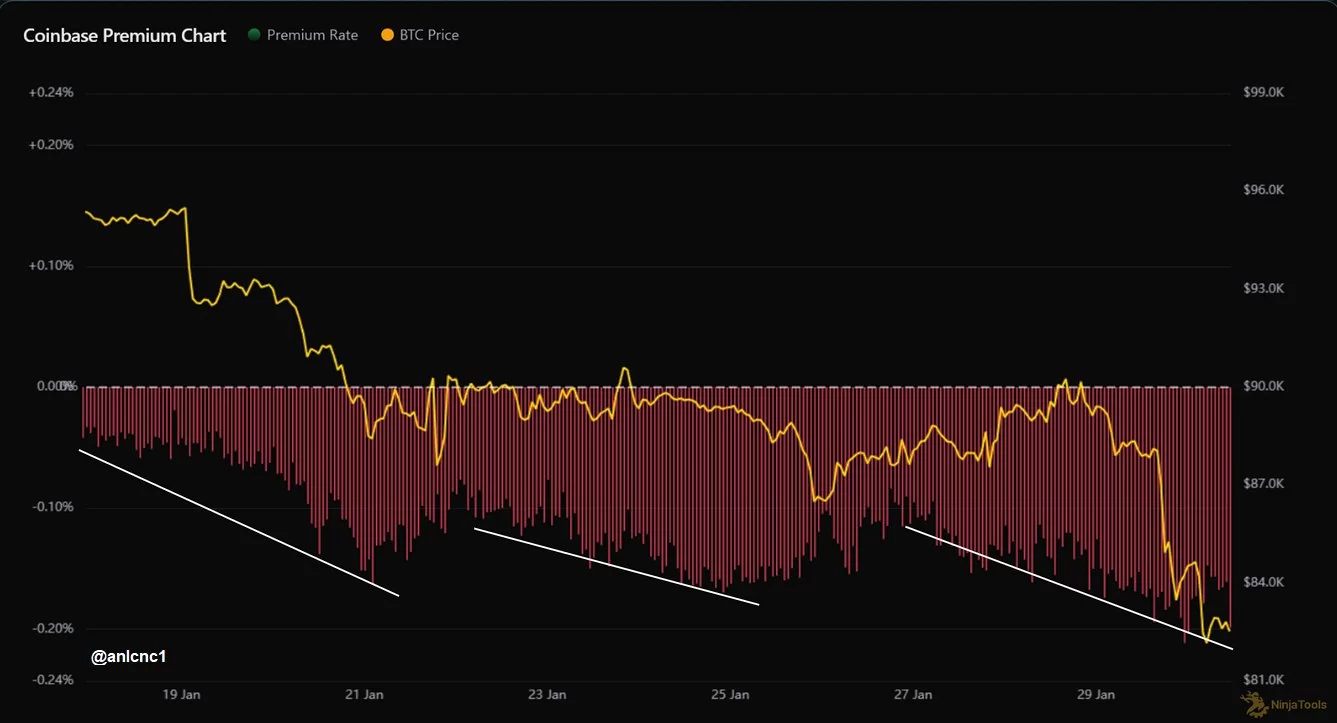

Anıl also drew attention to the indifference of investors on the US side.

“in Bitcoin Discounted Coinbase Premium still does not attract the attention of institutions. Maybe Saylor will step in next week.

As long as the premium trend remains negative, a sustainable rise is unlikely. “There is no need to argue.”