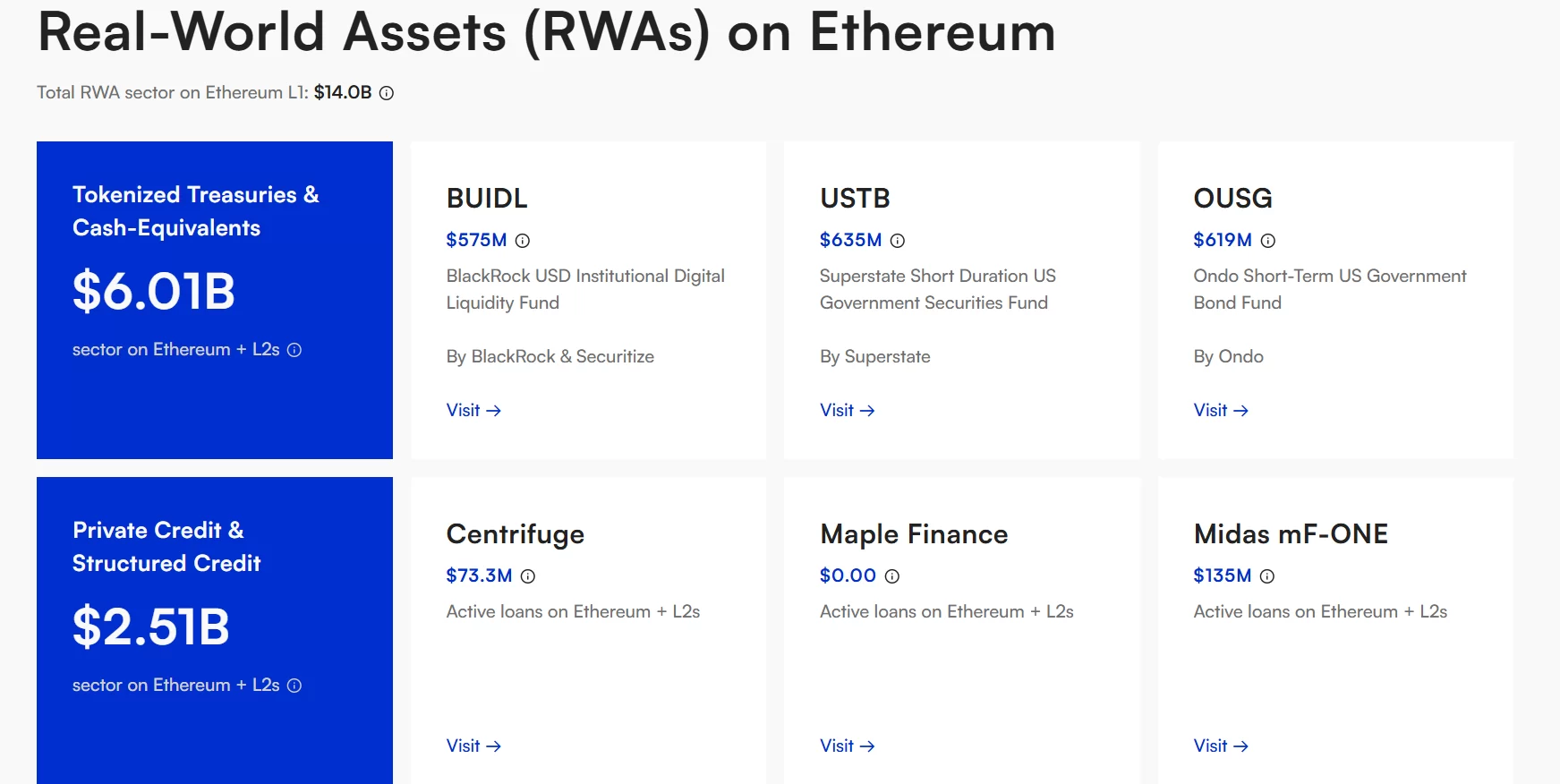

Ethereum, the largest altcoin by market value, already represents a significant portion of the RWA market. Billion-dollar giants are issuing tokenized assets on the Ethereum network. The RWA space, which is expected to reach the trillion-dollar market, will significantly support Ether. That’s why BitMine wants to acquire 5% of the altcoin king’s supply.

BitMine Buy Ethereum

While Strategy continues its purchases BitMine also ETH It accumulates. BitMine is now to Ethereum what Strategy is to Bitcoin. BitMine Immersion Technologies (BMNR) announced that it has raised 40,302 ETH (worth approximately $117 million at current prices) following a key shareholder vote that gave the company room to raise capital.

While the amount of ETH owned by the company was zero in June, it exceeded 4.24 million today. The company, which holds 3.52% of the ETH supply, wants to increase it to 5%. If they progress at this pace, they can reach their goals by June 2026, less than a year later.

The company has total assets of $12.8 billion, including 193 bitcoins, $682 million in cash and shares in Eightco Holdings, and a $200 million investment in Beast Industries, a startup founded by YouTube giant MrBeast.

They Believe in Ethereum (ETH)

The company, which stakes 2 million Ether, almost half of its total assets, also earns up to 5% annual staking income. This intense staking demand increased the waiting time for staking on the Ethereum network to 54 days. The company aims to generate $400 million in annual staking revenue and plans to constantly increase it.

The volume of BMNR shares has weakened these days, falling from among the 40 largest stocks by volume to 91. Average daily volume is at a relatively good point at $1.2 billion.

Although the company has many reasons to believe in Ethereum, the biggest reason is tokenization. BlackRock CEO Larry Fink said the following in his statements in Davos last week;

“Tokenization It is necessary… if we have a common blockchain, we can reduce corruption.”

BitMine’s President Tom Lee said in his announcement today;

“In 2016, Davos had artificial intelligence and the fourth industrial revolution on its agenda, and in the decade we have witnessed the massive growth of artificial intelligence and data centers and the complete change of direction of countries. Ten years later, we see 2026 as the year when policymakers and world leaders see digital assets as a central element for the future of the financial system. As Larry Fink noted, this is a positive development for smart blockchains. Ethereum remains the most widely used blockchain by Wall Street today and the most reliable blockchain with zero downtime since its inception.” It does.

of Ethereum to Bitcoin according to price ratio, i.e. ETHBTChas been rising steadily since mid-October. In our view, this reflects investors realizing that tokenization and other use cases developed by Wall Street are being built on Ethereum. To understand the scale Wall Street is building on Ethereum, the Ethereum foundation has listed on this website (https://institutions.ethereum.org/) a sample of 35 major financial institutions building on Ethereum in the last few months alone.”