At the time of writing, Trump signaled that Canada would be the next center of tension. The Fed will announce its interest rate decision next week, but expectations are to keep interest rates constant due to strong employment data, better-than-expected GDP and sticky inflation. So what is the next step in cryptocurrencies?

Will Cryptocurrencies Rise?

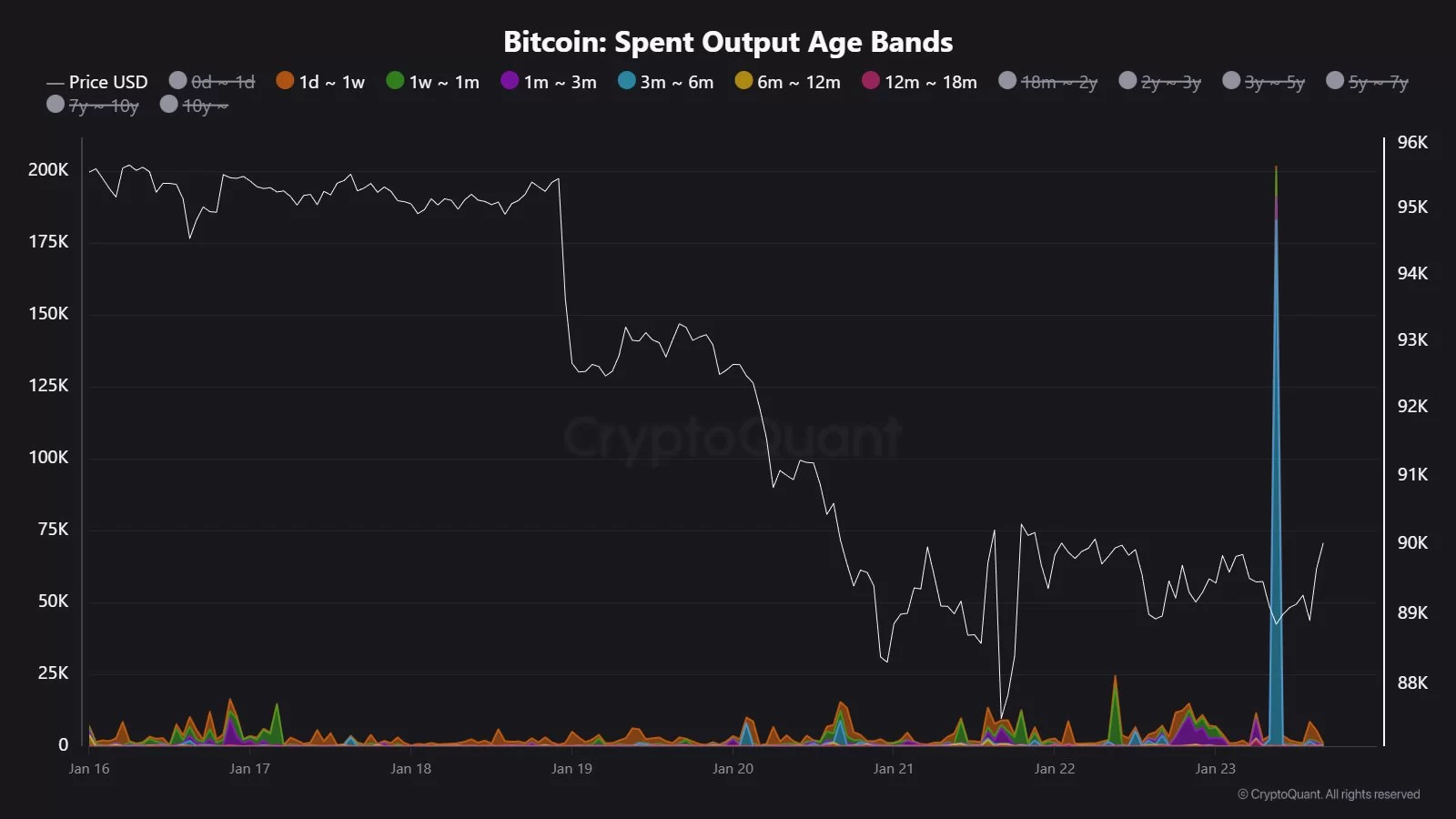

Yesterday, Ki Young Ju announced that the sales at a loss created a situation similar to 2022 and that the bear markets have officially started according to the last 30 days of data. Although BTC fell to the 88,500 band after the sell signal of CryptoQuant CEO, today it exceeded 90 thousand dollars again with the effect of NVIDIA recovery. In cryptocurrencies The day is dizzying. A few minutes ago, CryptoQuant CEO announced that leveraged funds are now reducing short positions in Bitcoin futures.

Trump, on the other hand, implied that geopolitical tensions will not calm down and tariff discussions will remain on our agenda, and he just wrote the following on his Truth Social account:

“Canada opposes the Golden Dome being built over Greenland, even though the Gold Dome will protect Canada. Instead, they have decided to do business with China, which will ‘devour’ them within the first year!”

The interest rate decision will be announced next week and, most likely, the Supreme Court’s customs duty decision will be announced on February 20. EU-US tariffs on February 1 were suspended in Davos as Trump reached an agreement with NATO. The agenda is busy, cryptocurrencies Life is challenging and investors are exhausted. It is difficult to predict what will happen in cryptocurrencies in the next stage, but if historical data repeats itself, we may see a decrease of at least half as much as 2022, if not as much as 2022, in an environment where the Fed delays QE. This is what traditionalists expect for the first half of the year.

Bitcoin Whales

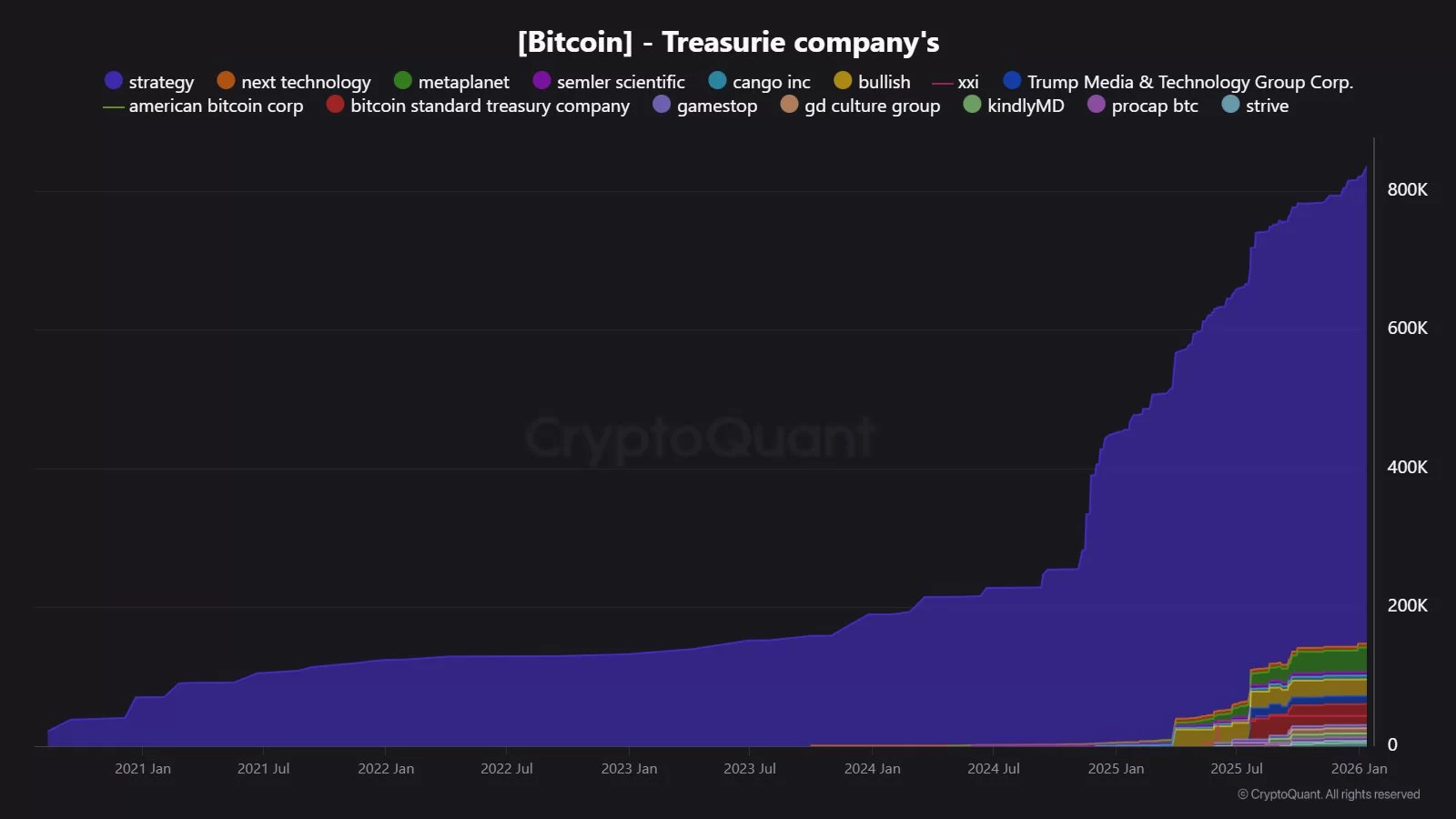

The chart below reflects the buying activity of large institutional investors and reserve companies. Purchases, which weakened in the last quarter of 2025, accelerated again in January and Strategy leads again.

JA_Maartun wrote;

“20 Billion Dollar BTC Transfer in a Single Block

224,248.67 BTC moved in a single block — a rare, massive transaction.

Important addresses:

- bc1qjasf…a4

- bc1qd4y…zr

“Possibly a UTXO consolidation by Tether/Bitfinex, but there are rumors of a $20 billion raise at a $500 billion valuation.”

We also have bad news. GameStop started to accumulate BTC with great excitement. GME all BTC moved its holdings to Coinbase Prime — possibly preparing for a sale. 4,710 in May 2025 BTC They bought it for ~$107.9K (~$504M). If sold now (~$90.8K), that would mean a loss of ~$76M.