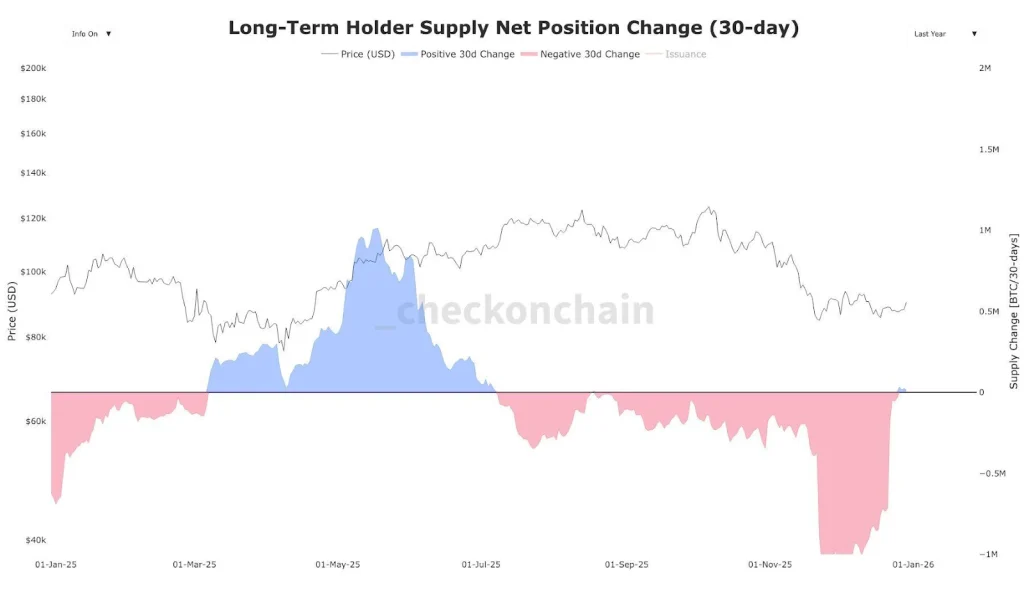

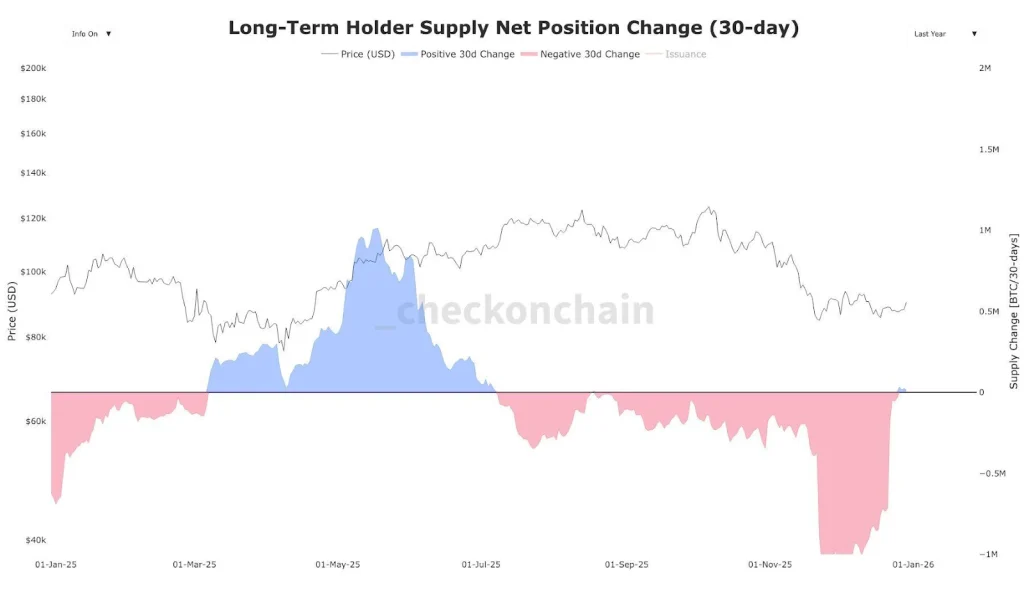

The long term Bitcoin (BTC) holders have begun accumulating for the first time since July 2025. The ongoing Bitcoin price consolidation has been achieved through the reduced selling pressure from long term investors and antidote rising demand from retail holders.

Bitcoin Long-term Holders Shifts Bullish?

According to onchain data analysis from checkonchain, the long-term holder supply net position, on a timeframe of 30 days, has turned positive for the first time since July 2025. Bitcoin price has since dropped over 26% since July to trade at about $87.3k at press time, catalyzed by significant selling pressure from whale investors.

During the past 24 hours, the long-term Bitcoin holders, led by Strategy that acquired 1229 BTC, have recorded a net positive change in their holdings. As such, it is safe to assume that long-term Bitcoin holders are predicting a continuation of the ‘Santa Claus rally’ in 2026.

Source: X

Is BTC Price Ready for Bullish Rebound Before End of 2025?

Technical Tailwind Favors Bullish Reboud

The renewed Bitcoin demand by long-term holders has supported bullish sentiments in the coming days and weeks. In the weekly timeframe, the BTC/USD pair has been retesting a crucial demand zone, likely to yield its rebound towards a new all-time high (ATH).

The midterm bullish outlook for BTC will, however, be invalidated if BTC price drops below $80k as traders will be looking for further drop towards the support level around $77k.

Supportive macroeconomic backdrop

The midterm outlook for Bitcoin remains bullish fueled by the supportive macroeconomic backdrop. The renewed demand from long-term investors has surged amid rising global money supply and the ongoing bull rally in the precious metal industry.

Although Bitcoin price is down over 7% year-to-date, its rising demand on a fixed supply of 21 million coins and cumulative fundamentals is expected to trigger a bullish outlook.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.