2025 last quarter to date cryptocurrency The markets are in bad shape and the lack of demand has sent the charts into a downward spiral. There are altcoins that are below their lows last year and even in 2024. Although the level of 85 thousand dollars is maintained on the BTC front, the fact that every rise turns into a selling opportunity shows that the cost bases will continue to appear as stronger resistances.

Cryptocurrency Bear Markets

CryptoQuant CEO Ki Young Ju is one of the most famous on-chain analysts and heads one of the largest platforms in this field. Although he rarely shares his evaluations these days, he shared a warning due to loss-making sales reaching significant levels.

Bitcoin Investors recorded net realized losses for the first time since October 2023. Losses since December 23 are 63 thousand BTC reached the level. This situation indicates a regime change from profit realization to loss realization in the last 30 days. Realized profit momentum has decreased steadily since the beginning of 2024, forming successively lower peaks in January 2024, December 2024, July 2025 and October 2025.

Sharing the chart above, Ki Young Ju helps to better understand the current situation.

So what does this mean? The current pattern closely mirrors the 2021-2022 bull-bear crossover. During this period, realized profits peaked in January 2021, formed lower peaks throughout 2021, and then turned into a net loss ahead of the 2022 bear market. So we have another data that supports the four-year cycle story and says that 2026 will be a repeat of 2022. Annual net realized profits contracted sharply, falling to 2.5 million BTC from 4.4 million BTC in October. This level is comparable to March 2022 and confirms that the dynamics on the network are now consistent with early-stage bear market conditions.

So this might be the signal we really need to look at.

How Not to Lose Money?

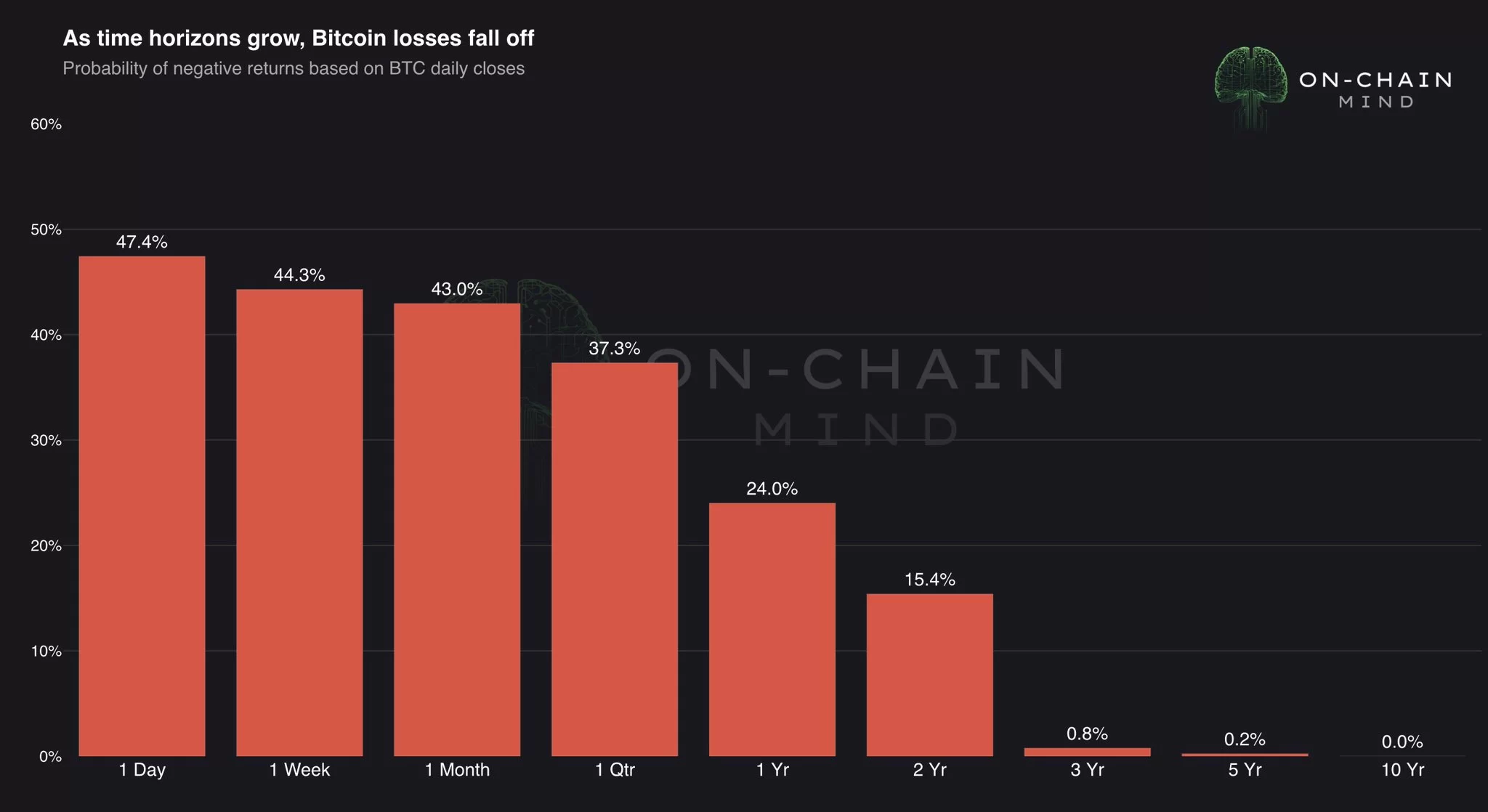

What can investors do to avoid losses in cryptocurrencies? On-Chain Mind Bitcoin In private, he says that there is no choice but patience. The chart below shows that the shorter intervals you trade, the more likely you are to lose.

- 1 day: ~47% probability of loss

- 1 year: 24%

- 3 years: less than 1%

- 5-10 years: Zero

“Bitcoin is not dangerous. What is dangerous is short-term thinking.” – On-Chain Mind