Bitcoin price is showing signs of strength this week as it holds key support levels, signaling potential upside for the coming days. Here’s a breakdown of the current market situation and what traders might expect.

Currently, the Bitcoin price is holding above the crucial $94,630 support zone. This area has been tested recently, and buyers have stepped in to keep the price stable. If this support continues to hold, the market could see a new upward run toward $100,000 in the coming week.

Weekend Bitcoin Price Action and Liquidity

As we approach the weekend, the Bitcoin price is likely to move sideways, ranging between the key support and resistance levels. Traders often see this as a period of consolidation, where the market gathers momentum for the next major move.

For long positions, a break above $95,820 could trigger a push toward the monthly high of $97,960, with the potential for further gains if momentum continues. Conversely, a break below the current support could lead to a sharper drop.

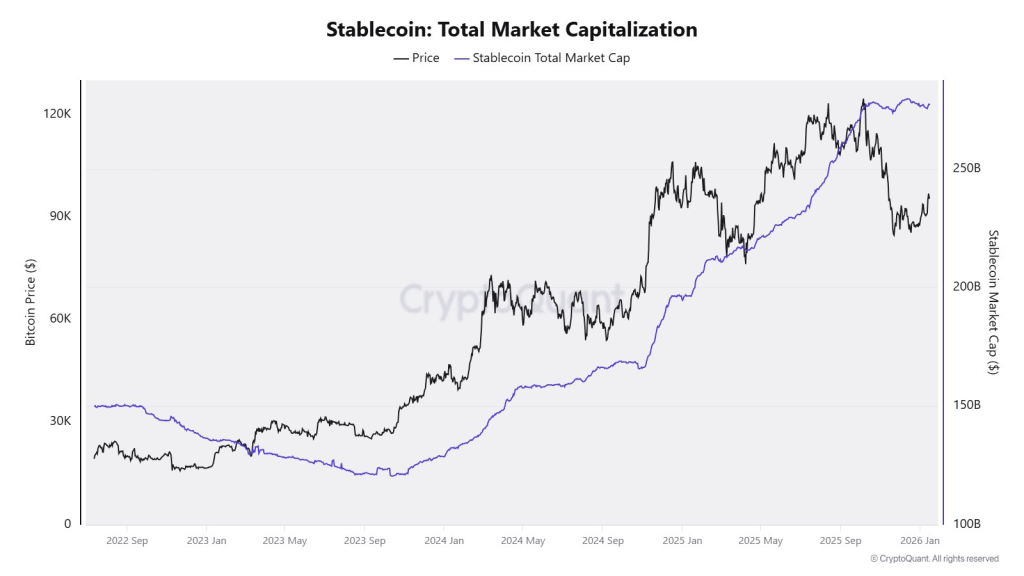

Stablecoin Flows Indicate Market Strength

The stablecoin market is nearing its all-time high, showing increased liquidity. More funds entering the market often lead to higher demand for Bitcoin, as investors look for opportunities in digital assets. The current trend of fund inflows aligns with Bitcoin’s price movement, hinting at the start of a potential new uptrend.

Institutional Interest Supports Upside

Individual investors appear cautious, with low funding rates and mixed market sentiment. Meanwhile, institutions are gradually returning, adding Bitcoin to spot ETFs and company balance sheets. This renewed interest could accelerate Bitcoin’s climb toward $100,000 in the near future.

Bitcoin Price Forecast For The Coming Week

According to the analyst, Bitcoin is also holding above $89,326, and as long as it stays above this level, the uptrend remains possible. The next significant resistance to watch is around $98,200, which, if breached, could open the path to $107,500.

At $107,500, a key decision point will occur: either the uptrend continues, or Bitcoin could face a rejection and fall back toward support zones around $83,822–$82,477. A break below $82,477 could see Bitcoin testing strong support levels in the $74,496–$71,237 area.

Bullish Bias, But Watch Key Levels

- Support: $94,630 (short-term), $89,326 (longer-term)

- Resistance: $95,820, $97,960, $98,200, $107,500

- Upside Potential: $100,000 and beyond if momentum holds

- Downside Risk: Daily close below $93,347 or $82,477

Overall, Bitcoin is positioned for a potential bullish continuation, but traders should watch key support and resistance levels closely. Weekend movements may remain range-bound, but a breakout early next week could set the stage for higher prices.

FAQs

Major risks include global recessions, tighter crypto regulations, declining liquidity, or a sustained breakdown below key support levels.

Bitcoin price forecasts for 2030 range from $380K to $900K, driven by scarcity, long-term adoption, and expanding institutional participation.

While uncertain, many long-term projections suggest Bitcoin could exceed $1 million by 2050 if it becomes a global store of value.

Bitcoin’s fixed supply makes it attractive as an inflation hedge, especially during currency debasement and long-term economic uncertainty.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.