Bitcoin’s price has slipped from recent highs, breaking below key short-term levels and triggering renewed fears of a deeper correction. However, beneath the surface, on-chain data tells a very different story.

Despite the pullback, long-term Bitcoin holders are not selling aggressively. Key on-chain indicators show that older coins remain largely inactive, suggesting the recent downside move is being driven by short-term traders and leverage resets rather than structural distribution.

This divergence between the BTC price weakness and holder behavior is critical. It points to a market that is cooling off and rebalancing—not one that is topping out.

What the On-Chain Data Is Saying

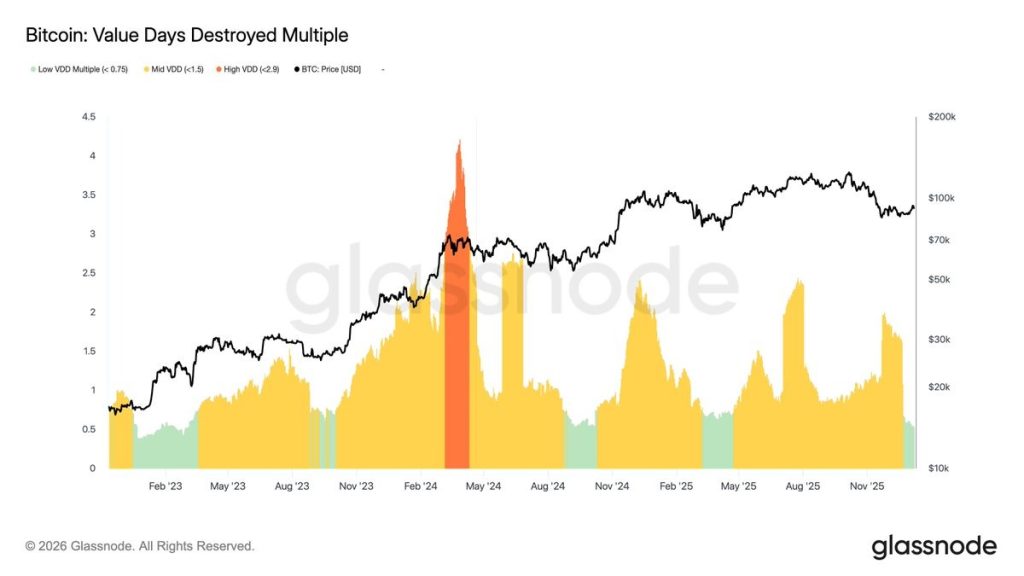

The Value Days Destroyed (VDD) Multiple tracks when older, long-held BTC is being spent. Historically, major market tops are accompanied by sharp red spikes, signaling long-term holders distributing into strength. Right now, that signal is missing.

Recent readings from Glassnode remain in the low-to-mid VDD range, indicating that:

- Long-term holders are not aggressively selling

- Most BTC being moved belongs to short-term participants

- Selling pressure is tactical, not structural

This behavior typically aligns with consolidation or trend continuation, not final tops.

Bitcoin Long-Term Holders Remain Optimistic

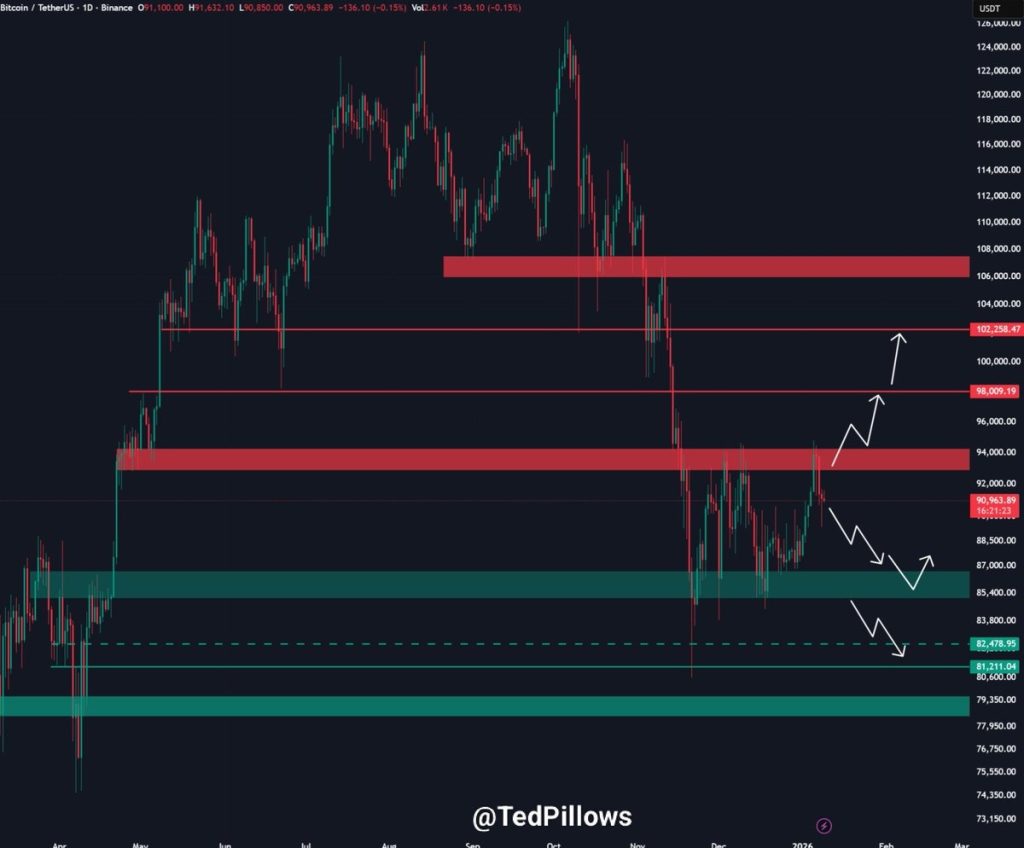

The price chart shows Bitcoin rejecting higher supply zones around the $105k–$110k region, followed by a breakdown below mid-range support near $102k–$98k. This triggered a sharp move lower, but importantly, the price has not entered freefall. Instead, BTC is reacting around the established demand zones. Volatility is high, but a structure is forming, and hence the moves could resemble liquidity sweeps but not panic sweeps.

The combined charts point towards three main outcomes. Firstly, no mass distribution from long-term holders. Secondly, distribution is occurring at higher levels, followed by a controlled reset and thirdly, short-term traders are driving volatility, not smart money exits. This is typical of mid-cycle corrections, where leverage and late longs are flushed while long-term conviction remains intact.

What’s Next for the BTC Price Rally?

Bitcoin price is facing notable upward pressure but continues to trade within a demand zone. If the price reclaims the range between $98,000 and $102,000, it could signal absorption and open the door for continuation. An invalidation could drag the price close to $82,000, which could weaken the broader bullish thesis. Besides, holding within the current demand zone between $88,000 and $92,000 could keep the structure constructive.

Despite the sharp pullback, on-chain data does not support a cycle-top narrative. Long-term holders remain calm, while price action reflects a market resetting excess, not unwinding conviction. For now, the BTC price appears to be digesting gains, not ending the trend. Direction will be decided not by fear, but by how price reacts at key levels in the days ahead.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.