The new year started in a dizzying way in cryptocurrencies, but the altcoin is repeating the performance of 2025. BTC, which made one of its usual resistance tests at $94 thousand, turned its direction down again. The big news expected on Friday, combined with today’s whale movement, upset altcoin investors.

730 Million Dollar Transfer

Darkfost, one of CryptoQuant analysts, paid attention to the huge BTC transfer in today’s evaluation. While the article was being prepared, the White House Press Secretary completed his statements and said something new. At 22:30 we will see Trump sign new decrees. If at 00:10 from the fed Bowman will participate in the Q&A.

It’s important because someone is transferring a large amount of BTC and assets have been held for 12-18 months. For the $730 million transfer worth 8,038 BTC, Darkfost wrote:

“So far, 8,038 BTC worth approximately $730 million have been transferred.

“As the timings are close together, it is likely to be the work of the same organisation.”

These types of transfers are generally interpreted as sales motivation and are not considered good for cryptocurrencies.

Friday Alert and ETF

Morgan Stanley crypto ETF While we were about to change the atmosphere of this week with its applications, we learned that the Supreme Court will announce its tariff decision on Friday. While the sentiment for cryptocurrencies turned negative again, an analyst with the pseudonym Negentropic warned investors.

“of BTC The key level to exceed is $94.7 thousand. A daily close at this level significantly increases the likelihood of ATH being retested.

ETH is stronger here, but BTC needs to lead the way for flows to start returning to the broader market. Volatility is expected through Friday, and the chance of the tariffs being called unconstitutional is over 70%. What matters are the details of the extent of the violation.

“The ISM non-manufacturing index came in strong and fiscal stimulus will set the stage for a strong medium-term outlook in the first quarter.”

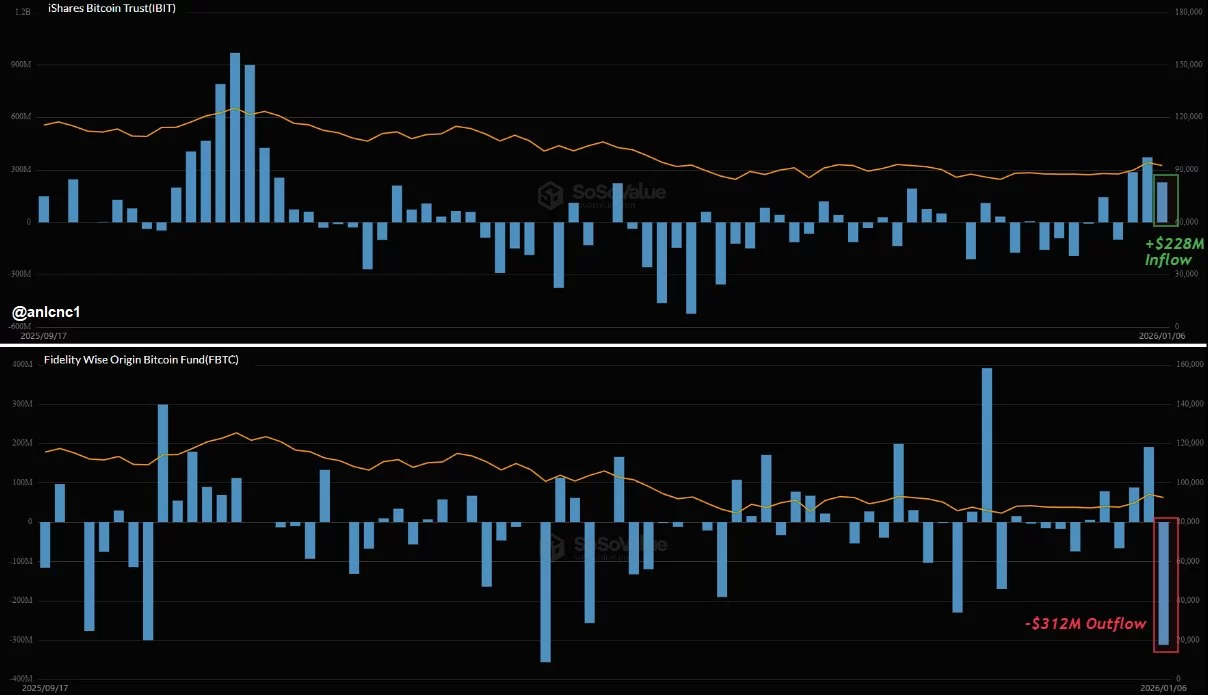

Turkish on-chain analyst In today’s evaluation, anlcnc1 pointed out that the outflows in Fidelity ETFs were balanced by BlackRock. Fidelity recorded a net outflow of $312 million, while BlackRock recorded a net inflow of $228 million on the same day. Unless there is a meaningful exit from BlackRock ETF The analyst, who says that the optimism in the channel may continue, is not very pessimistic for now.