Reaching its 2026 high, Bitcoin recently rose to $94,477. 93,500 is the key support that needs to be protected. So, what does Roman Trading, which correctly predicted the declines in the last 6 months, say about the latest rise? Do analysts believe in the rise in cryptocurrencies? Today we will discuss the first big rise of 2026 from different perspectives.

Crypto Oracle and Ascension

We mentioned the rise in US stock futures before the market open. US markets opened with gains and cryptocurrencies It was supportive for. Analysts got more hungry today as the rise continued and started to announce six-digit levels. If spot ETF If we see strong entries on the side today, we can see a more stable rise as corporate players enter the game.

The analyst with the pseudonym Roman Trading, who predicted major movements in the last 6 months significantly accurately, was expecting an intermediate rise in his previous evaluations. We shared the details throughout December. The scenario he envisions is a fake rise to $104,000 followed by a decline to $56,000. Sharing the chart above crypto oracle He wrote:

“I don’t want to be the messenger of bad news, but don’t get too excited about this latest spike.

We are coming out of a 2 week holiday period + volume is quite low.

“We have seen time and time again that the low-volume spikes resulting from the holidays have completely receded.”

We mentioned that the analyst, who advised investors to stay aside during the holiday period, was already expecting a move as of this week. If he is right, we should see this rise reverse quickly before the end of the week. Let’s see if those who use the peaks for short entry will be right this time.

Bitcoin Rise Predictions

Analyst Max Rager stated in his latest assessment that he was pleased to see strength in the chart. The analyst with the pseudonym Exitpump mentioned that testing the opening level of 2025 in the new year is extremely positive and wrote that breaking above 94 thousand dollars will open the door to 100 thousand dollars. BTC At the time of writing, it is trying to break the level of 94 thousand dollars, but it is difficult to be sure of six-digit levels without seeing at least a daily close above this level.

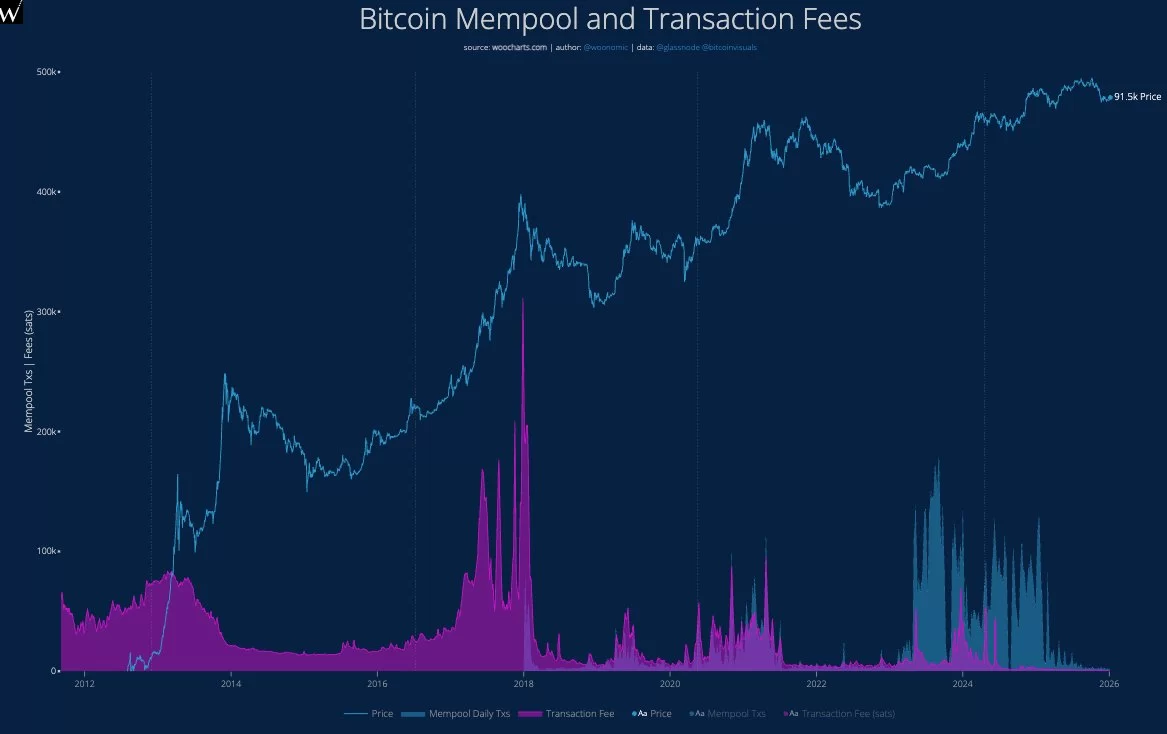

Willy Woo warned investors based on the weakness in the order book and low trading volume.

“I think there will be a short-term increase in January (we started to see liquidity reach a local bottom). But this graph (transactions and fees) is trending downward in the long term (macro cycle), it’s like a ghost town.”