BitcoinCME futures data spanning the last five years reveals that the $70,000–$80,000 band has remained historically weak. According to Investing.com data, the price spent only 28 trading days in the $70,000–$79,999 range, and the $80,000–$89,999 range was limited to 49 days during the same period. The market, which moved in the 80,000-90,000 dollar region throughout December, is once again touching a region that has not been sufficiently tested before, with the retreat after the record peak seen in October. On the intra-blockchain side glassnode‘s data also shows that the supply is low concentrated in the relevant band, strengthening the possibility of consolidation in a possible new correction.

CME Data Shows Where the Price is Strengthening

CME In futures transactions, how long the price stays within certain ranges stands out as a critical indicator to understand at what levels the market has accumulated positions. Bitcoin spent nearly two hundred trading days in the ranges of $30,000–$39,999 and $40,000–$49,999, creating a strong price memory in these regions. The same was true for the $50,000–$70,000 band, and there was intense consolidation at these levels throughout 2024.

On the other hand, the $70,000-$79,999 range stands out as one of the least touched areas of the last five years. In this band, where the price remained for a limited time, the opportunity for market participants to create positions remained limited. When short-term record attempts above $120,000 are excluded from evaluation, the 70,000–80,000 band stands out as the weakest price range.

Intra-Blockchain Breakdown Confirms Lack of Support

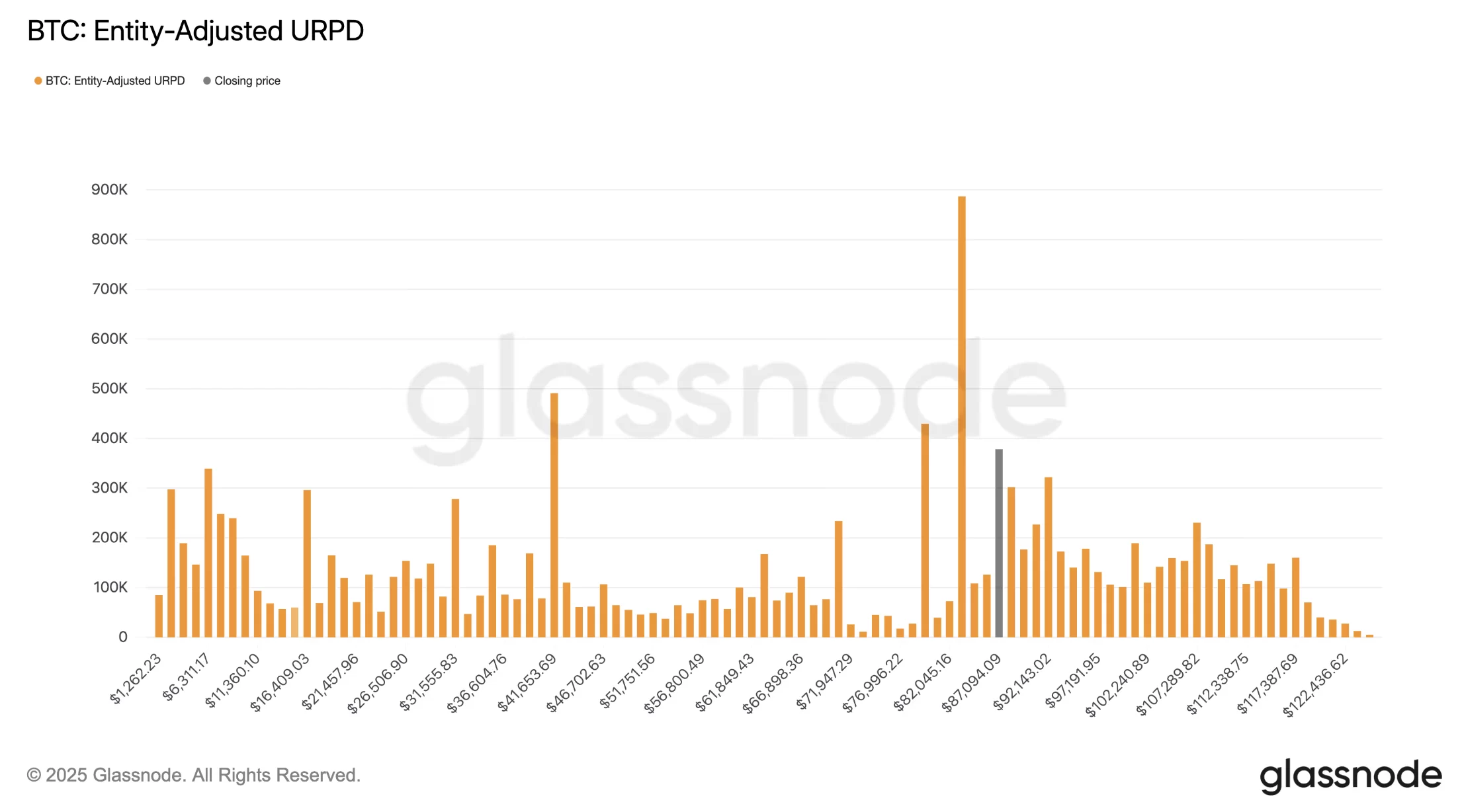

Powered by Glassnode UTXO Realized Price Distribution The indicator reveals the prices at which the current Bitcoin supply changed hands. This distribution, prepared with the entity-adjusted method, collects the balance of each investor at a single point based on the average cost and thus clearly shows the actual concentration levels of the supply.

In the relevant distribution, there is no obvious supply cluster in the 70,000-80,000 dollar band. This situation coincides with the short consolidation period detected in futures data. While it is considered normal for the price to behave more fragilely at levels where supply remains sparse, the assessment that structural support may strengthen if the market spends more time in the said range stands out.