Investors who have been trading with high leverage in futures for months have fallen victim to high volatility in both directions. However, short position holders fell prey in the hope of more profits, while long position holders suffered the biggest losses because they believed that the return from the bottom had begun. Alright in cryptocurrencies What conditions do you have to keep up with?

Bitcoin Demand Is Negative

ETF Interest in the channel is weak and there have been clear outflows for a long time. On an annual basis, we are experiencing an annual closing well below 2024 total inflows. Since October until today, Bitcoin’s apparent demand has been very weak and has now gone negative at its lowest level. Capriole Investment’s demand metric was -3,491 on Monday as demand decreased rapidly in the last 2 weeks. to BTC shows that it is declining.

Such weakness has not been seen since October 21. Both the fact that it was the end of the year and concerns about January greatly undermined the interest. Even though demand eroded, it was positive from November 6 until the last bottom, and there was interest, albeit weak.

Cryptocurrency Strategy

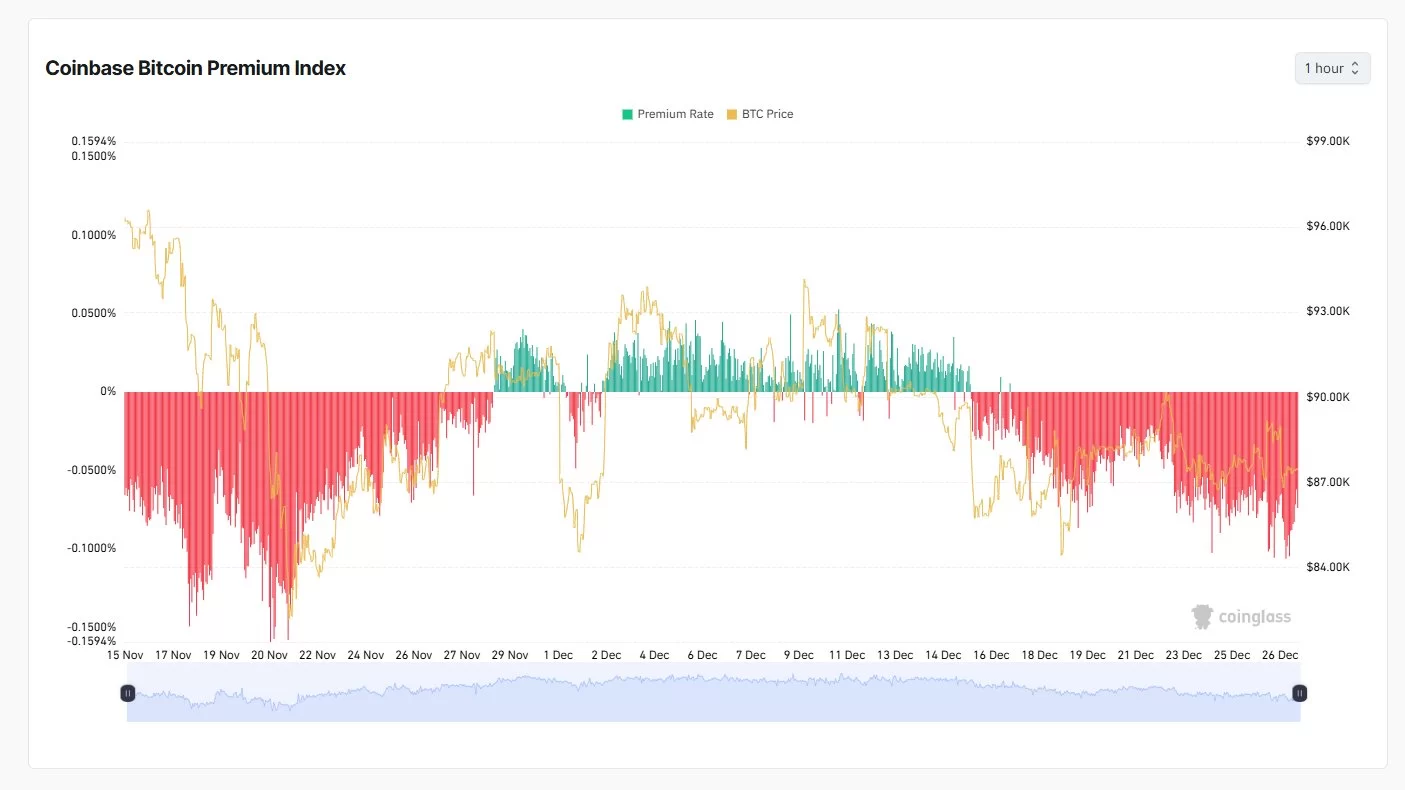

In such cases, the way to make money may be to monitor the crowds correctly. For example Coinbase Premium Index It has fallen sharply in the last 2 weeks. While it was above 0 on December 11, it now has a negative value. The lack of interest of US individual investors stems from the fact that every rise is seen as a selling opportunity. Investors who follow them have seen every rise as an entry opportunity for short selling for months and made profits.

We have also seen that those who want to catch the rise at the bottom with the excitement of returning from the bottom at the same time suffer constantly. Mv_Crypto wrote the following in his last evaluation;

“Coinbase BTC Premium refuses to reverse. It is still printing dark red bars, indicating that the selling pressure in the US has not yet disappeared. Every bounce is sold. Until this metric improves, extreme caution should be exercised when approaching long positions. “Don’t fight the wind.”

Under current conditions, the way to have the wind at your back may be to take short-term positions. Taking day trades in a bearish mood has long been profitable, especially for investors who aim for modest gains and stick to their strategy. The rise will of course start at some point, just like in the past. But catching the bottom or the top is no different than rolling the dice, and if you are determined to take a bullish position, you should see convincing moves.

Things such as the Coinbase premium index starting to remain constantly positive, the permanent breaking of the $98,000 resistance and the confirmation of the upward break in the news flow, volume increases may be the way to catch the rise, especially in altcoins, at the early stage, although not from the bottom.