The Bitcoin market is struggling to find a clear direction heading into 2026. There are serious differences of opinion among globally influential fund managers, crypto companies and on-chain analysis platforms. While some argue that new records are on the way, others are of the opinion that the bear market is not over yet. Bitcoin, which closed 2025 with a decline, has also questioned the classical four-year cycle narratives. This complex picture makes investors’ expectations for 2026 even more sensitive.

Corporate Optimism: Are New Highs on the Table?

On the bull front, there are strong names such as VanEck, Bitwise, Grayscale, Bernstein and Coinbase. According to these institutions, Bitcoin may experience a strong recovery in 2026 and hit a new all-time peak at $150,000. The point that Bitwise and VanEck point out is that although Bitcoin closed 2025 in the red, the four-year cycle theory may be no longer valid.

According to this view, Bitcoin will now move more synchronously with the US stock markets. A positive trend, especially in technology stocks, may also push the BTC price up. In such a scenario, a classically harsh bear market may not occur or its impact may be limited. VanEck Head of Digital Assets Research Matthew Sigel argues that the Relative Unrealized Profit (RUP) indicator is still not at dangerous levels and the market cycle has not peaked.

Bear Front and On-Chain Alerts

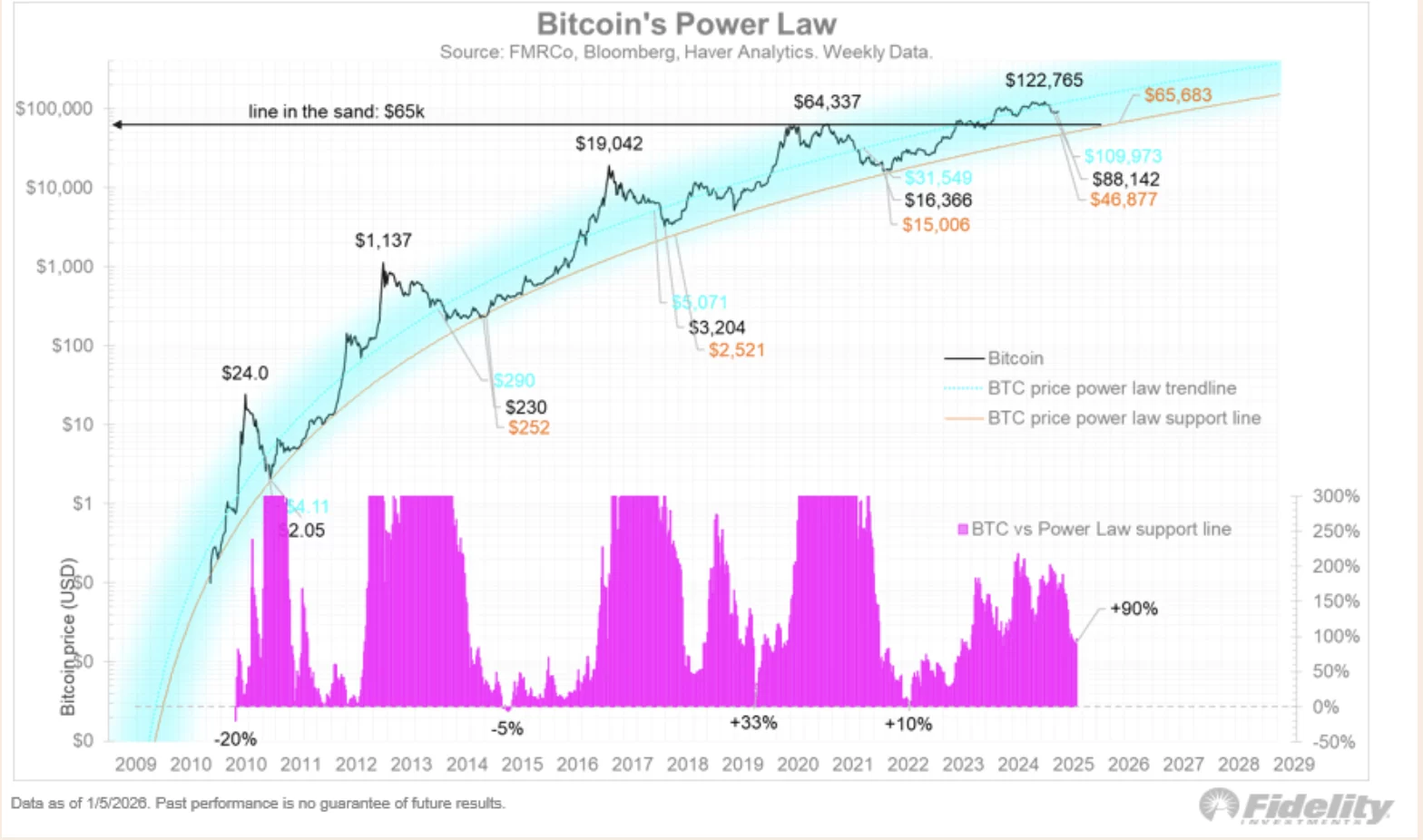

But not everyone is so optimistic. Jurrien Timmer, Fidelity’s Global Macro Director, is cautious about the idea that bear markets are over for good. According to Timmer, the critical threshold for Bitcoin is 65 thousand dollars, and below this level there is a risk of retreating to 45 thousand dollars. According to him, Bitcoin may remain horizontal for a year and try to rise again if it gathers strength during this period.

On-chain data also supports this cautious approach. According to CryptoQuant data, Bitcoin entered the bear market in November 2025 by falling below the one-year moving average. The company’s founder, Ki Young Ju, points out that the slowdown in the Realized Cap indicator is similar to previous bear periods. This situation is seen as a risk factor that may weaken the optimistic predictions made for 2026.

On the other hand, another development that increased uncertainty in the market was the slowdown in fund inflows to spot Bitcoin ETFs in the USA. The recent decrease in net inflows to ETFs indicates that institutional demand remains cautious in the short term, which may put pressure on the price.

As a result, Bitcoin’s journey to 2026 appears to depend more on macroeconomic conditions and corporate behavior than on classical cycles. On the one hand, there are powerful players who believe in new highs, and on the other hand, there are warnings of on-chain data. This chart shows that high volatility may be inevitable in the coming period and investors should not stick to a single scenario.