Weekend liquidity is usually thinner, and that’s exactly why BTC, ETH, and SOL are worth watching right now. When the market has fewer orders on the books, even modest buying or selling can move the price faster than expected. This weekend, two signals line up in a way traders can’t ignore: a large tracked account is leaning long on the majors, and derivative positioning is rising across Bitcoin, Ethereum, and Solana. Together, these point to a market that is turning more “risk-on”, but also one that can snap hard if the crowd gets it wrong.

Why BTC, ETH, and SOL are the weekend watchlist

Bitcoin, Ethereum and Solana have the deepest liquidity; they attract the most capital, and they tend to set the tone for the rest of the market. When BTC, ETH, and SOL get active at the same time, altcoins usually follow the direction rather than lead it. So even if you trade other names, the cleanest read often starts here.

Signal 1: Big positioning is leaning long

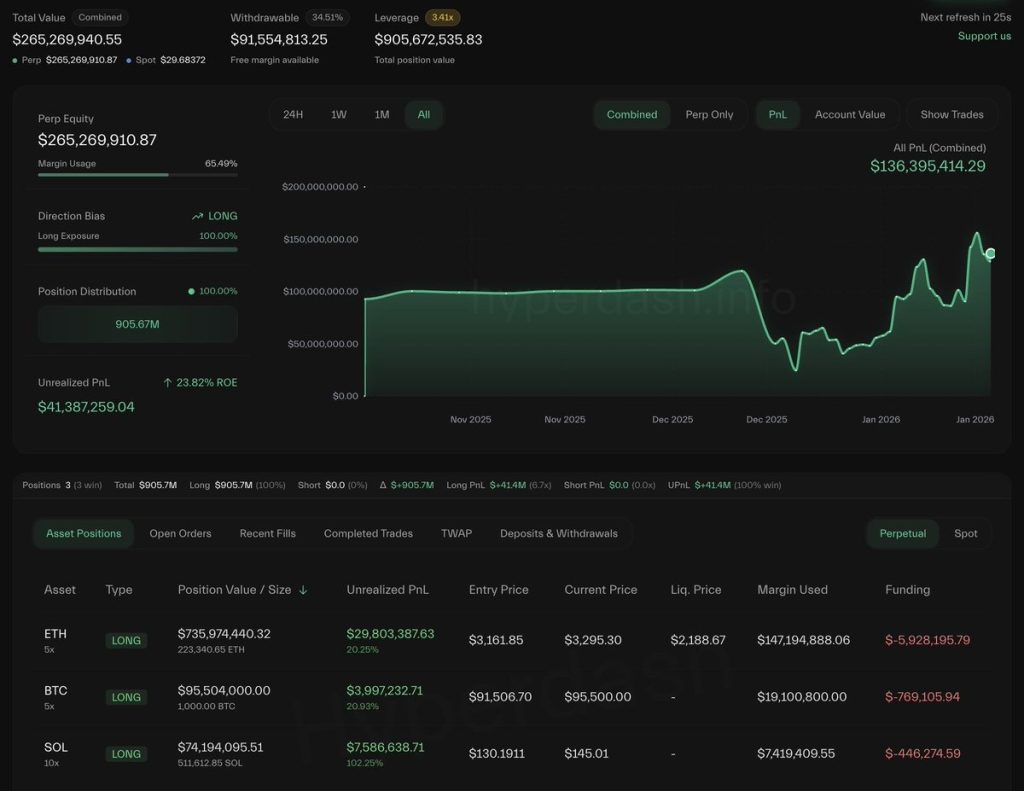

The data from Lookonchain shows a large account running a 100% long bias, with the biggest exposure in ETH, followed by BTC, then SOL. You don’t need to make it a “whale worship” story. Treat it as one thing: someone with size is comfortable holding long risk into the weekend.

That does not guarantee a pump. Large accounts can hedge elsewhere, scale in slowly, or exit fast. But it does tell you the current mood among bigger players isn’t defensive. They are not building a short book here. They are positioned for upside, or at least for prices to hold up.

Signal 2: Open interest is rising—leverage is coming back

The Santiment data is the bigger story for a weekend move. Santiment data shows open interest rising across the trio—roughly BTC: $36.5B, ETH: $17.2B, SOL: $3.7B. Rising open interest means more futures positions are being opened. In simple terms, more leverage is entering the market.

That can be bullish because leverage adds fuel. If spot demand shows up and price starts moving up, rising open interest can accelerate the trend. But leverage is a double-edged sword. If the price dips while open interest is still elevated, the market becomes vulnerable to liquidations. That’s when small drops turn into sharp wicks and fast flushes.

What to Expect This Weekend?

BTC, ETH, and SOL are the top tokens to watch this weekend because the market is sending a clear message: risk appetite is improving, and traders are adding leverage. The long positioning from a large account adds confidence to the bullish bias, but the rising open interest is the real catalyst—it can amplify gains, or it can punish crowded trades fast. If price stays stable while leverage builds, the path of least resistance remains up. If price weakens with open interest still elevated, expect sharper swings and potential shakeouts before the next direction is clear.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.