The fact that Bitcoin still cannot rise and we cannot see closings above 90 thousand dollars is also suffocating the altcoins. Although BTC continued to fluctuate in the same range, the declines caused altcoins to fall to deeper bottoms. Two major on-chain analysts discussed their assessments of the current situation and future expectations of the markets. Since there are valuable findings, let’s examine them immediately.

Why Can’t Cryptocurrencies Rise?

Because Bitcoin has been continuing its boring narrow range movements for a long time, and this has destroyed the already weakened appetite for altcoins. Bitcoin Without improvement on the side, a market-wide return seems unlikely. Coinbase Premium Index still negative. So why is this important to us?

If Coinbase Premium starts to stay in the positive territory, US-based retail investors can keep the price above $90 thousand in this scenario. The price falls every time because, compared to the global one, US investors have been in a much more bearish mood for a while. On-chain analyst anlcnc1 first gives this answer to the question “why is there no increase?”

“In the current situation, when we look at the 4-hour time frame, there has been an upward slope on the momentum side for the last 2 days on average. There was no high net outflow from ETFs on the first day, but yesterday there was an inflow of 355 million dollars. In other words, not everything happens at once, some data need to improve gradually.” – Anil

So, the current outlook is bad, but it is hopeful that it is gradually improving. Alright ETF Why doesn’t its introduction immediately reverse sentiment? We have seen many examples; right after a few good entries, buyers turn into sellers or ETFs are sold throughout the day. That’s why 1 day of positivity should remind us all of the saying “spring does not come with a flower”. While net inflows continue in the ETF channel, Coinbase Premium should recover and we should be able to say “yes, the long-awaited days have come.”

“So it makes more sense to follow the momentum on the premium side, and that’s what I’m doing. Volume on the US side is now very decisive, and that’s why the Coinbase Premium is more important than ever.” – Anil

Cryptocurrencies Will Rise

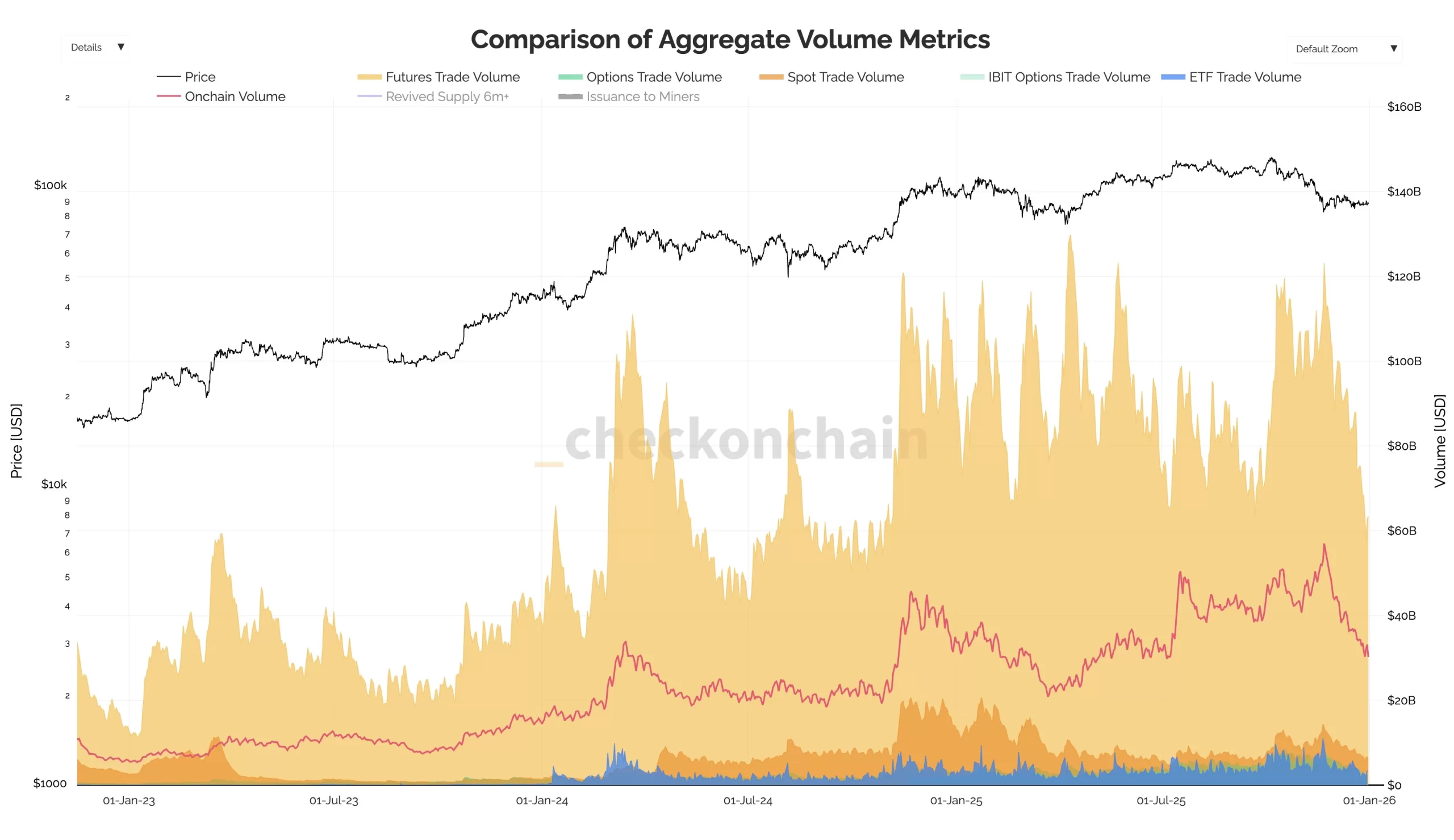

But not right away. In cryptocurrencies There is an important signal that shows that the rise may begin. First, let’s take a look at the details highlighted by CryptoQuant on-chain analyst Darkfost. These details will allow us to understand the background of the ongoing negativity. First of all, we need to know that “while futures volumes are decreasing, sellers are still in a dominant position”. Even though the volume has decreased by half since November 22, it continues to drag the spot markets behind it.

The chart above shows that BTC has moved into a phase of shallow volatility as volumes decreased from $123 billion to $63 billion. Futures volume is $63 billion per day, which is 20 times the volume of spot ETFs ($3.4 billion).

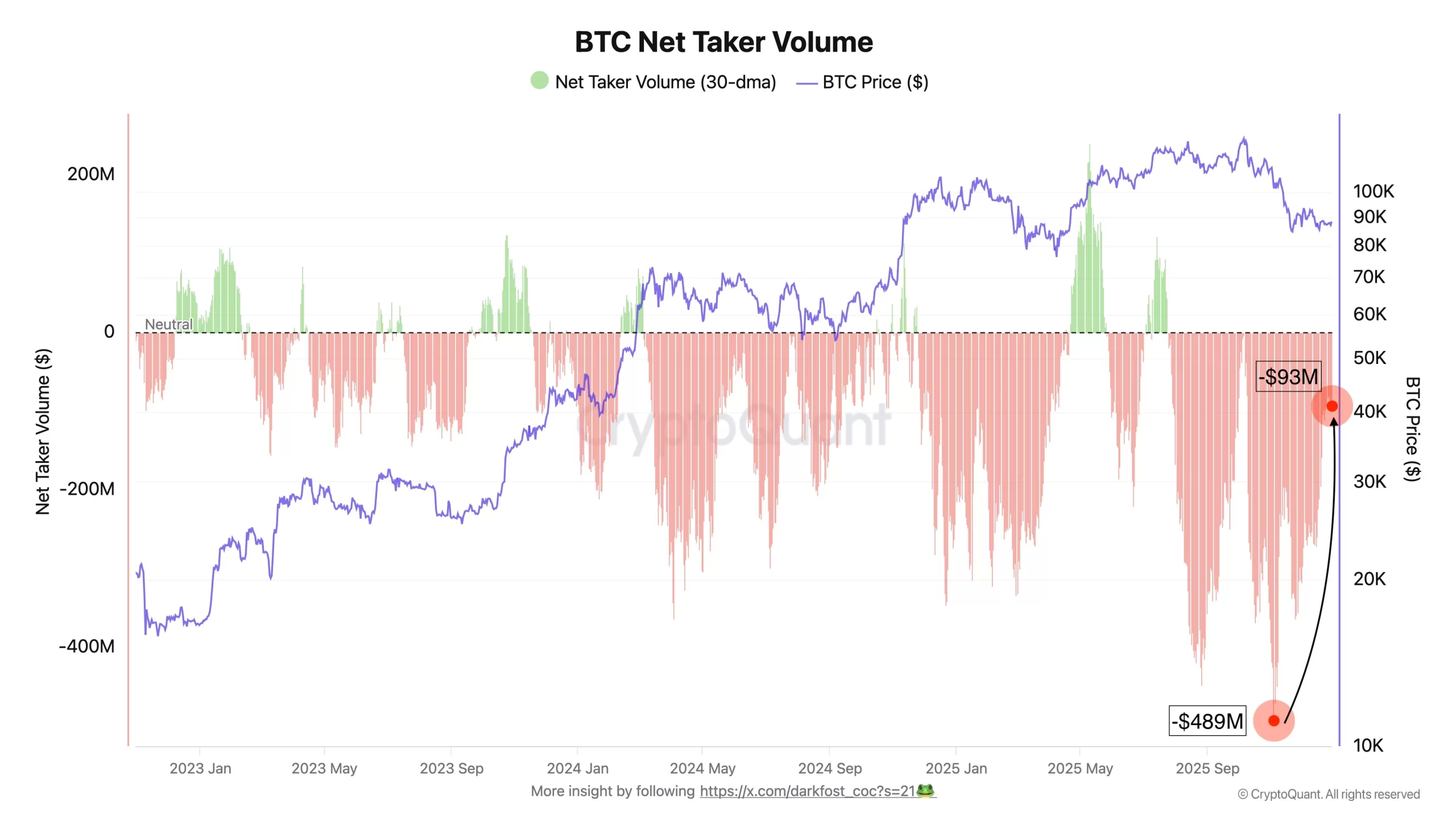

As net buyer volume declines in derivatives markets, Bitcoin enters a correction phase. When did this indicator enter negative territory? From July to today. When entering the negative zone, sales volume dominates and the stronger the trend accelerates, the stronger the selling pressure from the futures transaction on the spot price.

Net buyer volume was generally negative in July. ATH path was opened for BTC with a significant slowdown in October, but then, with the nightmare of October 10, selling pressure became dominant again.

What’s the situation today? Sales volume is still under pressure and Bitcoin That’s why it is compressed in a narrow range in 1 month. Now, coming to the “important signal that indicates that the rise may begin” that I mentioned in the introduction, the sales volume has been decreasing since the beginning of November. Net buyer volume increased from -489 million dollars to -93 million dollars.

Although it is not yet enough for an increase, the possibility that the net sales pressure will weaken and buyers will become dominant is promising.

“Liquidity remains weak and both ETF and spot market volumes are limited enough to allow BTC to break out of its current consolidation phase.

“This situation will need to be monitored closely.”