Following today’s data, Morgan Stanley announced that they foresee a total 50bp interest rate cut in June and September. Although their previous predictions were that the reductions would continue in January and April, the recovery in the employment markets paved the way for the Fed to pause the reductions. this situation cryptocurrencies bad for. So what is the latest situation in cryptocurrencies?

Solana (LEFT)

The Supreme Court tariff decision has been postponed and is likely to be announced on Wednesday. Since inflation data will be released next week, the importance of the coming days has increased. Since employment data is announced against risk markets, investors are likely to want to enter the new week cautiously. This shows that cryptocurrencies may not see serious increases at the end of the week. BTC is above $91,000 for now.

Solana (LEFT) It continues to linger around $138. Having been largely inactive for so long, Jelle wrote;

“LEFT It still continues to fluctuate below the $200 resistance level. I’m starting to feel like BNB. It looks like it will stay flat forever, then suddenly it will start to rise again.

I still have some coins; “I expect the same result.”

Returning to the days in December in the ETF channel, SOL Coin is experiencing net inflow days of over 10 million dollars. Interest is positive and total net assets are approaching 1.5% of supply. The expectation of a sudden move to $200 is probably also on the institutional side. Solana third best cryptocurrency It has the chance to be successful due to its strong ecosystem. Although they are thought to be competing for third place with XRP Coin, XRP Coin comes right after Ethereum as a strong layer1 solution in terms of market value alone.

Sharing the chart above, Crypto Tony wrote that the outlook is good and we will continue to see new highs when BTC calms down.

Big Move Is Coming

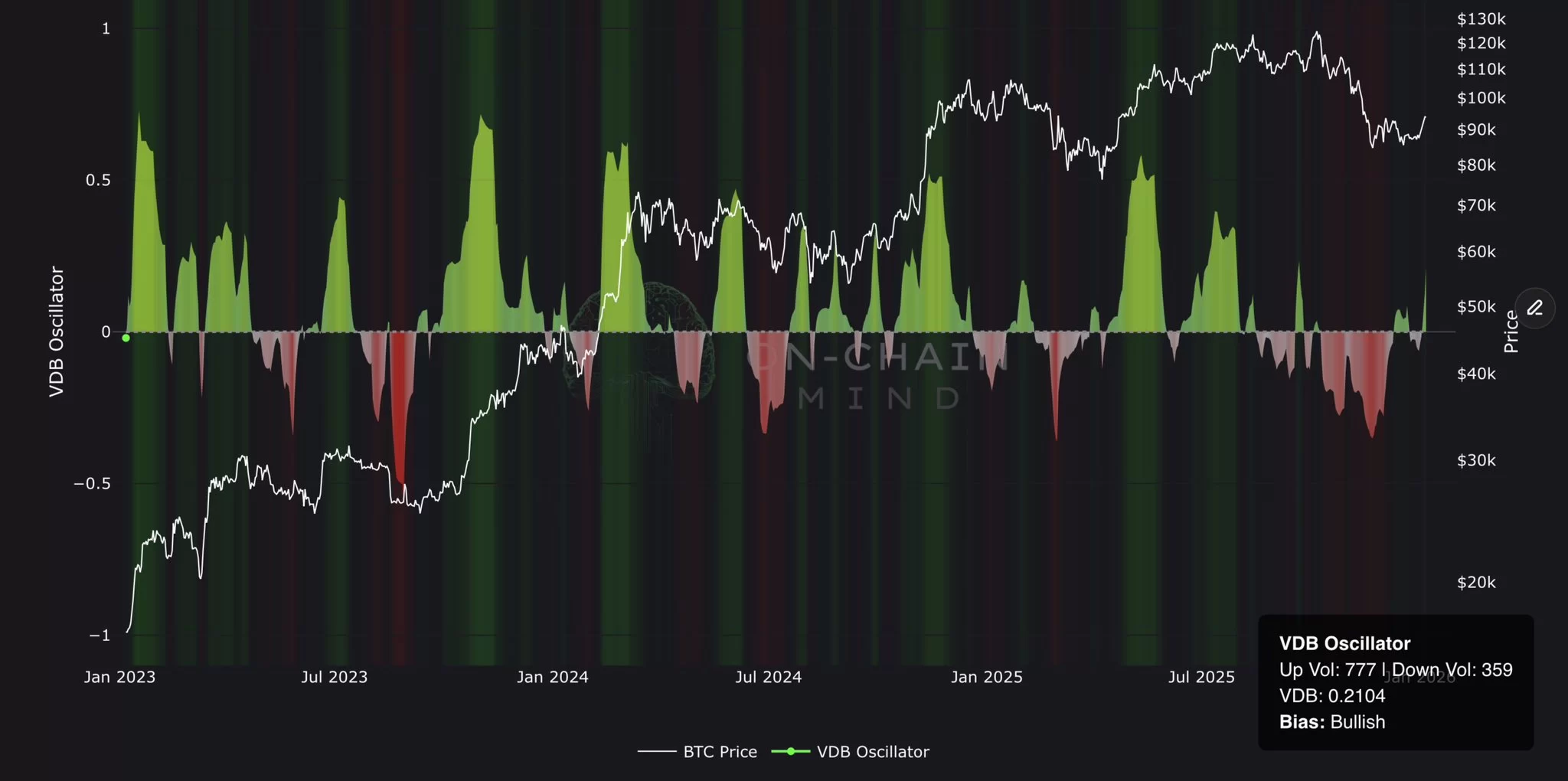

The news feed says we should see a big surge soon. Not only the news flow but also the VDB indicator signals that volatility will increase, although the direction is uncertain. Although On-Chain Mind thinks the upside potential is a bit more dominant of cryptocurrencies Those who have spent enough time here to understand its nature full of surprises are right to remain cautious.

If the direction is upward, the 98 thousand dollar threshold will be expected to be exceeded with a daily closing above 94 thousand dollars. Gaining the investor cost zone will help the buyers to stay in the game even as the excitement fades, thus helping the rise to continue in a healthy manner.