Bitcoin price On January 15, it maintained 96 thousand dollars and the belief that the increase in cryptocurrencies has begun is increasing. With the Supreme Court decision being postponed for the second week, BTC made greater peaks. Although there is a rejection from the 98 thousand region for now, BTC maintains the key support and this shows that something may have changed.

Predictions of Krüger and Darkfost

Crypto On-chain analyst Darkfost noted the BTC flow in his latest market assessment. More than 4,500 BTC net outflows were recorded from the Binance exchange on January 5. This was already a huge number, but on January 13 it was surpassed again with a net outflow of more than 5,200 BTC. This change in flow dynamics indicates a change in investor behavior. The analyst now thinks that things have changed in favor of the bulls.

“BTC, Binance When it leaves a major centralized exchange, this usually indicates transfer to cold wallets, long-term wallets or other self-storage solutions. This is often an early sign of renewed long-term belief, or at least a sign that immediate selling pressure is easing. Of course, it is too early to characterize this as a well-established structural trend. A few more weeks of data will be needed to confirm whether these outflows are sustainable or merely reflect a temporary stabilization following year-end extremes. However, necessary caution aside, the start of January is clearly encouraging.”

If the trend continues, we will be able to say that a “non-fake” rise has begun for the first time in months. There are still investors who want to turn this rise into a short selling opportunity, and this perspective has brought them serious profits for months.

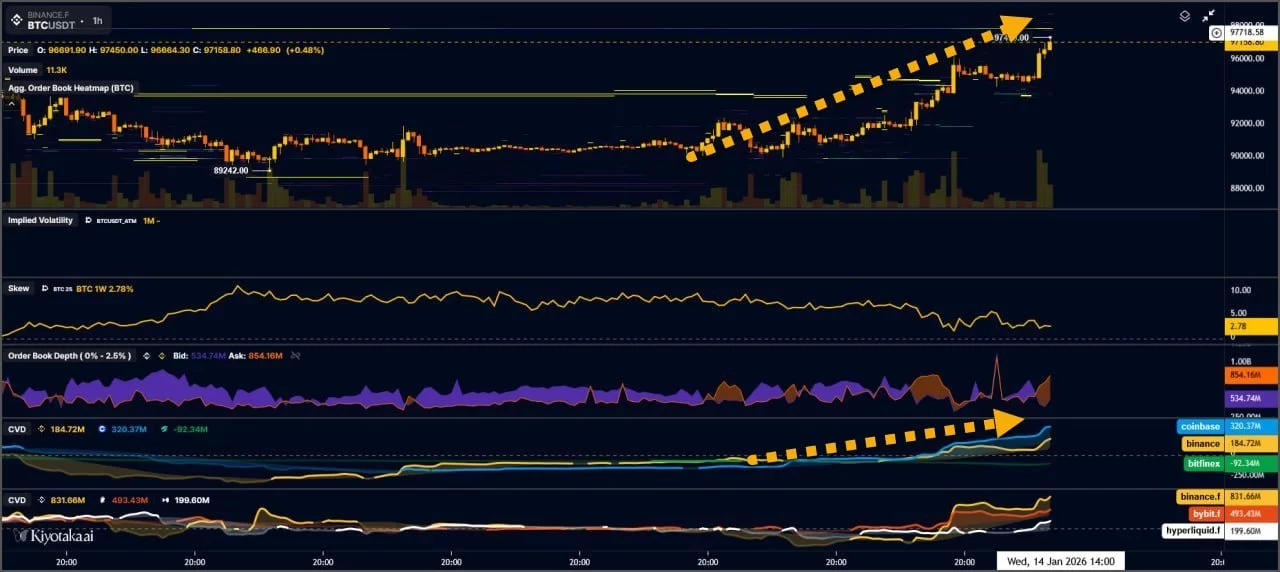

Economist Alex Krüger argues that the rise is due to the Fed.

“BTC’s rise since Powell’s subpoena news on Sunday has been largely driven by Coinbase spot buyers. You can see this in the Adjusted Coinbase Premium and CVD.

Ministry of Justice Powell’s His pursuit became an important litmus test for Bitcoin. After all, hedging against the tail risk of central bank profligacy is bitcoin’s most important long-term value proposition. Bitcoin should have risen on Monday. And it rose, albeit with a slight delay.”

Thinking that the battle area on the chart is the 50-week moving average (WMA), the analyst said that he will start taking profit here as there may be short-term retreats at $ 101,420.

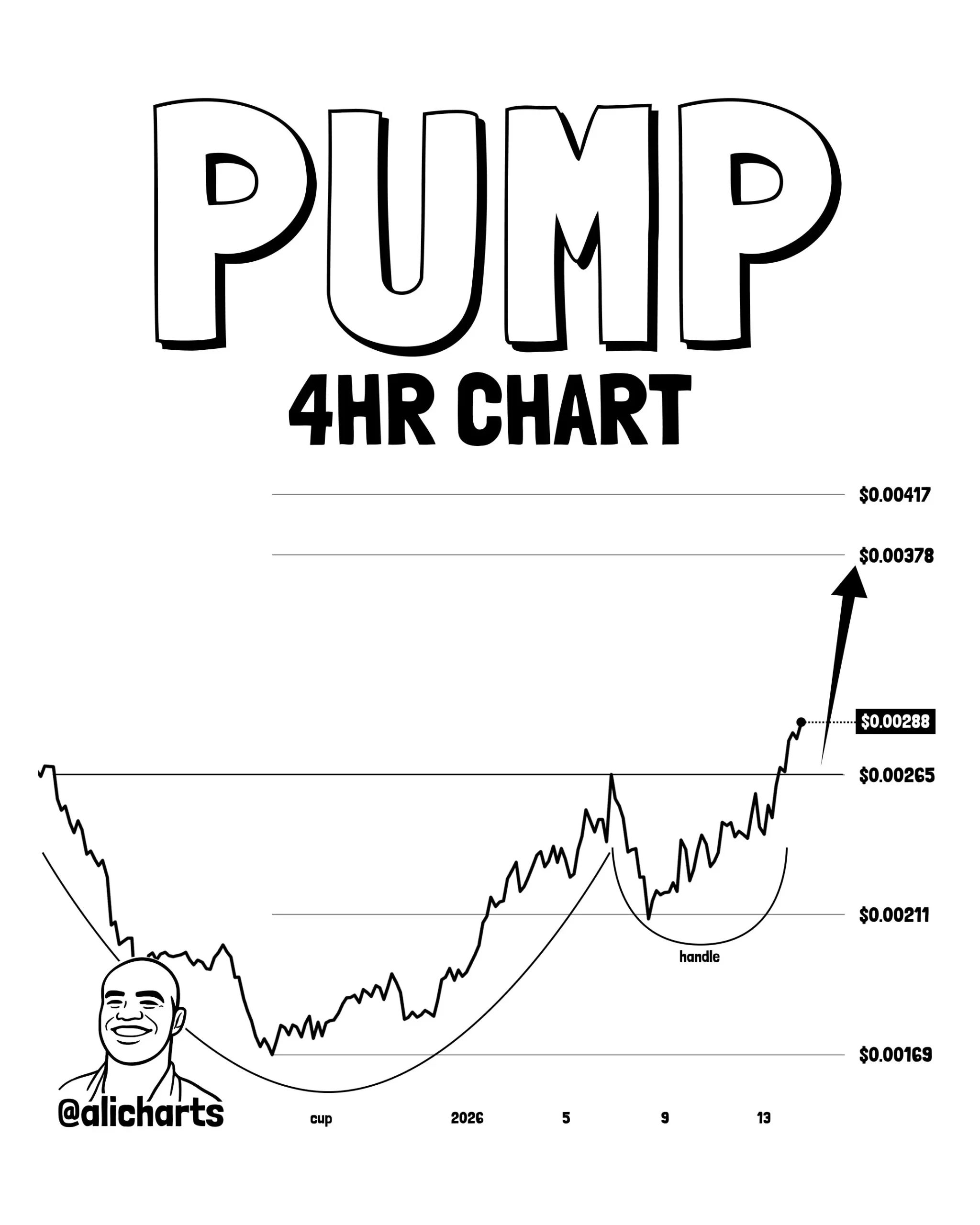

PUMP Coin Prediction

Ali Martinez for investors looking for short-term opportunities to PUMP Coin he pointed out. The analyst who shared the chart below wrote that we could reach $0.00378 soon due to the exit from the cup handle formation.