If BTC can stay above 90 thousand dollars until the daily close, we can see the continuation of the rise in altcoins over the weekend. For now, as the US market moves towards closing, BTC is also going up and down below $90,000. However, if the double-digit rise seen in many altcoins is not the fortieth bull trap, expect Aster and HYPE Coin to see bigger peaks in January.

Aster Coin Price Prediction

According to defiLlama data, while perp volume recovered, TVL did not change much and ASTER Its open positions are not far from the bottom levels at $2.5 billion. We mentioned that income-generating cryptocurrencies can make strong rallies in the new year. Aster Coin is one of them and incomes are recovering.

Aster, which was preparing to enter the weekend with a 4% increase, could not return to $ 0.78. If this level is gained, the target will be the range of $0.91 and $1.39. Depending on the weather in January, the ceiling for Aster could be $1.39.

Hype Coin Price Prediction

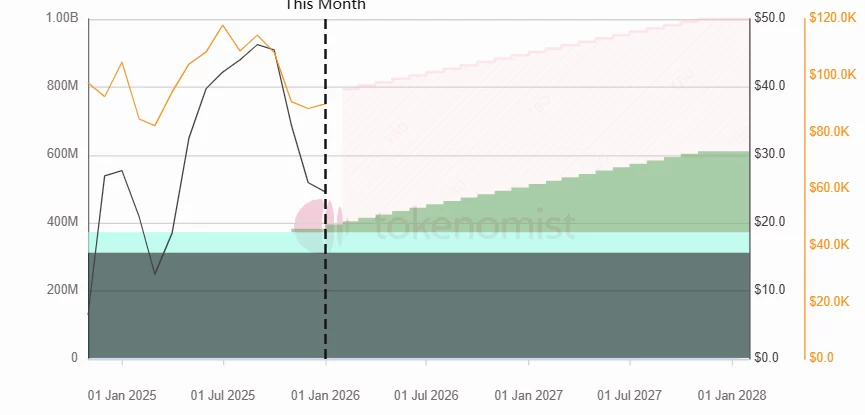

open positions hyperliquid It increases in the protocol and DefiLlama data is positive. Revenues are quite good compared to Aster and open interest is close to $7.5 billion. It seems that Hyperliquid will continue to enjoy the advantage of being the first new generation DEX for a while. There will be a lock opening of 12.46 million HYPE on January 6, and these openings will continue throughout the year and increase the circulation supply to 903 million. The circulation supply is at the level of 339 million, but it is possible to balance this with fuels etc.

If it continues to see stable burns, it is possible that lock openings of 3.61% of the supply will pressure the price less and we may see deflation. Since the lock openings will actually start this year, deflation seems difficult because the supply will increase very quickly, perhaps its negative impact can be limited.

As for the price, $24 has been defended admirably and the appetite of buyers is exciting. HYPE Coin Although investors with big long-term goals for the company may ignore the size of the locked supply with the motivation of token burns, this is a risk. many good altcoin The problem was annual double-digit inflation.

In the short term HYPE The lock may try to overcome its opening fears and reclaim $26.2. If market sentiment turns net positive, $29.5 ceases to be an ambitious target. With the good news of regular and large token burning, the target point is $ 35. So for HYPE, the focus is on the dynamics in the token economy rather than the technical structures on the chart.