Although it is one of the largest altcoins by market value, Chainlink (LINK) LINK Coin price could not carry it to the desired levels. Chainlink, which has signed agreements with many major partners including Swift and Mastercard, has virtually monopolized its field. Despite this, LINK Coin continues to linger below $14. But the whales got active.

Chainlink (LINK) Whales

CryptoQuant analyst Darkfost drew attention to the activity on the LINK Coin front in his market assessment a few hours ago. Even if the price does not meet the demand, the whales are moving. In the last few days on the Binance exchange LINK Coin Outflows increased sharply as whales took action.

Darkfost says that while there is an average daily outflow of 1500 LINK Coins from the Binance exchange, this is based on 4500.

“This dynamic began to take shape when the token was trading in the $12 to $13 price range after a significant correction of approximately 50%. As a result, the top 10 breakout average also began to rise. Historically, such behavior is often observed after strong correction phases. After prices have dropped significantly, whale activity intensifies and whales have the opportunity to increase their positions at more attractive costs. If this accumulation continues, the LINK token could definitively mark the bottom and resume the uptrend.”

The decline has stopped for now, and the increase in whale outflows is interpreted as the movement of stock market assets into cold wallets. If the overall market sentiment remains strong, LINK Coin may return above $20 with the support of whales.

LINK Coin ETF and Price

LINK Coin, which found buyers at $ 13.31, has not yet been able to fully benefit from the rise concentrated in meme coins. While Meme coins increased by an average of 6%, DePIN gained 4%. AI and NFT tokens also rose more on average than LINK Coin.

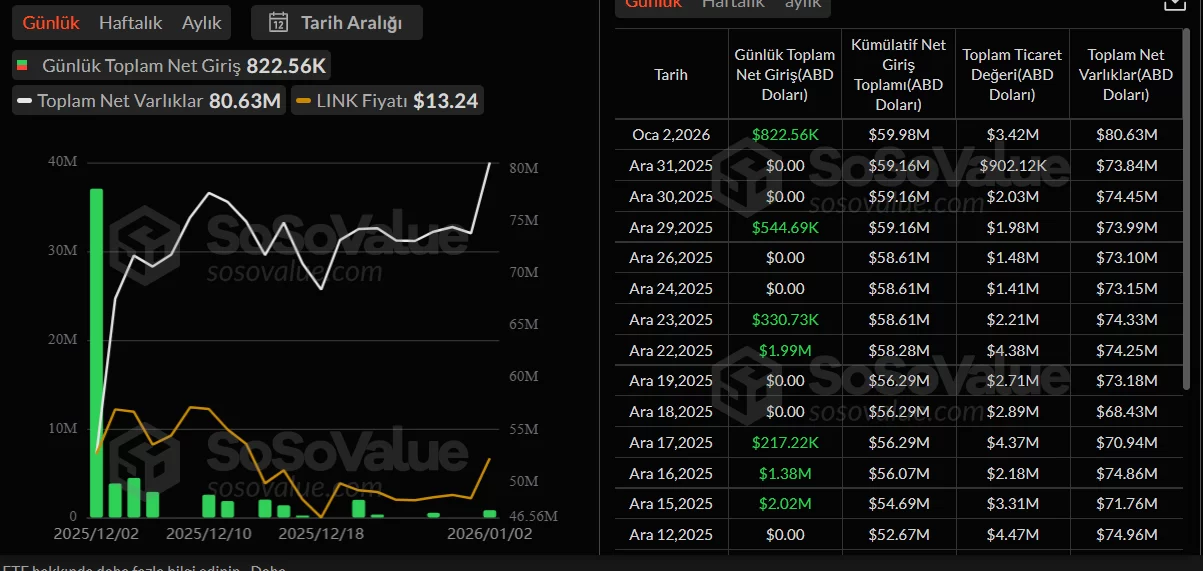

We mentioned that Friday’s ETF data would be important. The January rise in cryptocurrencies in general does not seem to have excited investors in the ETF channel. There was only an inflow of 822 thousand dollars (according to SoSoValue data). Although it is the largest inflow since December 22, the LINK Coin spot price has not yet taken action, and investors in the ETF channel do not allocate capital because they do not see an opportunity here. in the long run to Chainlink The only regulated channel of corporate investment LINK Coin ETF It is possible that we will see entries that will cause an upward spiral. But we have not reached those days yet.