The EU continues its threats today, and especially Germany and France are constantly Trump’s He expresses his discomfort with the impositions. Trump, on the other hand, declared that he would not refrain from using all kinds of instruments, saying, “I will now prioritize the interests of the United States.” The basis of the recent decline in cryptocurrencies is increasing tension and uncertainty. So what should we watch for the rise?

Rise in Cryptocurrencies

For the rise to begin, the dark clouds on the risk markets must first disperse. Gold And silver The steady rise we have seen in the charts for several quarters is the result of concerns about the global economic system. Since the first day he took office, Trump has taken steps that will shake the global structure he established after the Second World War.

Expectations about the change and transformation in the global economy increased the demand for assets such as gold and silver. The current environment will become even more complicated with the Supreme Court decision expected to be announced on Tuesday.

If the court cancels the tariffs, this will embolden other countries against Trump and prevent hundreds of billions of dollars of taxes and trillions of dollars of investment from entering the United States.

If the tariffs are not canceled, Trump will this time impose additional tariffs on the EU for Greenland and perhaps even Canada on other countries that oppose him. trump Although he brought up Greenland today, he constantly emphasized that Canada is a US state last year. While this situation feeds uncertainty and risks, it also negatively affects cryptocurrencies.

For the rise in cryptocurrencies, the negative atmosphere triggered by Trump’s hand must normalize, and a permanent rise seems difficult without the weather changing.

Ascension Signal

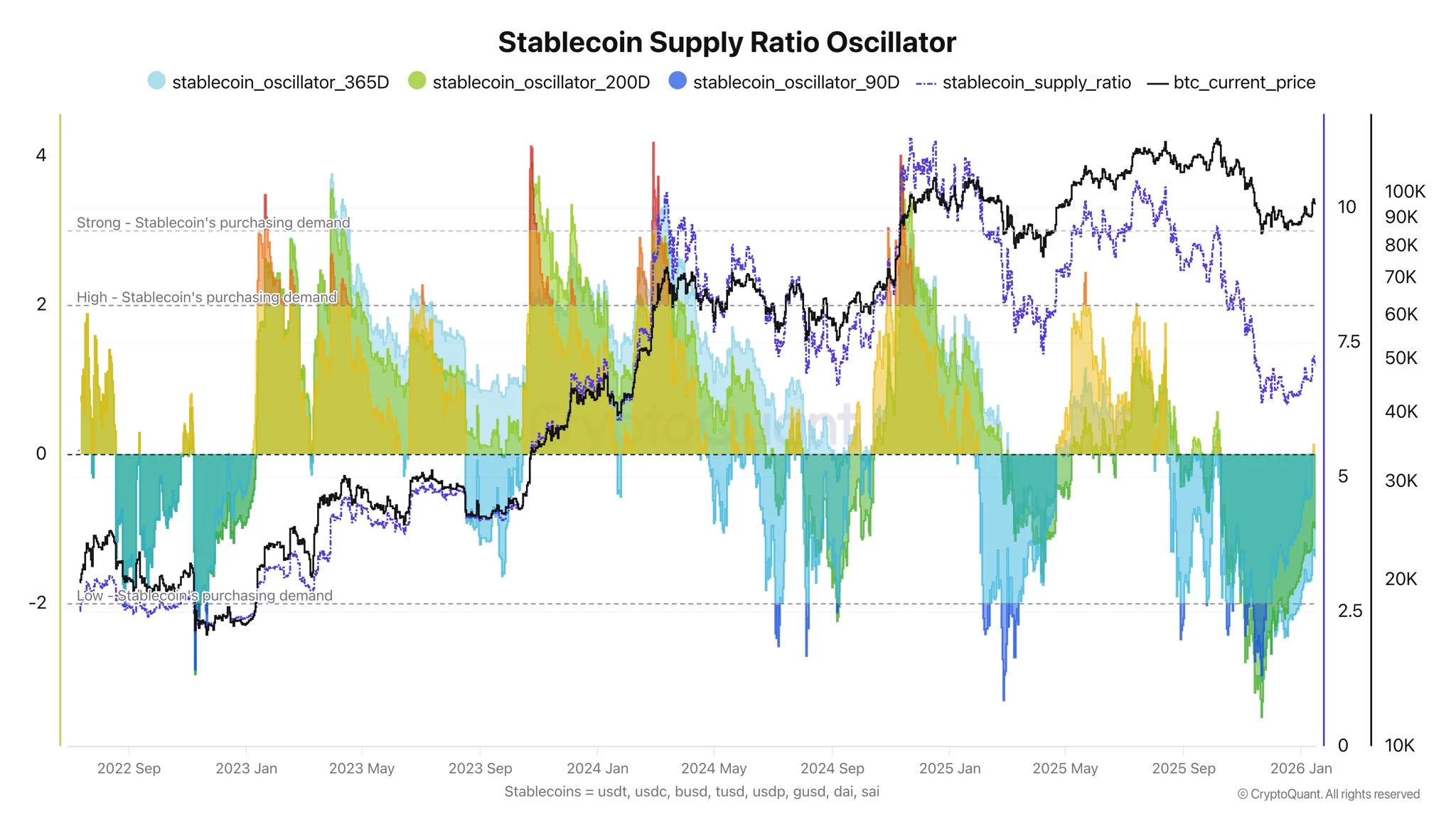

In his assessment today, CryptoQuant analyst Darkfost mentioned that stablecoin growth is an indicator that should be watched closely for the rise in cryptocurrencies. Stablecoins, which became legal in America last year with GENIUS, have become the focus of banks and large financial institutions. Therefore, the environment for accelerated growth is quite strong.

If stablecoins are rapidly becoming more popular and their market value is increasing strongly, this generally indicates a positive market environment. Therefore, Stablecoin Supply Ratio (SSR) should be watched closely as a bullish signal.

The analyst who shared the chart below mentioned that he was hopeful considering the current situation.

“This rate of Bitcoin It compares the total market cap with the value of stablecoins. When the SSR rises sharply, it indicates that Bitcoin’s purchasing power is weakening relative to its market cap growth, indicating a trend losing momentum.

Conversely, when the SSR drops significantly, it indicates that BTC is undervalued relative to the current liquidity in the market.

Following the last BTC correction, SSR experienced a sharp decline, the strongest of this cycle. This means that Bitcoin’s market cap is falling much more aggressively than the market cap of stablecoins.

Historically, these are periods when market bottoms tend to form, and this may be the case once again. Now we need to wait for SSR to continue rising, which will indicate that stablecoins are starting to come into use.

However, we are currently in a highly uncertain macro environment, further exacerbated by geopolitical and trade tensions.

As a result, it is very important to continue monitoring the evolution of stablecoin market values, which should definitely not decline.”