The largest institutional Bitcoin whale and reserve company Strategy Even though it was a holiday week, he didn’t stay idle. The company, which announced that it made a new purchase last week, is entering 2026 with a new purchase amid uncertainty concerns. Saylor, who gave his usual buy signal on Sunday, shared the good news today.

Crypto Whale Breaking News

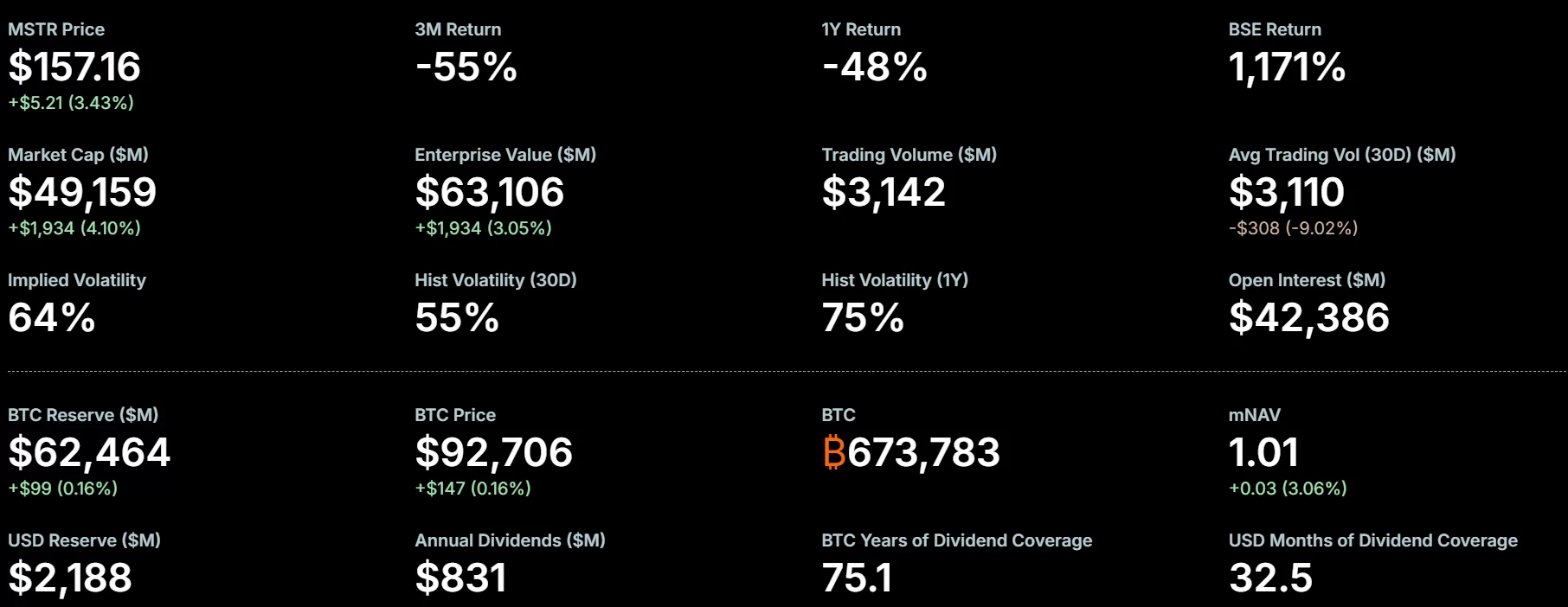

In today’s 8K filing, his company announced that it had acquired another 1,286 BTC worth $116.3 million at a cost of $90,391. The company’s total reserves are 673,783 to BTC output. The company, which continued to increase its cash US dollar reserves before the January 15 MSCI decision, has $2.25 billion in cash. If MSCI does not classify cryptocurrency reserve companies as funds, the good news is that MSTR can immediately transfer $2.25 in cash to purchase BTC.

After the last purchase, made between December 29 and January 4, the company’s average cost increased to $75,026. Strategy, which has $63 billion in BTC assets, spent $50.6 billion on it and made most of its significant purchases after Trump’s victory at the end of 2024. So its average cost increased quite rapidly.

The company alone holds more than 3% of the 21 million BTC supply mNAV It is exactly at the level of 1.01 and fell below 1 this week. If BTC does not continue to rise and mNAV remains below 1, Strategy will have a very difficult time borrowing or will not be able to borrow, and even if FUD grows, it will have to sell BTC and buy shares. January will be extremely active and the risks have not been eliminated.