It is one of the few altcoins that made investors happy this year. Hypeliquid (HYPE) happened. Its success is not a coincidence as it is one of the pioneers of the new generation DEX story and exports actually used products. On the other hand, Avalanche (AVAX), one of the most popular layer1 networks of 2021, experienced bear markets this year. AVAX and HYPE duo represent two opposite poles. Today we will discuss analyst expectations.

Hyperliquid (HYPE)

Protocols that generate revenue can continue to grow in the long run, even though they experience token inflation. HYPE Coin is a good example at this point. We mentioned that new investors can start crypto directly with DeFi as trust in CEXs weakened after the FTX crash. This prediction at the end of 2022 came true with Hyperliquid, which started operating in 2023.

The biggest problem in the DeFi world was that the user interface was too complex and cumbersome to compete with CEX platforms. There were examples that solved this, but the most successful was Hyperliquid. It has reached a huge volume in futures transactions and protocol revenues are at a satisfactory level. Therefore, although the HYPE Coin price fluctuates, its investors are hopeful of its gains in the long term.

The analyst nicknamed Altcoin Sherpa also added HYPE Coin to the top of his favorite list and wrote the following in his evaluation a few hours ago:

“The strength of HYPE is impressive. I’m not sure if it’s just because of LIT’s launch, but it’s been pretty stable over the last few weeks. Maybe it’s a local bottom…

From a few months’ perspective HyperLiquid There is still no clear opinion about it. Everyone wants to buy this altcoin under $20. “We’ll see how much it drops.”

HYPE Coin We had warned OBO for and the price seems to have bottomed around $22.3 for now. If the rise continues, we can see that the rising bottom of $ 35 is reached in January by exceeding $ 27.6. We have seen the rise accelerate from the $35 level many times, and $43 will be the first major stop. The ultimate target will be the new top range at $48-60.

Avalanche (AVAX)

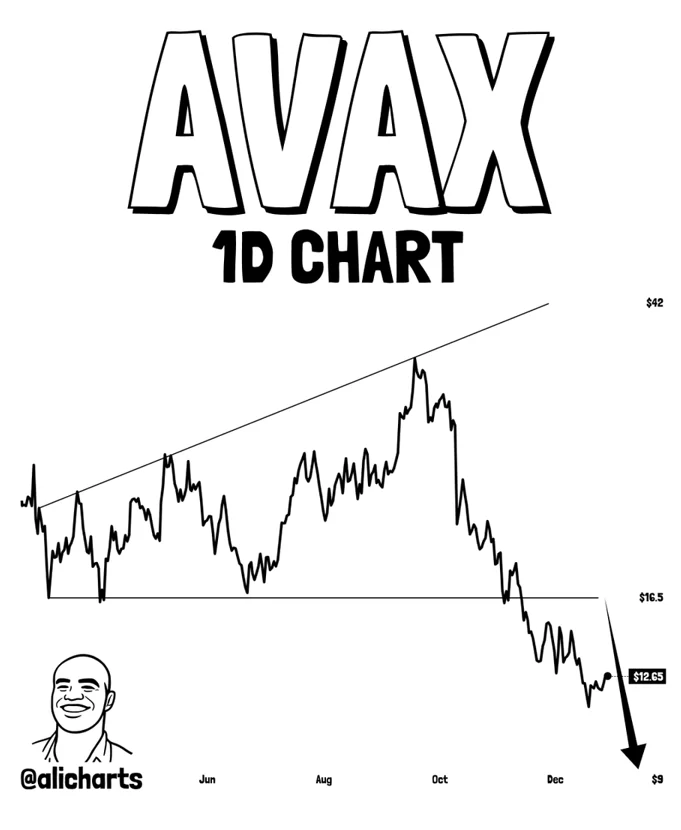

It will be the result of many reasons such as double-digit inflation, poor network usage, lack of interesting applications, and the inability to use the wind it had in the beginning in ecosystem growth. AVAX It is back below $13. He couldn’t even regain last year’s top spot this year.

Ali Martinez believes there is more downside potential here. The target of the analyst who shared the chart above is $9 after confirming the exit from the vertical rising and expanding wedge formation.