As per recent glassnode’s report, BTC price has entered Q1 2026 on a much steadier footing after the leverage-heavy unwind seen in October 2025, with bitcoin trading below 29% from its prior peak above $125,000 and consolidating near key levels. While macro conditions still remain supportive, and even multiple on-chain metrics suggest that the market is transitioning into a more selective and distribution-driven phase rather than a broad risk-on environment.

Macro Backdrop Supports Risk Assets for Now

Meanwhile, the macro environment has provided a constructive backdrop for BTC crypto markets. Inflation remained contained at 2.7% in the December CPI reading, while real GDP growth for Q4 2025 was estimated at a robust 5.3%. At the same time, expectations of two rate cuts priced into Fed funds futures continue to act as a tailwind for risk assets, including bitcoin.

That said, labor market momentum has cooled. US job creation slowed sharply in 2025, and while AI-driven productivity gains explain part of this moderation, a more pronounced deterioration could shift investor positioning toward caution.

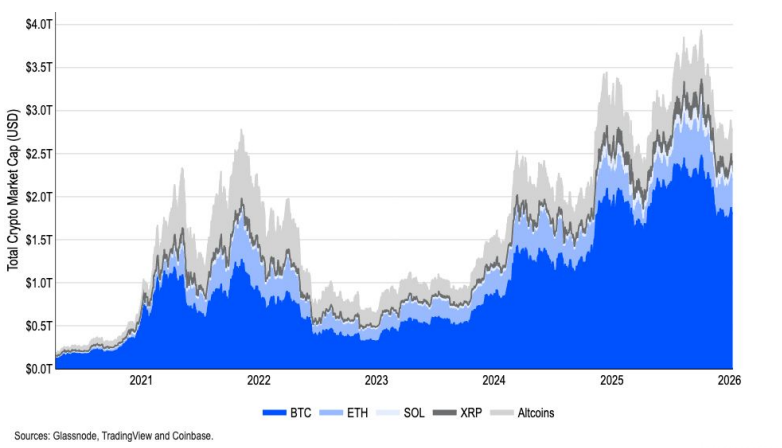

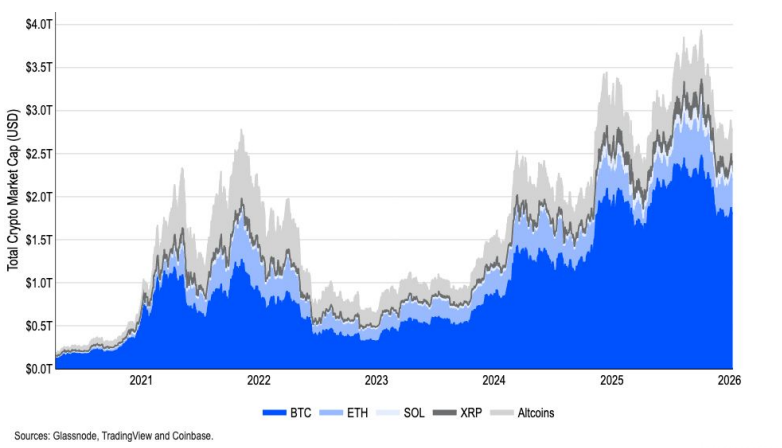

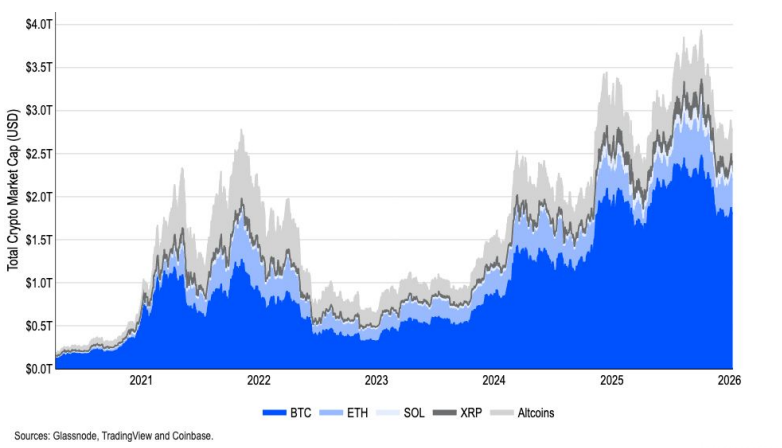

Bitcoin Dominance Holds Firm Despite Altcoin Stress

From a market structure perspective, Bitcoin dominance remained resilient during Q4 2025, edging up to 59% even as mid-cap and small-cap altcoins struggled to maintain earlier gains. Still, the BTC chart shows that this dominance stability came amid a broader deleveraging event, particularly in perpetual futures markets.

Open interest in BTC options overtook perpetual futures, signaling a growing demand for downside protection rather than outright directional exposure. The options market’s 25-delta put-call skew remained positive across multiple expiries, reinforcing the defensive tone.

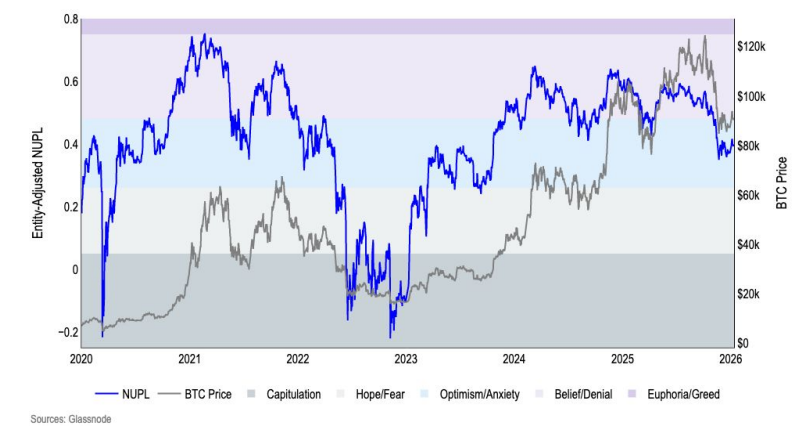

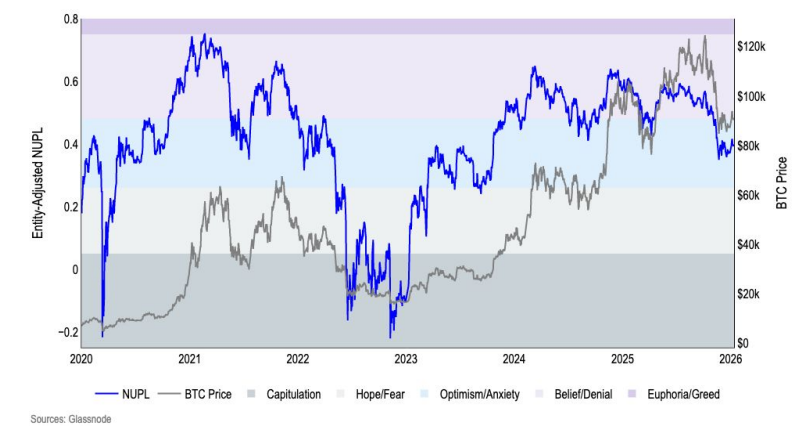

On-Chain Sentiment Slips Into Anxiety Zone

From a technical perspective, entity-adjusted Net Unrealized Profit/Loss (NUPL) shows that bitcoin sentiment deteriorated from “Belief” to “Anxiety” following October’s selloff and has remained there since. Still, the chart suggests this level historically aligns more with late-cycle consolidation than outright capitulation.

At the same time, BTC supply dynamics shifted notably, too. Per BTC report, the Bitcoin supply active within three months have surged by 37% in Q4, while the coins that were dormant for over a year declined by 2% only.

This increase in short-term activity indicates elevated distribution velocity, a pattern often observed when long-term holders reduce exposure into strength.

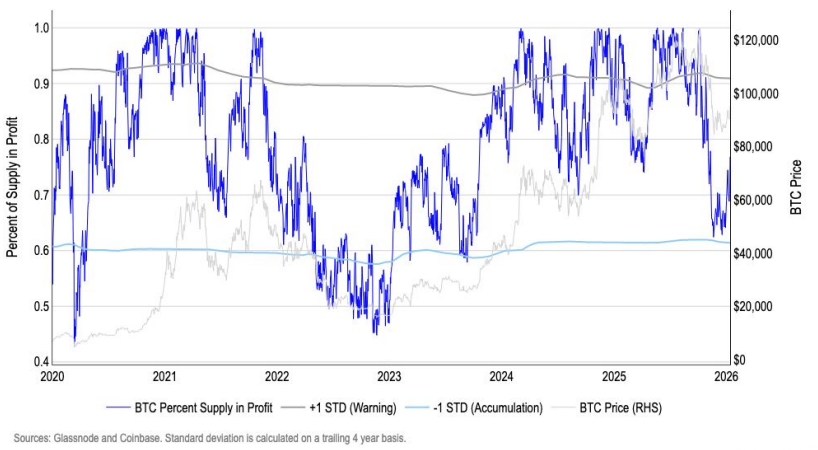

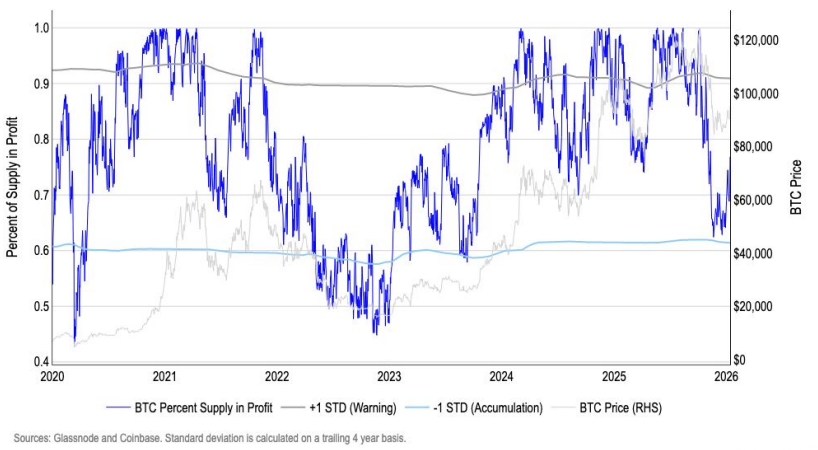

Cost Basis Levels Gain Importance

Realized price and MVRV metrics add further context. Based on this report, the sharp decline in the percentage of BTC supply held in profit points to the $80,000–$85,000 price range as a most potential accumulation zone for systematic strategies.

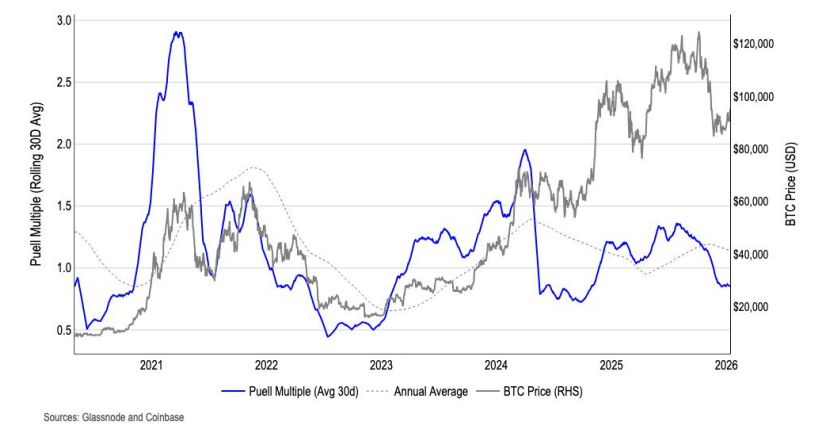

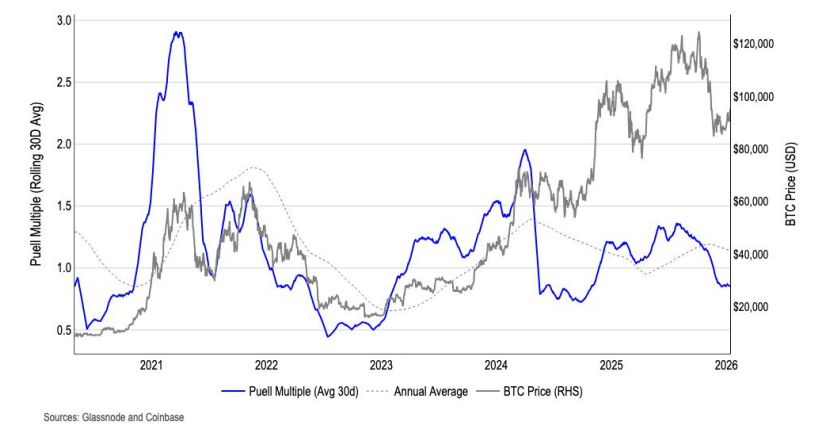

Meanwhile, the other metric “Puell Multiple” has slipped to 0.9, which is suggesting that miner revenues have only fell modestly below their annual average historically this a signal of tightening margins rather than distress.

Also, the report add that the Stablecoin supply growth and transaction volumes remain constructive too, but forward-looking indicators suggest tightening could emerge beyond Q1.

BTC Price Entered 2026 With Selective Strength

Taken together, the glassnode’s BTC report highlights that market appears healthier, yet increasingly selective in risk appetite. While bitcoin continues to attract defensive positioning relative to altcoins, the BTC price remains dependent on liquidity trends, macro stability, and whether distribution pressure gives way to renewed accumulation.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.