At the time of writing, Trump is at the signing ceremony and has not yet made any significant statements. BTC is stalling at the $97,000 level. Kashkari said this evening that cryptocurrencies are useless for individual investors. In cryptocurrencies The agenda is busy and Efloud shared the latest short and long term ETH chart analysis.

Ethereum (ETH)

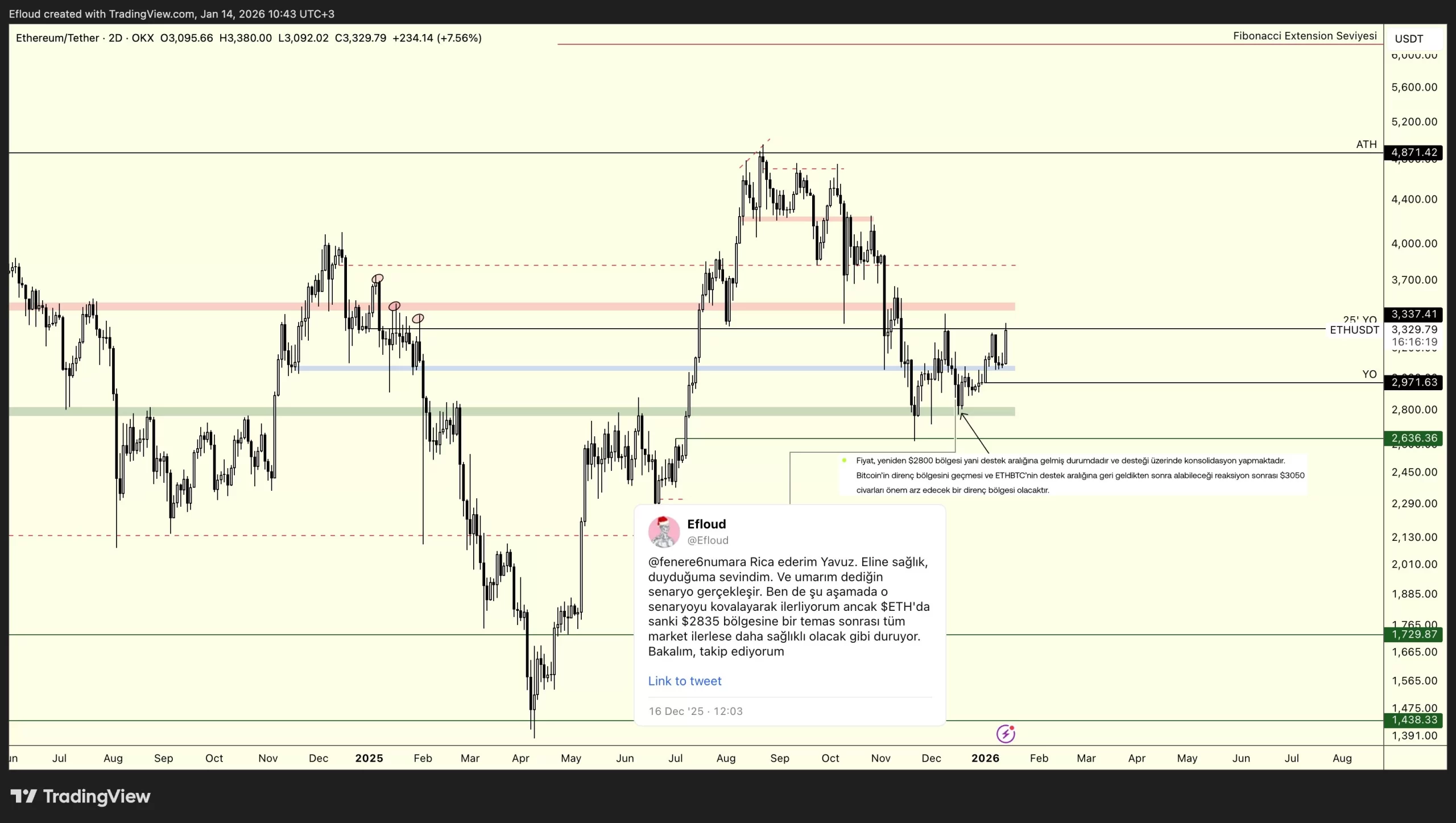

ETH price over $3,300 at the time of writing. Efloud is happy to have the green box acting as support in the short term. In the long term, the blue box acts as support. Stating that $3,500 is his first main target, the analyst aims to close his positions at this level.

In the short-term timeframe, $3,180 is likely to act as support.

The analyst, who thinks that the dashed line, that is, around $ 3,700, can be tested in the scenario where the red box is exceeded, underlines that he will not lose his upward motivation without losing the support points.

ETH Stabilization of the chart is also very important for altcoins. When we look at the ETHBTC parity, although the 0.0322BTC level was maintained as support, the previous level of 0.0354BTC, which turned into resistance, could not be regained. This shows that it is too early to rejoice in altcoins. If BTC If it can continue to close above 96 thousand dollars, we can see that the liquidity in altcoins increases as the tests of 98 thousand dollars will begin.

Otherwise, the BTC rise will remain a short-term speculative movement and space will be opened for altcoins to see deeper bottoms. The delay in the Supreme Court decision is interpreted by some experts as a possible decision in favor of Trump, but the uncertainty will disappear when the decision becomes final this month.

Bitcoin is at a turning point

Cryptocurrency markets have been in a terrible state for months, and the rise in early 2026 was largely about its normalization. On-Chain Mind wrote that, looking at the current situation within the framework of BTC monthly active supply, we may now have reached the reward phase. So he expects the rise to continue for a while.

“of Bitcoin This aligns with the biggest milestones when monthly Asset Supply rises above ~100,000 BTC.

- Spikes during rallies indicate distribution.

- Spikes during sell-offs often signal eventual capitulation and major bottoms.

Accumulation has always been rewarded when activity collapses or turns negative. We are currently in this final stage.“