By mid-january 2026, Bitcoin price rose about 12%, surpassing the $95K resistance level after a period of stagnation. This rise is fueled by strong institutional demand and positive macro conditions. However, short-term catalysts are uncertain, though key on-chain factors point to a bullish outlook.

Institutional Demand Reignites BTC Price Momentum

The Bitcoin price chart, which has recently jumped above $95K, has been largely bolstered by rising institutional interest, particularly through spot Bitcoin Exchange-Traded Funds (ETFs).

Recent data indicate that spot BTC ETFs’ weekly inflows of $1.8 billion were the largest influx since early October. This suggests a resurgence of investor confidence.

This week’s momentum in the Bitcoin price was further complemented by Strategy’s aggressive accumulation. Michael Saylor publicly disclosed that it increased its total holdings close to 687,410 BTC.

Such large-scale corporate purchases serve as a clear indicator of long-term conviction. This strongly reinforces the narrative of Bitcoin as a treasury asset.

Regulatory Dynamics and Macro Sentiment Influence Price Direction

Beyond institutional strength, the BTC price rally was also influenced by broader macro and regulatory developments. As an early draft of the Clarity Act which was circulated, prompted optimism about future crypto regulation that led to rise in price. However, rise remained brief, as an in-depth analysis of the draft sparked opposition from the Coinbase CEO, leading the Senate to delay the bill’s markup, which created mixed sentiment in the current market.

While this delay was necessary, it has sustained near-term momentum and reminded traders of the ongoing regulatory uncertainty that continues to temper any acceleration in Bitcoin’s price. That underscores the need for clear, favorable legislation, as this could further unlock institutional flows and bolster the Bitcoin price forecast narrative.

In addition, easing geopolitical tensions contributed to short-term risk-on sentiment, too. Reports suggest that potential conflict triggers in the Middle East were being de-escalated that also provided mild support for risk assets, including Bitcoin and broader crypto markets.

On-Chain Buying Signals Improve Supply–Demand Structure

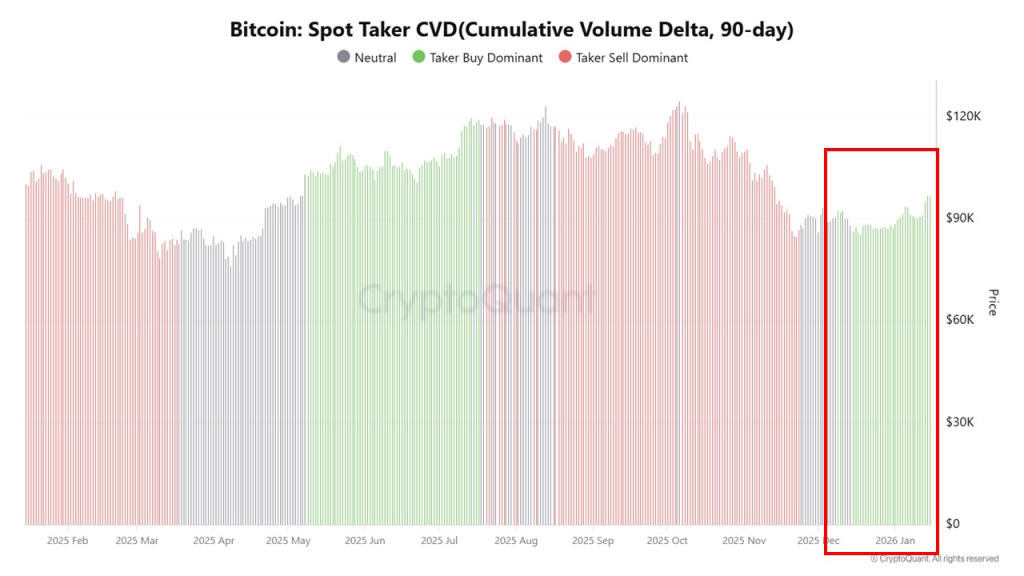

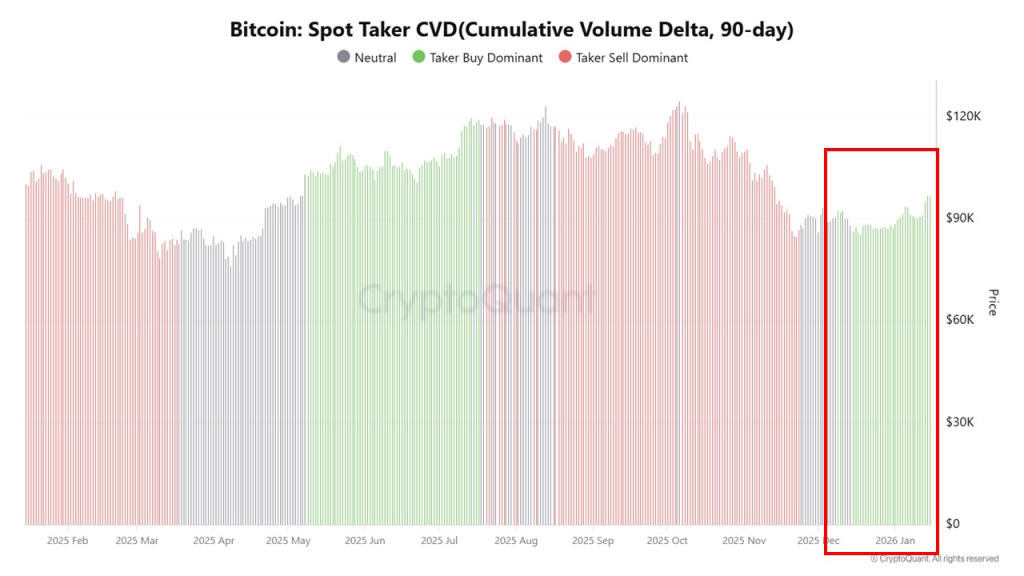

Beyond flows and macro events, on-chain metrics are also pointing toward healthier accumulation dynamics. A key metric, the 90-day Spot Taker Cumulative Volume Delta (CVD), has shifted toward a taker buy dominance phase.

This suggests buy-side pressure is growing relative to sell-side activity, indicating that sellers are being absorbed and the supply-demand structure is improving.

The combination of institutional ETF inflows and positive on-chain indicators paints a picture of strengthening fundamental support for the BTC price prediction in early 2026.

BTC Price Eyes Critical Technical Breakouts

Technically, on the daily chart, Bitcoin price now faces the dynamic resistance posed by the 200-day Exponential Moving Average (EMA). A successful flip of this level could propel the BTC price toward the next psychological target near $108,000.

For now, the market’s direction hinges on continued institutional participation, regulatory clarity, and the evolving macro landscape.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.