Whale movements observed in the Hyperliquid ecosystem since December 2024 have become one of the key elements shaping the price structure and liquidity balance of the HYPE token. Especially the fact that large investors followed gradual buying and staking-oriented strategies instead of hasty purchases and sales created a perception of controlled growth rather than speculative fluctuations in the market. This process directly affected not only price movements, but also the protocol’s total value locked (TVL) and revenue sustainability.

Whale Accumulation and Supply Dynamics

In the early days of December 2024, a Hyperliquid whale made regular spot purchases, receiving approximately 20,849 HYPE in each transaction. While the first purchase was made at $ 7.91, subsequent transactions were concentrated between $ 8.10 and $ 8.69. Thanks to this laddered buying strategy, the wallet rose from a single-digit position to over 250 thousand HYPE in a short time. The most important detail was that with this method, slippage was minimized and the existing liquidity in the market was digested and used.

Since wallet movements included entries linked to both decentralized exchanges and centralized exchanges, it became clear that the purchases were planned rather than hasty. Moreover, this behavior was not a singular example; Other whale wallets of similar size were also found to accumulate gradually during the same periods. This pointed to strategic positioning before staking rather than short-term price speculation. As liquid supply shifted to staking, token balances on exchanges decreased, contributing to limiting downward pressure.

TVL Growth, Fee Income and Staking Output

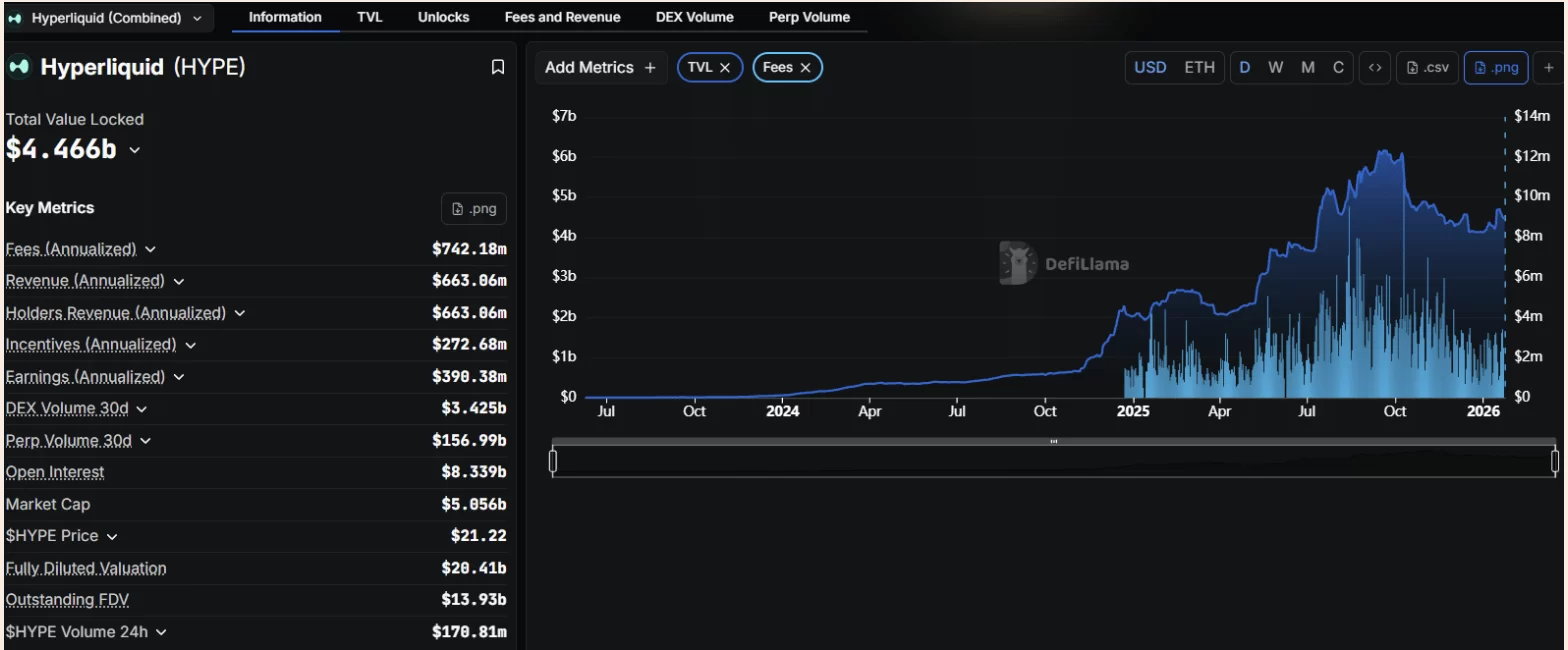

Hyperliquid’s TVL has increased steadily throughout 2025, from around $2 billion at the beginning of the year to near $6 billion by the end of the summer. This growth was supported by strong trading volumes and regular fee generation rather than temporary fund inflows. The fact that daily fee income frequently fluctuated between 3 and 10 million dollars showed that the capital in the protocol was actively working. Although TVL retreated to the 4-5 billion dollar band in the last quarter of the year, maintaining this level strengthened the perception of “sticky” liquidity.

It was noteworthy that in January 2026, a large HYPE investor deposited approximately 665 thousand tokens into Bybit. With this move, a profit of approximately 7.04 million dollars was realized. The investor in question directed the HYPEs he collected at an average of $11.50 at the end of 2024 to staking instead of active trading. With an APY of approximately 2.3%, accumulating staking rewards increased the total balance over time. It was clear that the release was planned due to the one-day lock and seven-day unstaking queue.

In parallel with these developments, in a different news report, it was reported that whales in the dYdX ecosystem similarly started to resolve their staking-oriented positions and made controlled transfers to central exchanges. This points to a maturing market behavior in derivative DEXs.