Bitcoin continues to stall below $90,000 and it’s another red day for altcoins. For the last 3-4 months, Bitcoin has been stuck in the same range and fell to the bottom because the resistance level could not be overcome again. Some analysts compare BTC’s performance in 2022 with its current situation and warn about risks.

2022 vs 2026 Bitcoin

Conditions are very different from 2022, but the possibility that the Fed will cut fewer interest rates this year following the latest data restricts QE support. Moreover, Trump’s endless demands manage to engulf the global financial system every quarter. Greenland seems solved, so what’s the next chaos? If it’s about Trump, it’s impossible to predict. Could it be Iran, after the Supreme Court cancels the tariff, a compulsory donation campaign is launched and military force is used instead of tariffs on the USA? With Trump in that seat, you have to push the limits of your imagination.

Some analysts predict similar behavior in 2022. of BTC He thinks he can make deeper bottoms this year. Roman Trading targets the range of 76 and 56 thousand dollars. CryptoBullet shared the chart below and wrote:

“BTC 1D chart | 2026 vs 2022

It tested the MA100, was rejected and pulled back to the Support level – perfectly tracking the 2022 pattern.

“I think we will test the MA200 now.”

If BTC does not lose support after its first test of resistance, it may test $102 thousand for the last time. But in any case, analysts who predict a decline for 2026 think we will see below 70 thousand dollars before the end of the second quarter.

The analyst nicknamed Mags is trading around the middle Bollinger Band. BTC He wrote that the price must exceed the band to start the rally.

“Historically, when the price breaks the middle Bollinger Band, Bitcoin enters a strong bullish phase. In this cycle, the price regained the middle band around $26,000 in October 2023 and then rose to $126,000.

So far the price has tested the middle Bollinger Band for the first time this cycle, which is a key support level. “A break below this level could trigger a major correction and signal a bear market, but a successful hold could lead to a strong upward move.”

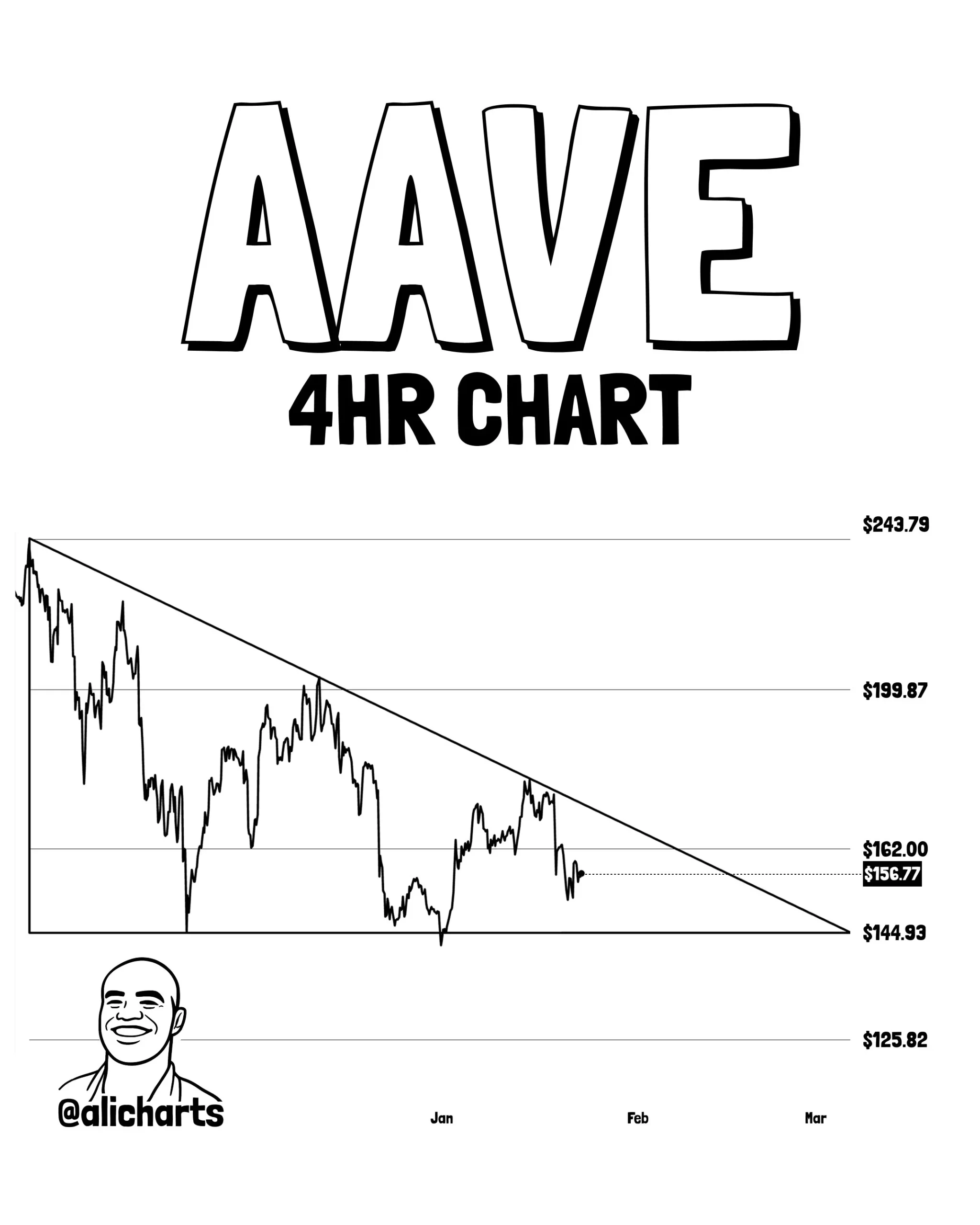

How Many Dollars is AAVE Coin?

Bitcoin The outlook for is negative and the price continues to linger in the risky zone. AAVE Coin What we see in the example also applies to many altcoins. If BTC accelerates the sell-off, altcoins just above key support levels could suffer major losses.

Sharing the chart above, Ali Martinez wrote that a loss of $144.93 in the short term will trigger a test of $125.8 for AAVE Coin.