At the end of last year ZEC Coin A big rally started and then we started to see rapid losses with the departure of the think tank. So has it hit the bottom now? What do different analysts expect for Bitcoin (BTC)? Let’s take a look at the current outlook and forecasts and look at the markets from different windows.

ZEC Coin

Among privacy altcoins ZEC Coin It was the leader last year, but sales were expected to start by 2026. Amid the regulation wave, many investors turned to privacy altcoins to secure their assets, and this took altcoins such as ZEC, XMR, and DASH to unusual heights.

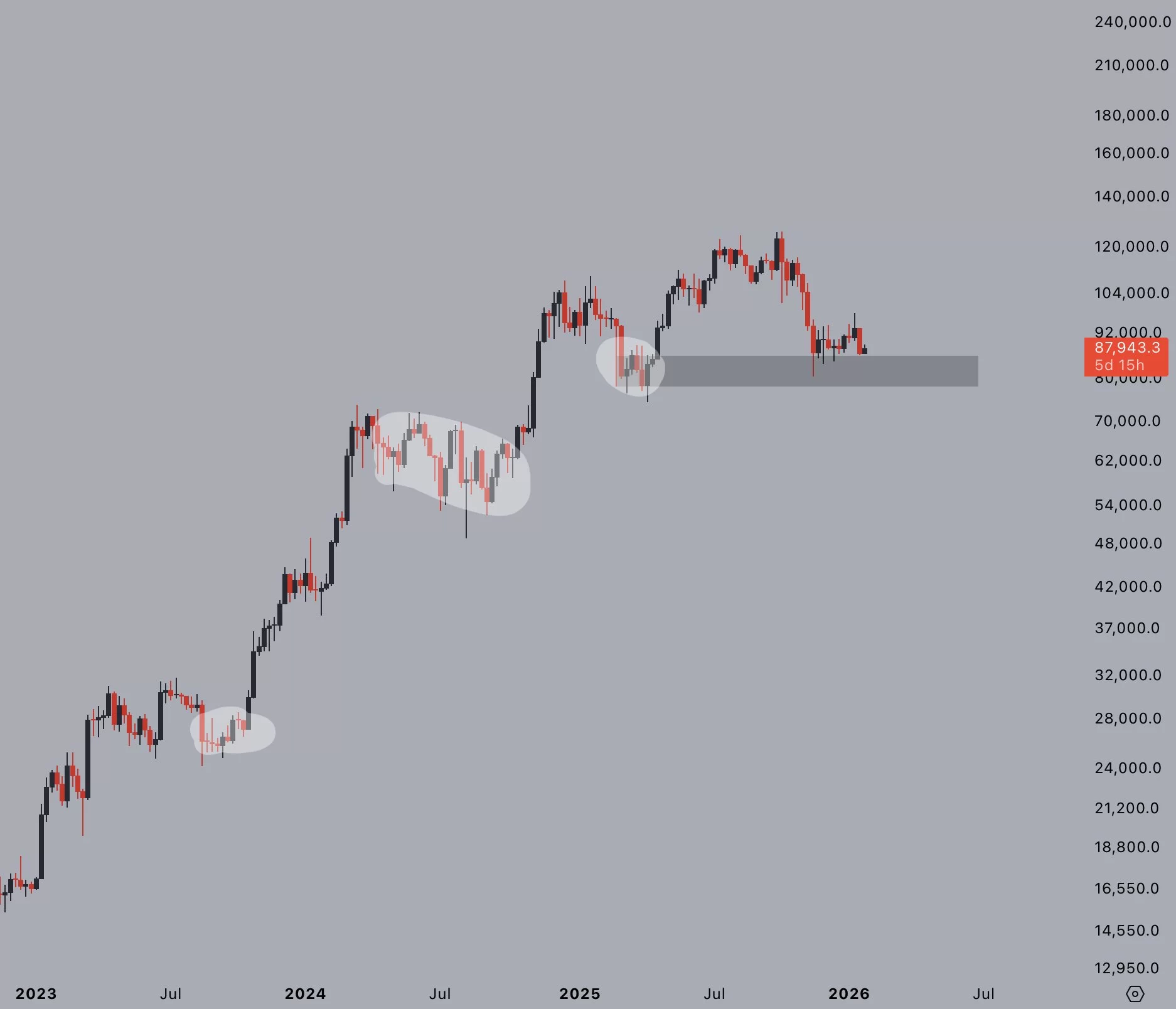

Sherpa says current conditions are not attractive for trading. Important price levels are marked in the chart below.

“It’s really hard to say where ZEC will go in the short/medium term, to be honest. It had a great reaction to the 0.618 fib level in early December and has since pulled back. It will either make a few more weak bounces and then decline, or it will fluctuate for a while and consolidate. Either way, trading on this pair doesn’t seem very interesting for now.”

So, according to Sherpa, it may not be the right time to buy ZEC Coin for now.

Bitcoin (BTC)

Minutes ago, Trump threatened Iran again and sent a new warship to the region. After the Venezuela incident, there is a possibility of intervention in other countries in the region. For Europe, the Greenland debate has become the last straw, and although Trump seems to have reached an agreement for now, he also has problems with that part of the world. All this Bitcoin It means more sales for you.

As for the charts, Jelle wrote that the structure that previously caused reaction increases has formed again and the support may not break down at the end of this process.

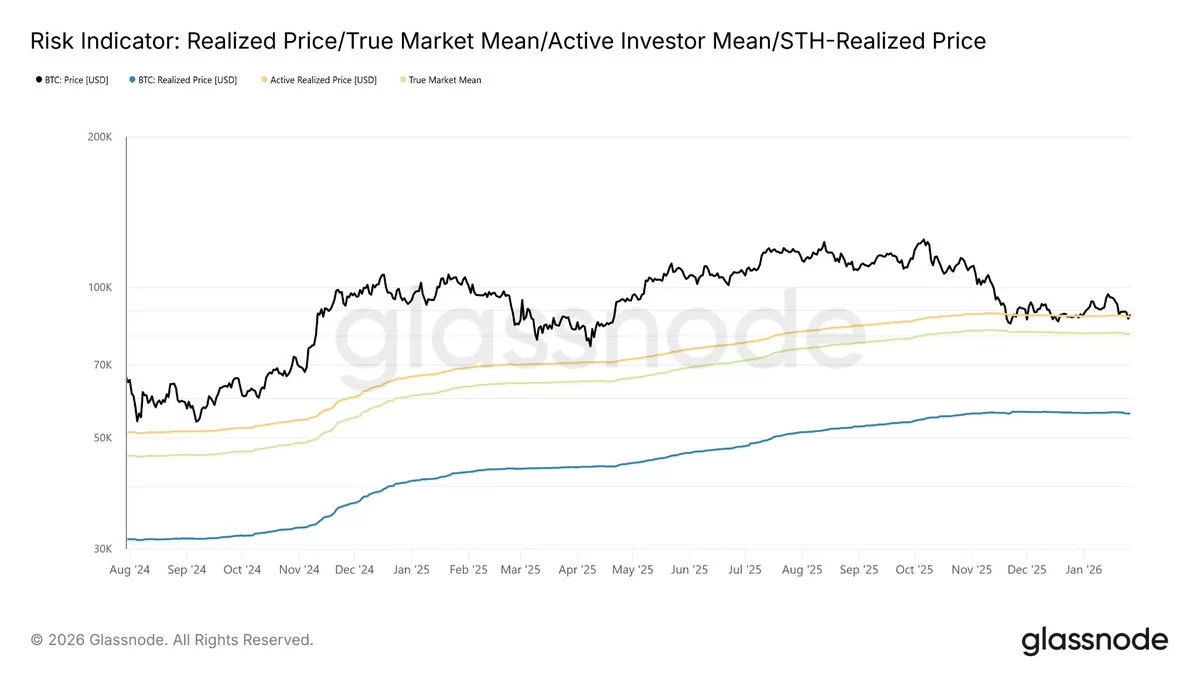

Nic, who shared the chart above, is hopeful that we are slightly above the Active Realized price (the price at which active coins move or are purchased).

“We have managed to regain this level multiple times since November. If we break below this level, the next important level will be the True Market Average ($80,700). Note that the total investor realized price is $56,000. This is the level that many point to as a potential bottom if we enter a prolonged bear market.”

The price is trending below the range following the decline, and larger losses appear to be the most predictable path from this point. Pointing to the support line, the analyst nicknamed Columbus pointed here as the key area for a comeback.