While the cryptocurrency market entered the weekend with a calmer outlook than expected, the Bitcoin price has stabilized at around $95,000. The fact that the market is taking a breather after the rapid rises in recent days shows that investors are looking for short-term direction. While a similar stagnation was evident in most large-volume altcoins, the sharp retreat on the Monero front attracted attention.

Bitcoin Seeks Balance at $95 Thousand Level

While Bitcoin spent the previous weekend relatively calm, it launched a strong attack in the first days of the week. BTC, which showed a rapid rise from 90 thousand dollars to 92 thousand dollars on Monday, paused at this level several times. By overcoming this resistance on Tuesday, the rise gained momentum and as of Wednesday evening, it climbed to the level of 98 thousand dollars, reaching its highest point in recent months.

In this process, Bitcoin gained approximately 8 thousand dollars in value in just a few days, bringing the total increase since the beginning of the year to around 10 thousand dollars. However, after such a rapid rise, a limited retreat was inevitable. BTC price came under pressure with the sales on Thursday and Friday.

The peak of the decline came after news in the US that Donald Trump would not nominate Kevin Hassett for the Fed Chairmanship, and Bitcoin briefly tested below $94,500. However, with the buyers stepping in, the price recovered again and managed to hold on above $95 thousand. While Bitcoin’s market value is stabilized at around $1.9 trillion, its dominance in the total crypto market remains at 57.4 percent.

Recession in Altcoins, Sharp Retreat in Monero

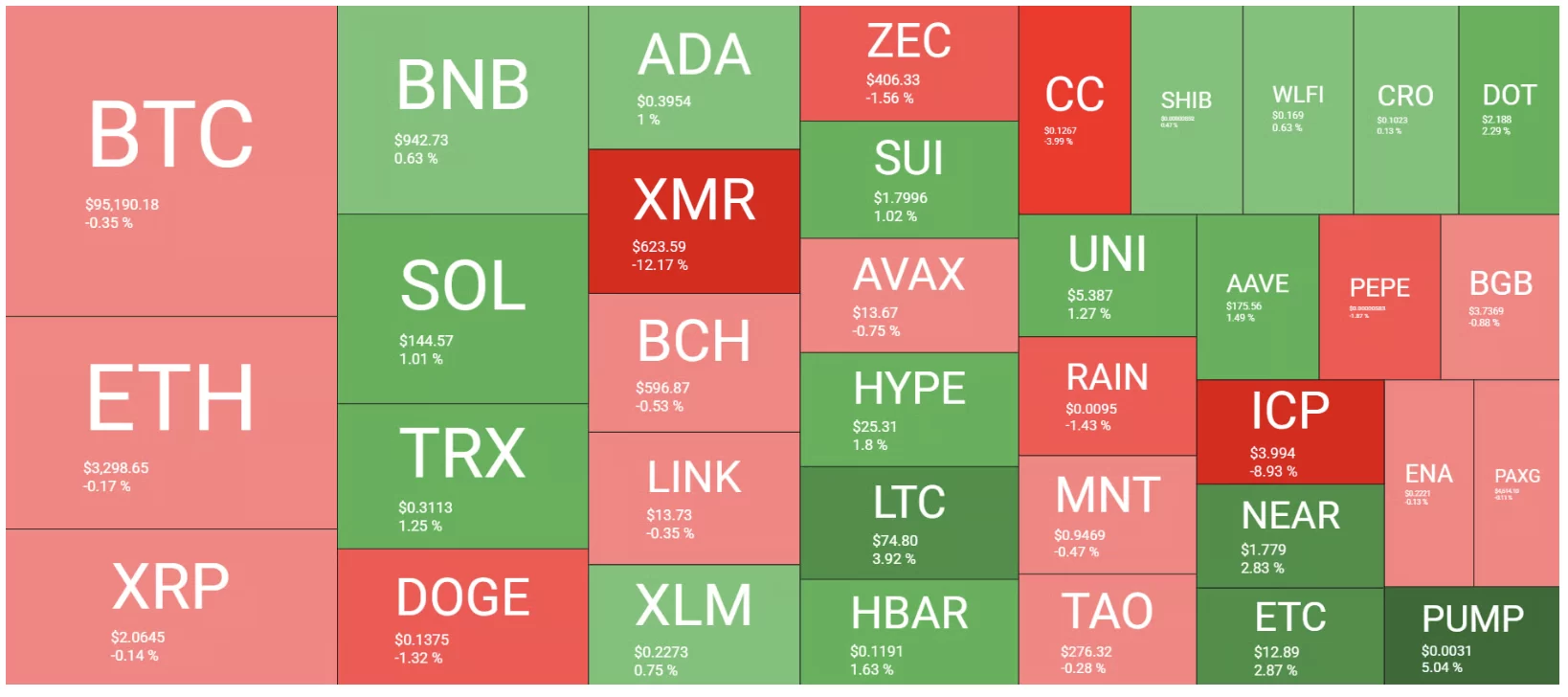

There has been an unusual stagnation in the altcoin market in the last 24 hours. While Ethereum is moving sideways around $3,300, XRP continues to maintain the $2.05 support level. While BNB, TRX and Solana recorded limited increases; DOGE, BCH, LINK and ZEC are in the red zone with slight losses.

Within this chart, Monero (XMR) diverges negatively. The privacy-focused cryptocurrency had a strong rally last week, approaching its all-time high of around $800. However, with the harsh sales from this level, the price dropped to $ 620 and lost 12 percent of its value in the last 24 hours alone. Similarly, Internet Computer (ICP) experienced a 9 percent decline on a daily basis, making investors nervous.

On the other hand, when looking at the overall market, the total cryptocurrency market value continues to remain above 3.3 trillion dollars, according to CoinGecko data. In addition, the recent news that institutional inflows to spot Bitcoin ETFs have started to increase again stands out as a development that may support the market in the medium term.

As a result, Bitcoin’s calm hold above $95,000 shows that there is no strong panic in the market. However, the volume decline in altcoins and the sharp corrections seen in some assets such as Monero reveal that investors continue to act cautiously. While it seems likely that the horizontal trend will continue in the short term, macroeconomic news flow and corporate demands will be the main factors that will determine the next direction of the market.