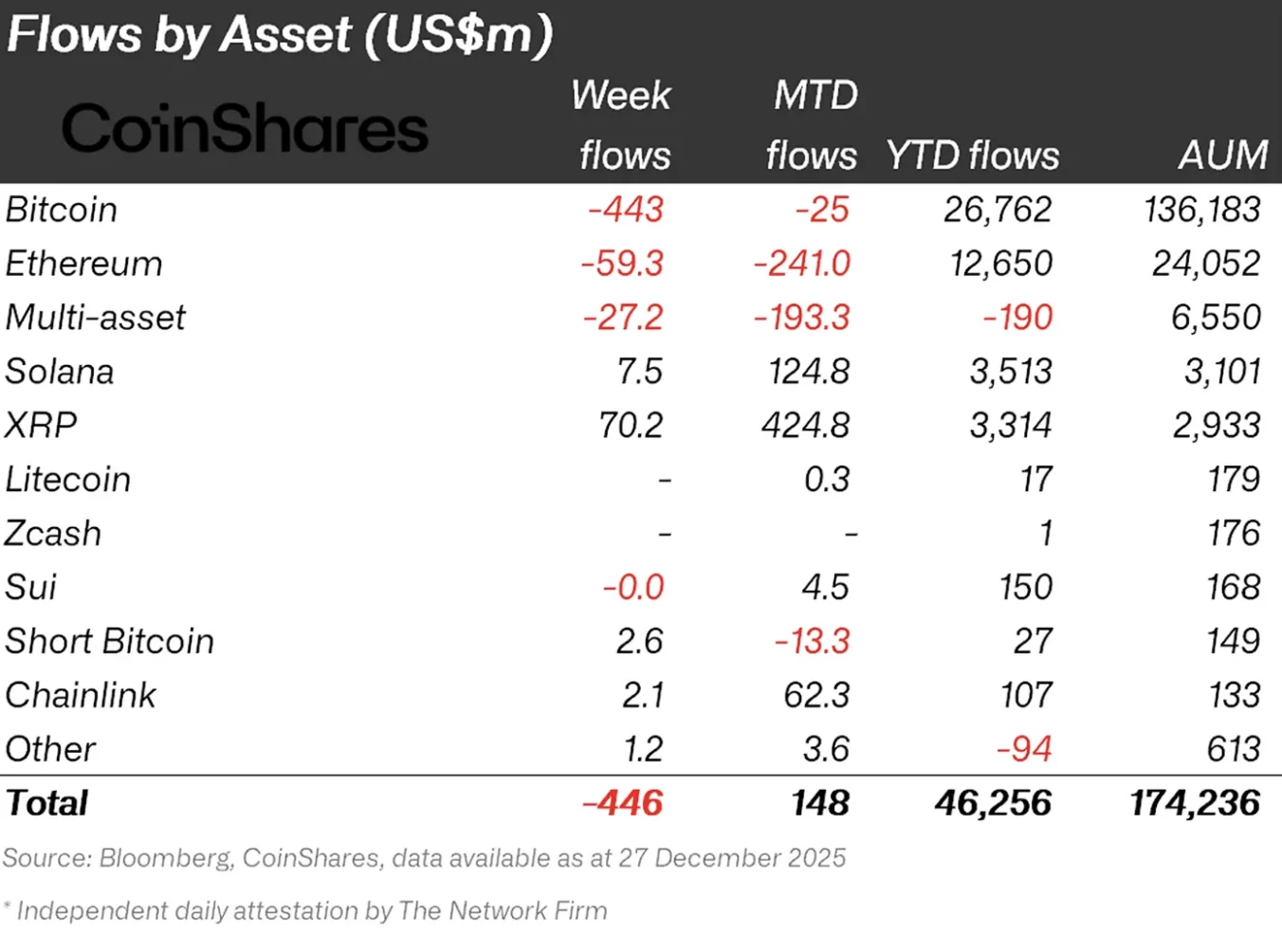

cryptocurrency As we entered the last week of the year in investment-based investment products, fund outflows continued unabated. According to the data published weekly and recently presented by CoinShares, there was a net outflow of $446 million from cryptocurrency-based investment products on a weekly basis, and the total outflow since the beginning of October has increased to $3.2 billion. Despite the seemingly strong inflow figures throughout the year, investor behavior points to a fragile environment of confidence.

Weak Confidence in Global Fund Movements

CoinShares‘s published weekly report It clearly revealed the cautious stance of investors in cryptocurrency-based investment products. While there was a total fund outflow of 446 million dollars in the last week of December, this figure shows that the process that started after the sharp price drop on October 10 has not yet ended. Cumulative outflow since October has reached $3.2 billion.

The total amount entered into investment products since the beginning of the year is 46.3 billion dollars, and the figure is close to the same period last year. However, the increase in total managed assets was limited to only 10 percent. This table indicates that the average investor will not be able to achieve a significant return throughout 2025 when fund flows are taken into account.

Most of the weekly releases Bitcoin And Ethereum concentrated on its products. There was a net outflow of $443 million from Bitcoin-based investment products and approximately $59 million from Ethereum-based investment products. Multi-asset investment products also continued their negative trend and closed the week in minus. However, looking at the whole year, Bitcoin still maintains its position as the asset with the highest total inflow.

When viewed on an asset basis XRP, solana And Chainlink based investment products diverged positively. While XRP-based investment products completed the week with an inflow of 70.2 million dollars, 7.5 million dollars flowed into Solana-based investment products and 2.1 million dollars into Chainlink-based investment products. Since the ETF transactions opened for trading in the USA in mid-October, a total of $1.07 billion has entered XRP ETFs and $1.34 billion has entered Solana ETFs. In the same period, there was an outflow of $2.8 billion and $1.6 billion in Bitcoin and Ethereum products, respectively.

This separation causes investors to invest in specific assets rather than high-volume core assets. altcoin It reveals that it focuses on its themes and reshapes the risk distribution.

Divergence Between Countries

Regional distribution showed that investor behavior was not homogeneous. Biggest rise on a weekly basis USA and there was a fund outflow of $460 million from US-based investment products. Switzerland It was also among the countries that recorded limited negative flows.

Germany stood out as a notable exception. Last week, a net fund inflow of 35.7 million dollars was seen from the country. Total inflows to Germany during December reached 248 million dollars. Data shows that German investors consider the recent price weakness as a buying opportunity.