The global cryptocurrency market lost nearly $150 billion in value over the past 24 hours as investor sentiment turned cautious. This decline pushed Bitcoin below $88,000, marking a drop of almost 3%.

Other large-cap cryptos like Ethereum fall below $3,000 after seeing a 6% decline. While XRP, Solana, TRON, and Monero also slipped from 4% to 18%.

So, what is driving this sell-off, and why is the crypto market down today?

Trump’s Tariff Warnings Shake Global Markets

One major reason for the market drop is fresh tariff worries linked to U.S. President Donald Trump. He warned eight European Union countries about possible tariffs, reportedly connected to demands related to Greenland.

European leaders quickly rejected this and hinted they may respond with their own actions.

Adding to the fear, the U.S. Supreme Court has again delayed its decision on these tariff issues. Investors were hoping for clarity, but the delay has raised concerns that the decision could support Trump.

Bitcoin ETFs See Heavy Outflows

Institutional selling has also weighed heavily on Bitcoin. Spot Bitcoin ETFs recorded outflows of nearly $874.4 million over the past two days. Fidelity led the selling with about $357.3 million in outflows, followed by Grayscale, Bitwise, and ARK Invest.

These continued withdrawals reflect growing caution among institutions amid geopolitical risks.

As a result, capital has been rotating into traditional safe-haven assets like gold and silver, both of which recently hit all-time highs.

$1 Billion in Liquidations Adds More Pressure

The sharp price drop triggered widespread liquidations across the crypto market. Data from CoinGlass shows that 183,050 traders were liquidated in the last 24 hours, with total liquidations reaching $1.02 billion.

Nearly 90% of these were long liquidations, totaling about $928.45 million, as bullish traders bet on a recovery that failed to happen. The single largest liquidation occurred on Bitget, where a BTC/USDT position worth $13.52 million was wiped out.

Where Is Bitcoin Heading Next?

Over the past three days, Bitcoin has fallen from around $97,000 to near $88,000. Meanwhile, the Fear and Greed Index slipped to 32, firmly in the fear zone, showing traders are stepping away from risky assets amid rising uncertainty.

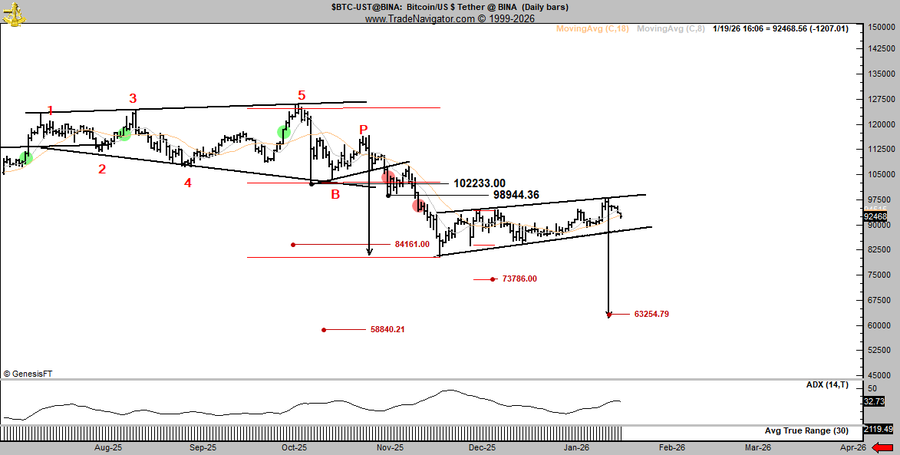

However, veteran trader Peter Brandt recently warned that Bitcoin could fall to the $58,000–$62,000 range within the next two weeks.

He noted there is a 50-50 chance of such a move.

Despite the price decline, trading volumes have increased, suggesting strong activity as traders reposition.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.