December close is on the horizon, and the crypto markets, including Bitcoin, Ethereum and XRP, are gearing up for a bearish close within a consolidated environment. XRP price action has remained under pressure in recent sessions, even as ETF-related inflows linked to the token continue to stay positive. While such inflows are typically seen as supportive, XRP’s on-chain and derivatives data suggest a different short-term reality.

Cooling network activity, rising sell pressure, and weakening derivatives positioning point to a growing risk that the XRP price could revisit lower demand zones if key support levels fail.

Top Reasons Why XRP Price Remains Under Bearish Influence

The XRP price has been maintaining a steep descending trend soon after it lost the range-bound consolidation between $2.7 and $3.3. Since then, some of the on-chain data have also turned bearish and, unfortunately, remain bearish, which poses a serious threat to the XRP price rally in early 2026.

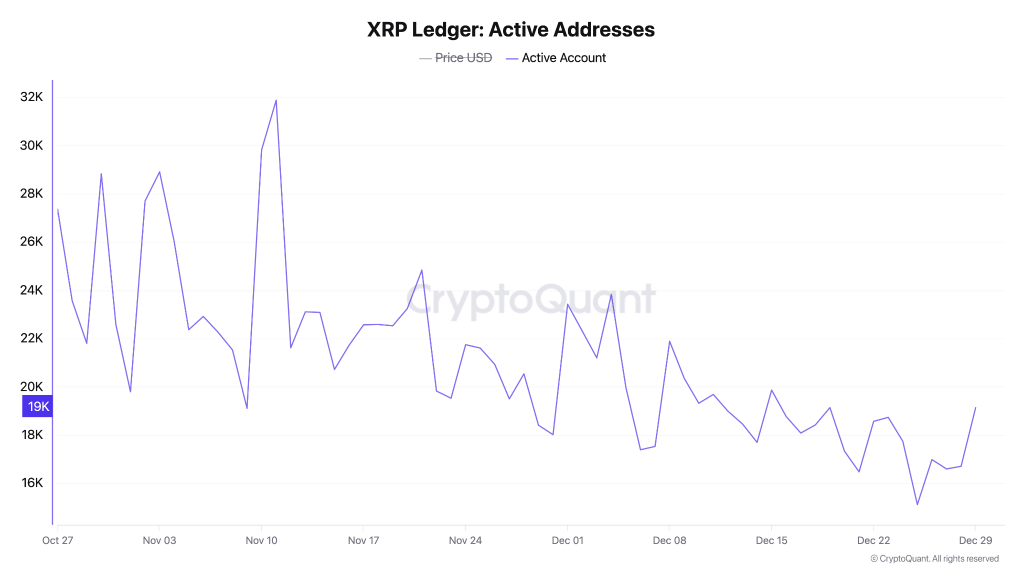

Network Activity Shows Fading Demand

One of the early warning signs comes from the XRP Ledger itself. Daily active addresses have dropped to around 19,000, highlighting a clear slowdown in user participation. Historically, sustained price advances in XRP have required expanding network activity. The current contraction instead suggests weakening organic demand, making it harder for the price to absorb fresh supply.

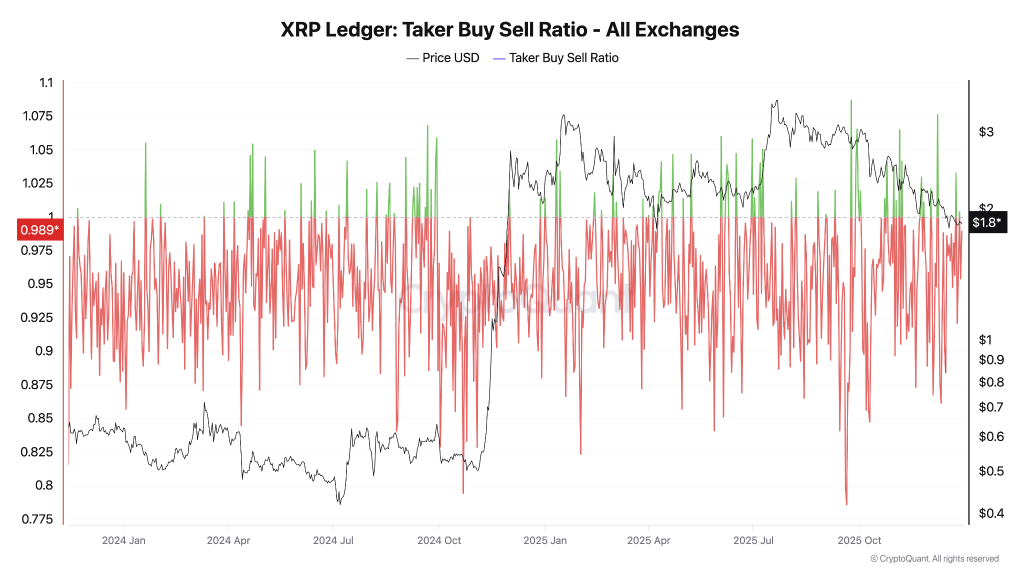

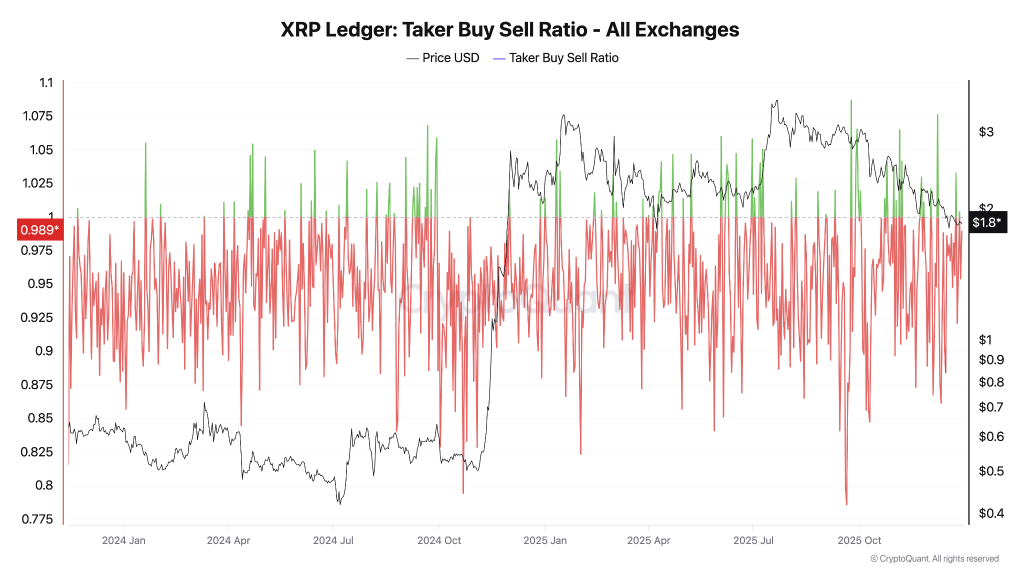

Sellers Remain in Control of Short-Term Price Action

Derivatives flow data reinforces this view. The taker buy/sell ratio across exchanges has stayed consistently below 1, indicating that sell-side market orders dominate. In simple terms, rallies are being sold into rather than chased higher. This explains why XRP has struggled to sustain upside momentum despite intermittent positive news flow.

Open Interest Collapse Signals Risk-Off Behavior

Open interest across XRP derivatives markets has dropped sharply from earlier highs above $3 billion to below $1 billion. This decline shows traders actively reducing exposure, not positioning for a breakout. When open interest falls alongside price, it usually reflects de-risking rather than healthy consolidation.

Key Levels to Watch for the XRP Price Ahead of the Year-End

XRP bulls are failing to revive bullish momentum, as the price has been maintaining a steep descending trend since the start of Q4 2025. The trend seems to have reversed since the middle of the month, but this does not suggest bulls gaining control of the rally.

As seen in the above chart, the weekly supertrend has turned bearish for the first time this year. Meanwhile, the price is heading towards the crucial support at $1.78, which has to be defended to keep up the bullish momentum. On the other hand, the weekly RSI has been maintaining a steep descending trend since the start of 2025. As the levels are yet to test the lower threshold before triggering a rebound, the XRP is also expected to drop further to $1.5 in the coming days.

The Final Take: Will XRP Price Lose $1 Despite a Rise in ETF Inflows?

ETF inflows represent long-term positioning, while XRP’s short-term price is still driven by spot demand and derivatives activity. With network usage cooling, whales distributing, and traders stepping back, ETF inflows alone are not enough to reverse the prevailing pressure. XRP’s weakness is not a contradiction of positive ETF inflows but a reflection of short-term market structure.

Until demand returns, selling pressure eases, and open interest settles, downside risks remain elevated. For now, the $1 level stands out as a key psychological and structural zone that could decide whether XRP stabilizes—or searches for deeper liquidity before any meaningful recovery.

From a technical perspective, XRP is now approaching a critical zone. A sustained failure to hold $1.77 would expose a broader liquidity gap. Below that level, the next major demand area sits in the $1.00–$0.80 range, where buyers may attempt to re-establish control.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.