After Trump’s statements, Bitcoin fell again and altcoins are in the red. The last 2 times we’ve seen the big warning signal for cryptocurrencies flash for the third time, and this could be a harbinger of what’s to come in January. Today we will take a look at the current predictions of different analysts on cryptocurrencies.

Cryptocurrency Signal

The last signal shared by Michael Poppe BTC with Gold upward divergence between. While BTC is consolidating, Gold is consolidating after the recent ATH level and Poppe thinks this indicates the rise of the king cryptocurrency. But we have to forget 2 things. Gold has been rising for a long time and may continue to rise if tensions increase with Trump’s latest statements. The second important detail is that Poppe has been stuck in a bullish psychology for years.

“There is a major bullish divergence on the daily time frame for BTCUSD and Gold.

Gold is falling, Bitcoin is consolidating and this is starting to look better. Moreover, given that this is a valid bullish divergence, it means Bitcoin will outperform Gold in the coming period. Similar bullish divergence periods:

– 3rd quarter of 2024

(Just before Bitcoin exceeded the $100,000 threshold)

– 4th quarter of 2022

(End of bear market for Bitcoin)

“The big transformation is on the horizon.”

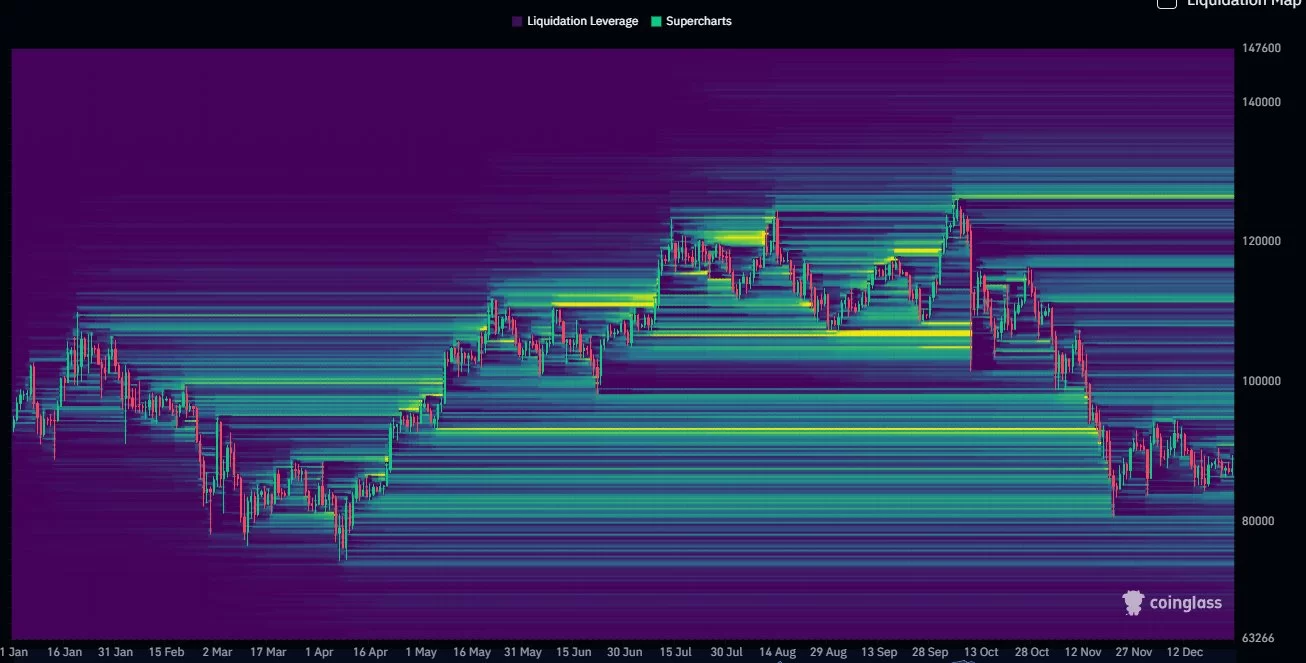

Bitcoin Will Move

An analyst with the pseudonym DaanCrypto shared the liquidation heat map and drew attention to the elimination of large clusters in the last 6 months. big over time liquidation clusters We will see it re-form, but the analyst says there will be large movements for this. So the Bitcoin price will move in both directions.

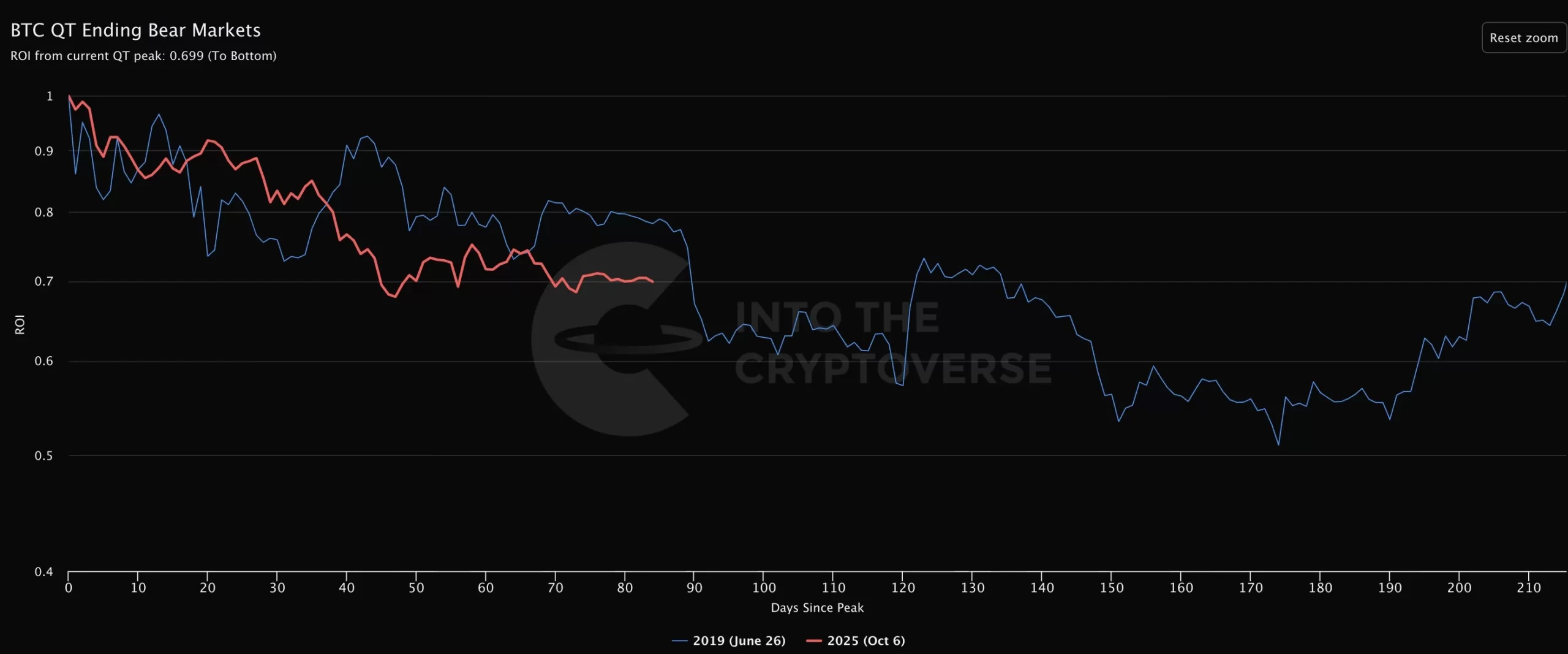

Benjamin Cowen reminded us of 2019 by sharing the chart below.

“Bitcoin peaked in June 2019, just before QT ended in August, and then the market slowly trended downward for a while.

However, this decline was not as severe as seen in bear markets (2017, 2021) that peaked in euphoria.”

Analysts make predictions about the future by looking at past price movements. However, cryptocurrencies have different conditions in each period. The things we have experienced in the last 2 years are things that cryptocurrencies have never seen in the past and ETF Many factors, from the change in demand in the channel to the possibility of acceleration of regulations, will shape the course of next year. Fed’s rate of interest rate cuts and of inflation It is impossible to predict the future today because too many events, such as stickiness, will shape the graphs.