Bitcoin We mentioned that the price may experience difficult times due to the agenda of the new week. BTC, which lost its support of 94 thousand dollars as of Monday, is pricing in both the potential for the cancellation of tariffs and the increasing tension between the EU and the USA. So what does on-chain data tell us? Is risk appetite recovering?

Cryptocurrency Drop

In our evaluations yesterday, we talked about why the new week could be negative. New tariff tensions have been sparked between the EU and the US, and the Supreme Court may announce its tariff decision on Tuesday. Besides Fed interest rate decision A serious decline is not expected for PCE beforehand. Since employment data is currently strong, the possibility of an interest rate cut has disappeared and therefore inflation data does not have much meaning.

Trump should have provided a calmer environment and supported the markets in the midterm election year, but we see from the debates growing around Greenland these days that these expectations will not come true. Cryptocurrencies started the new week with a decline as they tend to price the risk.

BTC Withdrawing $94,000 may make it possible to test $98,000 again. However, in the opposite scenario, the intensification of the decline to 88 and 85 thousand dollars will diminish the 2026 gains in altcoins.

Cryptocurrency Risk Appetite

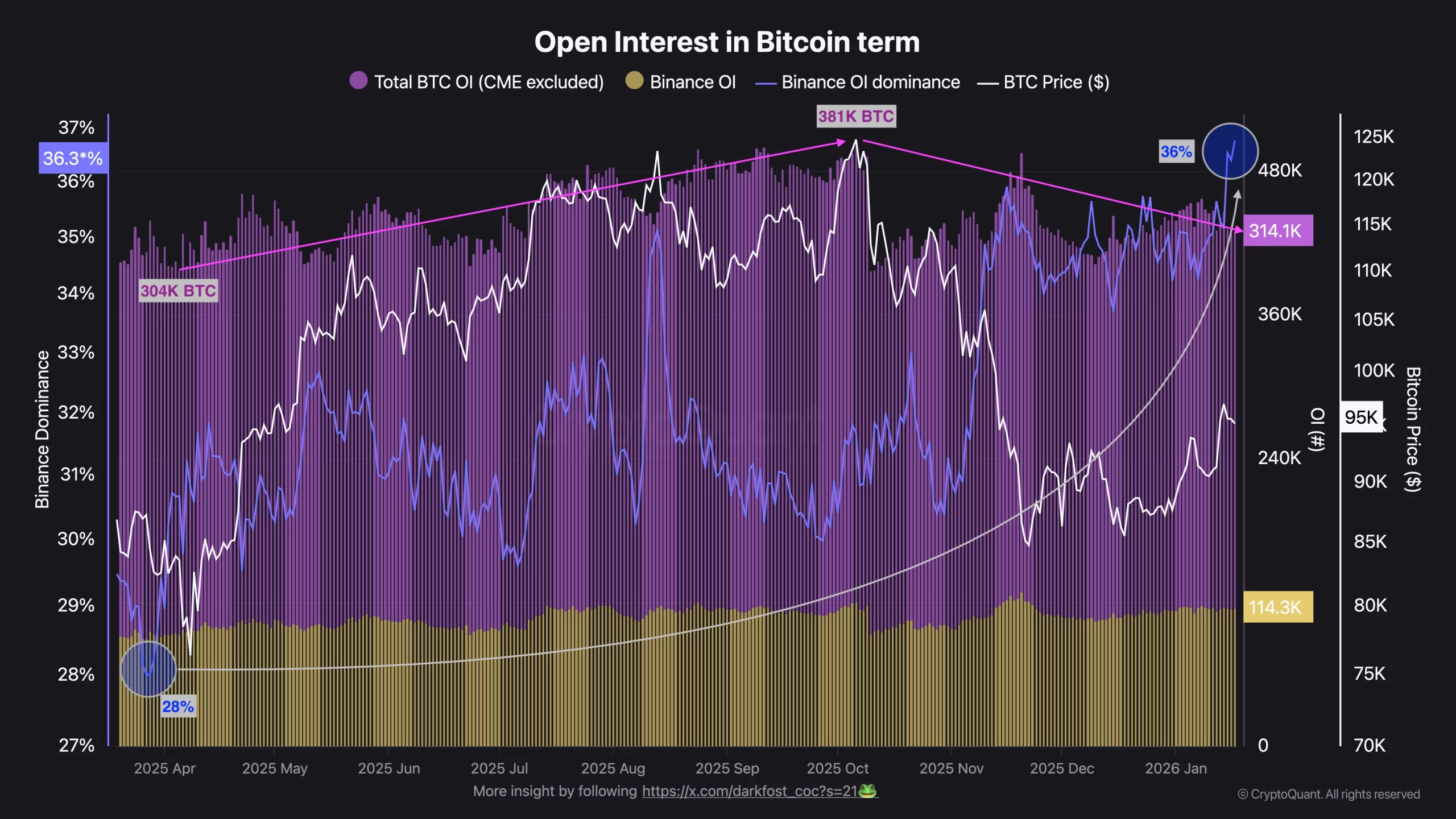

CryptoQuant analyst Darkfost is monitoring the status of Bitcoin open positions to understand risk appetite. This accounts for the vast majority of Bitcoin trading volume, well ahead of futures markets, spot and ETFs. In this context, Open Positions are important to evaluate investor behavior.

darkfost Binance He mentioned that the stock market is the dominant market to watch as it holds 36% of the total open position and wrote;

“Since the last ATH, BTC has undergone a correction of approximately 36%, accompanied by a partial deleveraging in the derivatives markets. Open Interest decreased by approximately 17.5%, from 381,000 BTC to 314,000 BTC, reflecting the phase of risk reduction and closing of leveraged positions.

Following the April 2025 correction, we observed a gradual return of positions in the futures markets, with open interest hovering around 300,000 BTC and Binance’s dominance falling to approximately 26%.

Approximately 80,000 BTC re-entered the futures markets and this dynamic supported the upward trend and ultimately contributed to the formation of a new ATH.”

By considering the open position size in BTC instead of USD, the analyst isolates the analysis from the change caused by price fluctuation. Currently, open positions are showing signs of a gradual recovery, confirming that risk appetite is slowly returning. In other words, unlike what happened in last year’s withdrawals, BTC can continue its rise by reclaiming $ 94 thousand as there is a gradual increase in momentum.